Share price and market cap

Share price: ₹2232.40. Market capitalisation: ₹41,100 crore (approx).

Revenue and short-term trend

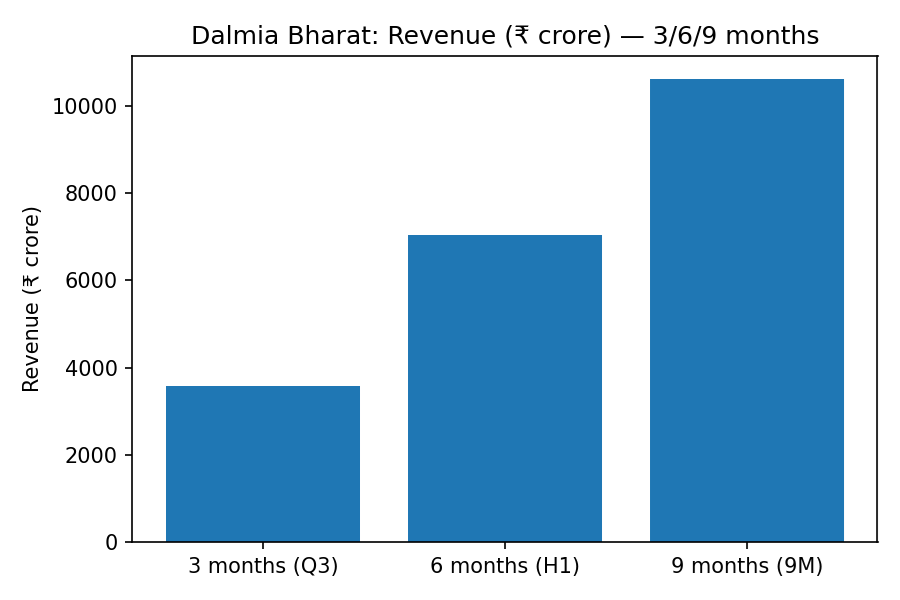

3 months (Q3) revenue: ₹3568 crore. 6 months (H1) revenue: ₹7053 crore. 9 months (9M) revenue: ₹10621 crore.

Quarter performance

EBITDA (Q3): ₹602 crore. PAT (Q3): ₹122 crore. Quarterly sales volume: 7.3 MnT. New clinker capacity: 3.6 MTPA clinker line commenced trial production on 20 Jan 2026.

Market analysis

Sector demand shows early signs of recovery. Fiscal measures and renewable integration support margins. Competitive pricing remains a constraint.

Analyst views

Brokerages provide mixed views. Some see upside from capacity and margins. Others warn on regional pricing pressure and valuations.

Mergers & acquisitions

No material M&A announced in the quarter. Management disclosed disposal of a minority stake in an associate in early January 2026.

Outlook

Management expects gradual demand improvement and will prioritise capital allocation to capacity and low-carbon projects. Short-term risks include pricing and regional demand variability.

Segment results

Cement operations continued to drive consolidated performance. Renewable energy and efficiency measures improved unit economics. No separate standalone segment losses reported.

Dalmia Bharat Limited announced consolidated unaudited results for the quarter and nine months ended 31 December 2025. The company reported total revenue for Q3 at ₹3,568 crore. EBITDA for the quarter was ₹602 crore. Profit after tax for the quarter was ₹122 crore. Sales volume for the quarter stood at 7.3 million tonnes. The company has commenced trial production at a 3.6 MTPA clinker line at Umrangso, Assam.

The company closed at a share price of ₹2,232.40 on 21 January 2026. Market capitalisation is approximately ₹41,100 crore. The quarter-on-quarter revenue change was modest. H1 (six months) revenue was ₹7,053 crore, resulting in a nine-month total of approximately ₹10,621 crore.

Segment performance remained driven by cement operations. Volume growth resumed after the H1 decline. EBITDA per tonne improved versus prior periods, supported by lower input costs and renewable energy integration. Management highlighted renewable energy capacity expansion and operational efficiencies as key drivers.

Market analysis notes improving sector demand and recent fiscal measures supporting consumption. Analysts offered mixed views. Some brokerages retained positive bias based on capacity addition and improving margins. Other analysts flagged competitive pressure in eastern markets and advised caution on realisations.

On acquisitions and corporate actions, the company disclosed commissioning updates and capacity expansion. There were no material M&A closures announced in the quarter. The company reported disposal of a minority stake in an associate earlier in January 2026 as part of portfolio rationalisation.

Outlook from management is cautious to constructive. The company expects gradual demand recovery and continued focus on cost management. Capital allocation will prioritise strategic capacity and low-carbon initiatives. Short-term risks include pricing competition and regional demand variability.

Investment considerations include improved EBITDA margins, ongoing capacity addition and a strong renewable energy mix. Risks include legal and regulatory matters disclosed in filings, and near-term pricing pressure. Traders and long-term investors should consider valuations and sector dynamics before taking positions.

This report is a factual summary of the company status as on 21 January 2026. Figures are presented on a consolidated unaudited basis.

Chart: Revenue comparison (3/6/9 months)

Chart note: Revenues are consolidated and unaudited for the specified periods.