Dalmia Bharat is among India’s top cement manufacturers and the fourth largest by installed capacity. Founded in 1939, the company has a significant presence across the cement manufacturing and selling sectors in India.

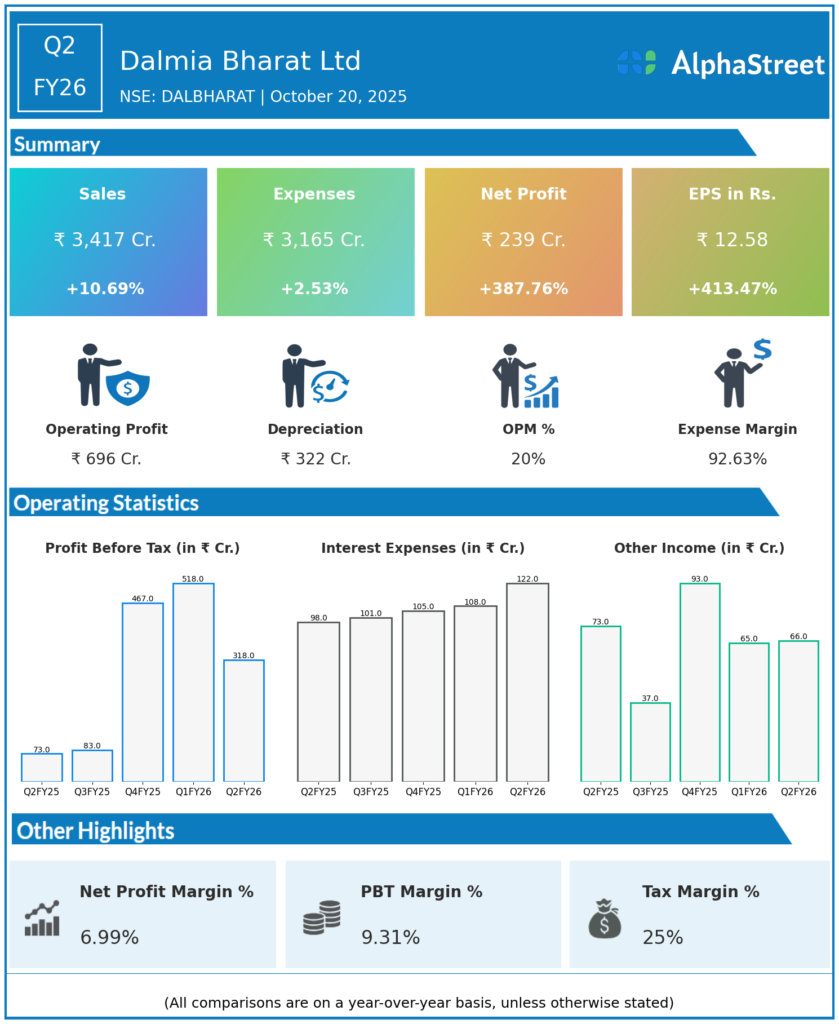

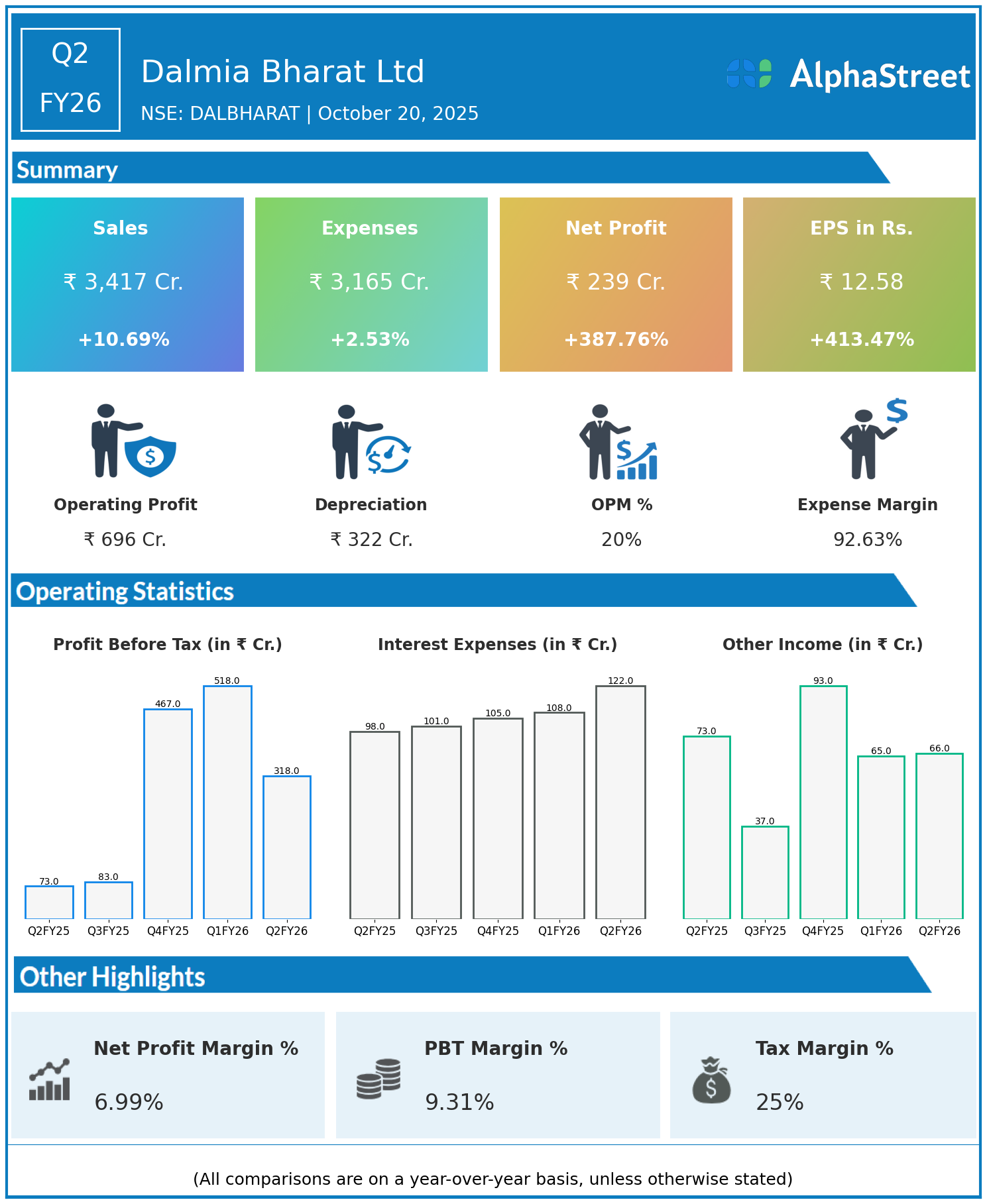

Q2 FY26 Earnings Summary (Jul–Sep 2025)

Consolidated revenue stood at ₹3,417 crore, up 10.69% year on year from ₹3,087 crore.

Total expenses increased moderately by 2.53% to ₹3,165 crore, compared to ₹3,087 crore last year.

Profit after tax (PAT) jumped dramatically by 387.76% to ₹239 crore from ₹49 crore in the same quarter last year.

Earnings Per Share (EPS) rose sharply by 413.47% to ₹12.58 from ₹2.45 year on year.

Operational and Business Highlights

Despite a slight volume decline due to monsoon-related seasonality, Dalmia Bharat improved cement realizations by 7.5%, supporting revenue growth. The company maintained stable costs through efficient fuel and power usage, with increased renewable energy usage reaching 48.1%. The commissioning of the Umrangso clinker line in September 2025 is expected to further bolster production capacity from Q3 FY26 onwards. Strategic acquisitions for captive solar power indicate a focus on sustainability and cost efficiency.

Financial Position and Outlook

Dalmia Bharat sustains a healthy balance sheet with moderate net debt and strong operational cash flows. EBITDA surged by around 60% year on year, expanding margins to over 20%.

Management remains optimistic about sustainable double-digit revenue growth and profitability, driven by robust cement demand, operational discipline, capacity expansions, and sustainability initiatives.

The board declared an interim dividend of ₹4 per equity share, reflecting strong cash generation and shareholder value.

Dalmia Bharat Ltd is well poised to consolidate its position as a leading cement manufacturer in India, capitalizing on favorable market dynamics and strategic investments through FY26 and beyond.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.