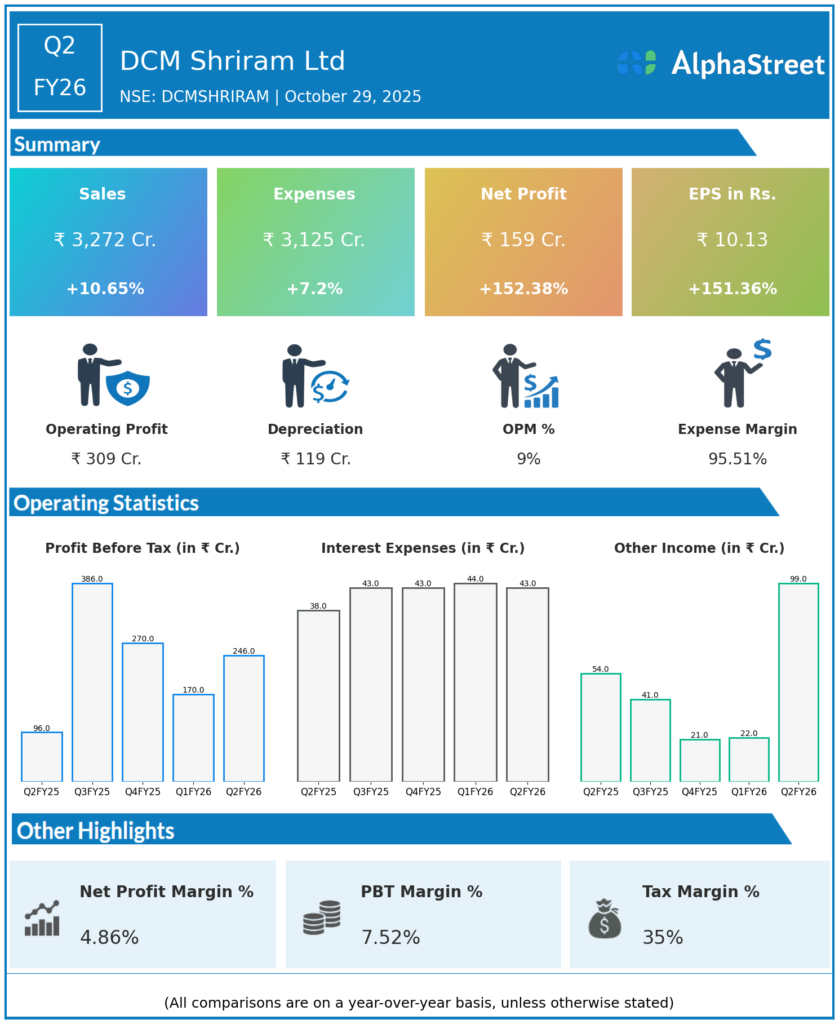

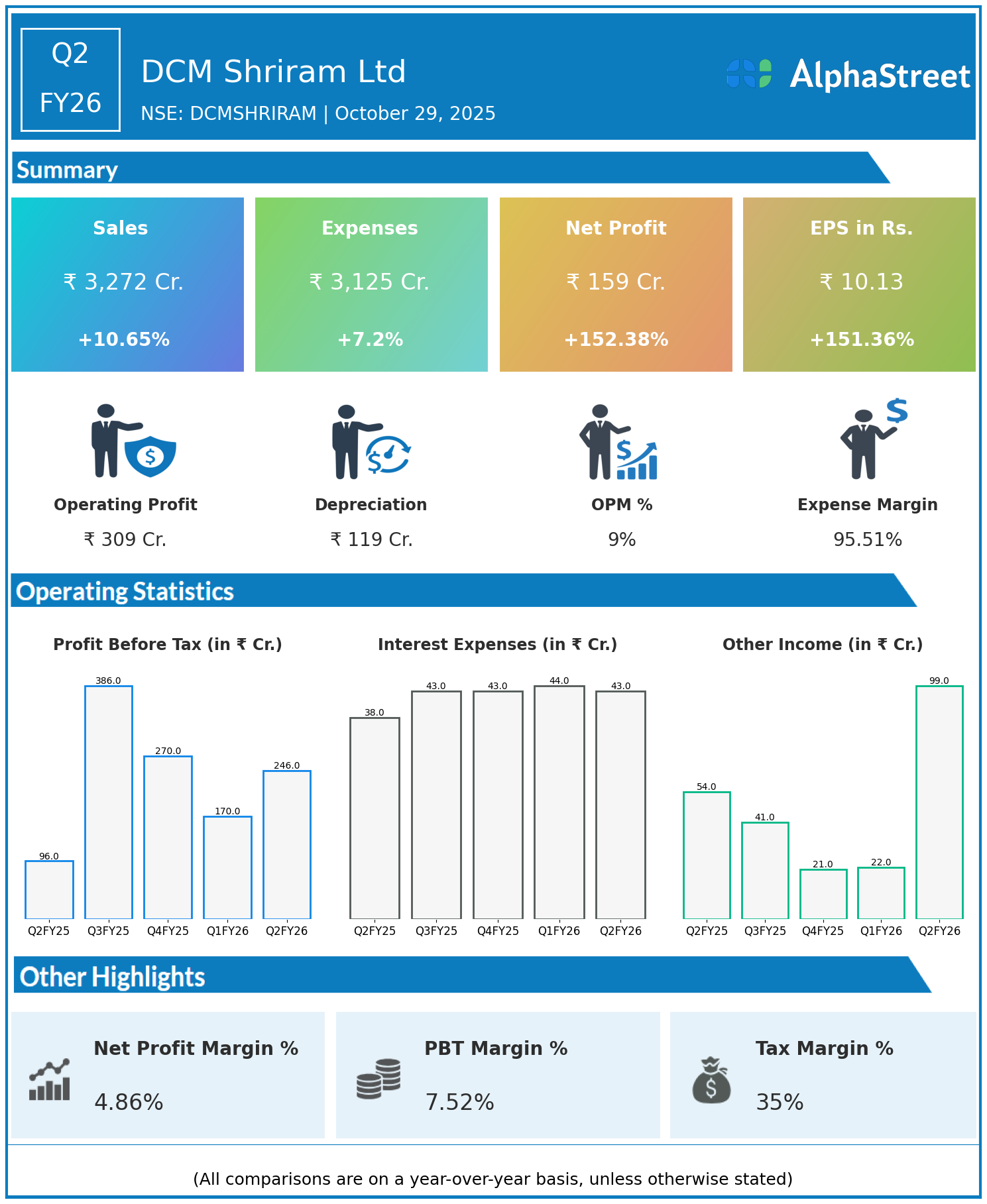

DCM Shriram Ltd reported a remarkable 152% increase in consolidated net profit for Q2 FY26, along with a 10.65% rise in revenues. The profit soared to ₹159 crore from ₹63 crore in the same quarter last year.

Financial Highlights:

- Revenue increased from ₹2,957 crore to ₹3,272 crore.

- Total expenses rose slightly by 7.2% to ₹3,125 crore from ₹2,915 crore.

- Earnings per share (EPS) jumped 151% to ₹10.13 from ₹4.03.

Segment-wise Performance:

- The chemicals and vinyl segment recorded revenue of over ₹1,100 crore, up 43% YoY, with a PBDIT surge of 195% to ₹254 crore.

- The sugar & ethanol segment experienced a slight decline in revenue by 6%, but PBDIT increased by 143%, driven by higher ethanol margins.

- The farm solutions business grew 27% in revenue, with PBDIT increasing by 47%, supported by demand in agri-inputs.

- Fenesta Building Systems’ revenue increased 28% to ₹283 crore.

- The fertiliser segment’s revenue declined by 8%, but profitability remained stable.

Overall, the company delivered volume-led growth supported by operational agility, new capacity launches, and strategic acquisitions. The market responded positively, with shares rising to ₹1,400, up 7.5%.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel

.

.