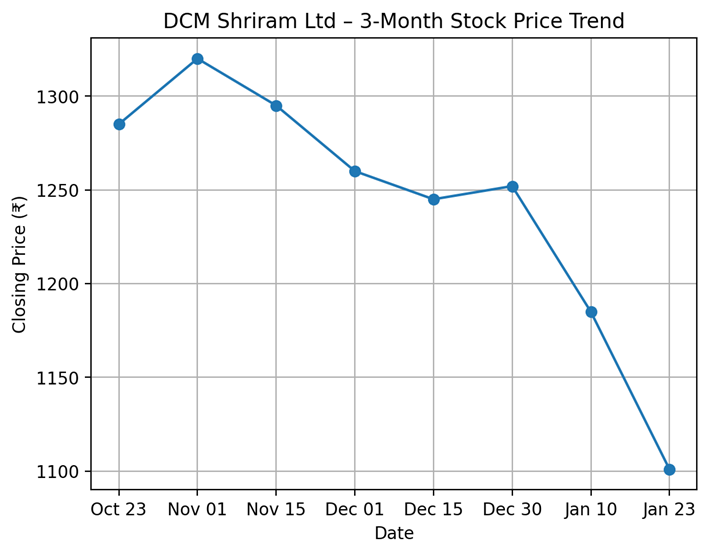

DCM Shriram Ltd (NSE: DCMSHRIRAM, BSE: 2337) closed at around ₹1,101.40, down modestly on the day. The stock’s intraday move reflected market reaction to Q3 FY26 results and dividend announcements. ₹1,101.40 was the last reported trade on the National Stock Exchange as of market close.

Market Capitalization

DCM Shriram’s market capitalization stood at approximately ₹17,175.48 crore based on the latest closing price on NSE/BSE.

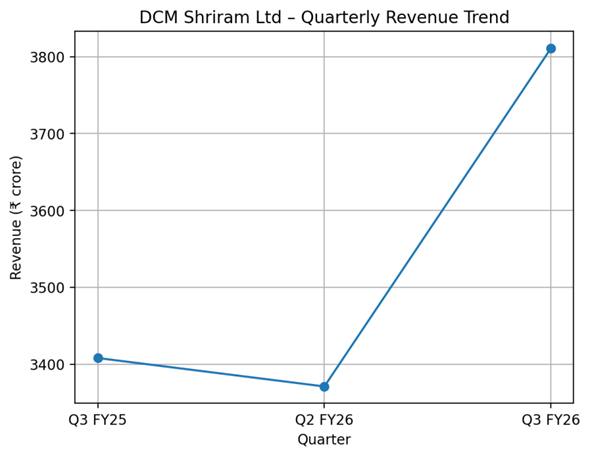

Latest Quarterly Results (Q3 FY26)

For the quarter ended 31 December 2025, the company reported the following consolidated results:

- Net Revenue: ₹3,811 crore, up ~13% year-on-year.

- Profit After Tax (PAT): ₹212–₹213 crore, down around 19% year-on-year.

Segment Highlights:

• Chemicals & Vinyl: Revenue ~₹1,122 crore, up ~20% YoY.

• Sugar & Ethanol: Revenue increased, supported by volumes and duty reversals.

• Fenesta Building Systems: Reported higher revenue growth.

• Shriram Farm Solutions: Contributed to overall segment revenue expansion.

Full-Year Results Context

For FY25, the company’s annual consolidated revenue was around ₹12,219.49 crore, with profit after tax of approximately ₹604.27 crore, compared with prior year figures showing lower revenue and profit levels, indicating an uptrend in top-line and bottom-line metrics.

Business & Operations Update

During Q3 FY26, DCM Shriram declared a second interim dividend of ₹3.60 per share, aggregating to ₹56.14 crore.

Segmental expansion continued, with Chemicals & Vinyl and Sugar & Ethanol reporting notable revenue increases, and Fenesta Building Systems maintaining higher throughput.

Equity Analyst Commentary

Institutional summaries noted the company’s revenue expansion alongside narrowing net profit at a segmental level. Analysts cited diversified segment contributions but flagged the impact of one-time charges under new labour regulations.

Guidance & Outlook

DCM Shriram has outlined operational priorities to monitor revenue streams across chemicals, sugar, ethanol, and building systems segments. Regulatory environment and input cost dynamics remain areas of consideration for ongoing performance tracking.

Performance Summary

DCM Shriram shares declined at the latest close. Quarterly revenue grew about 13% YoY to ₹3,811 crore. PAT fell around 19% YoY to ₹212–213 crore. Chemicals & Vinyl, Sugar & Ethanol, and other segments contributed to expanded revenue. Interim dividend declared. Trade volumes and future operational metrics to watch.