Incorporated in 1991, Deep Industries Limited is a specialist in oil and gas field services, offering a wide array of solutions such as Air & Gas Compression Services, Drilling and Workover Services, Gas Dehydration Services, and integrated project management for oil and gas operations. The company supports critical upstream requirements for the energy sector, leveraging expertise in niche engineering services. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

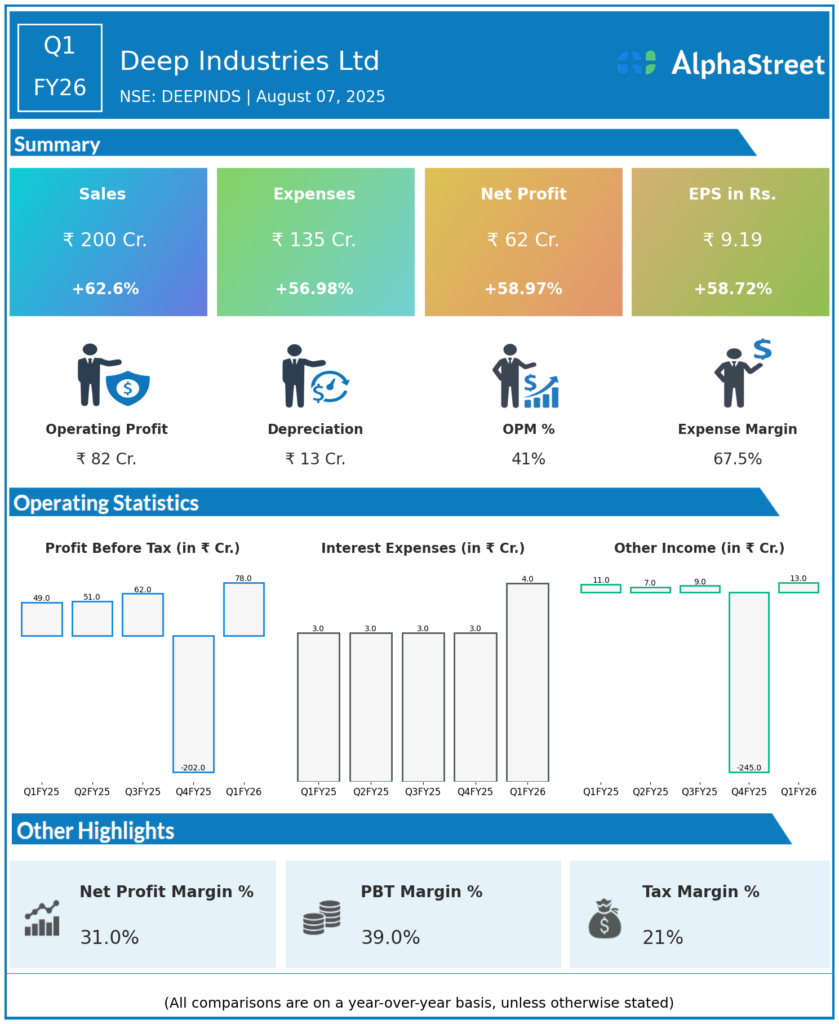

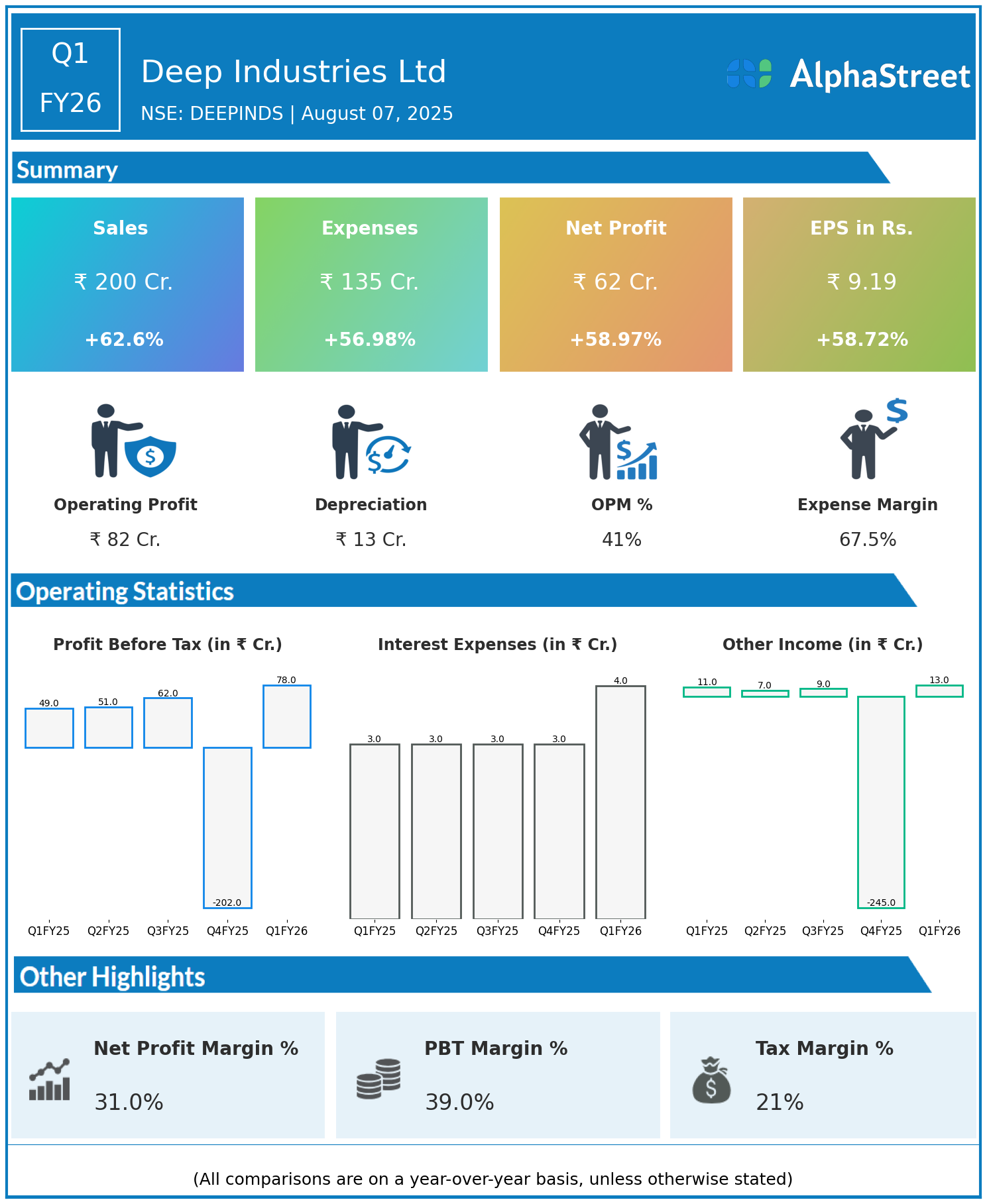

- Revenue: ₹200 crore, up 62.6% year-on-year (YoY) from ₹123 crore in Q1 FY25.

- Total Expenses: ₹135 crore, up 56.98% YoY from ₹86 crore.

- Consolidated Net Profit (PAT): ₹62 crore, up 58.97% from ₹39 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹9.19, up 58.72% from ₹5.79 YoY.

Operational & Strategic Update

- Exceptional Revenue Growth: The robust 63% topline surge mirrors expansion in core oil & gas field services, supported by new project wins, successful contract executions, and rising demand for compression, drilling, and dehydration services.

- Cost and Margin Management: Expenses grew at a slightly lower rate than revenues, reflecting prudent operational scale-up and cost containment, resulting in healthy margin expansion.

- Profitability Surge: Net profit and EPS jumped nearly 59%, outpacing expense growth, and underscoring improved operational leverage, disciplined service delivery, and business scalability in the oilfield segment.

- Service and Market Trends: Deep Industries continues to benefit from the intensifying focus on hydrocarbon recovery and the maintenance of older basins, both domestically and in select international markets. Integrated project management and value-added services remain critical differentiators.

- Strategic Initiatives: Ongoing investments in fleet capacity, technology, and employee training are enhancing execution capability and competitive positioning in a rapidly evolving market.

- Industry Dynamics: The company is well-placed to tap ongoing and future oil & gas field development across India, benefiting from renewed exploration, field rejuvenation, and expanded infrastructure requirements.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 marked an outstanding growth quarter for Deep Industries, combining aggressive revenue expansion with disciplined operational and cost management. The company’s strategic focus on comprehensive oilfield service solutions is driving financial strength and market relevance.

Looking Ahead

Deep Industries is poised to capitalize further on rising activity in India’s oil & gas sector, with a well-diversified service portfolio and strong execution track record. Continued investments in technology, service innovation, and project capabilities should drive ongoing growth, margin resilience, and value creation for stakeholders through FY26 and beyond.

To view DEEPINDS’s previous results: Click Here