Dabur is an Indian multinational company. It mainly deals with consumer goods. It was incorporated in the year 1884. The founder was S.K Burman. It mainly deals with following products which include Ayurvedic medicine, FMCG products. In the FMCG sector it deals with Personal care, skin care, Haircare, Oral hygiene, Health supplements and drinks.

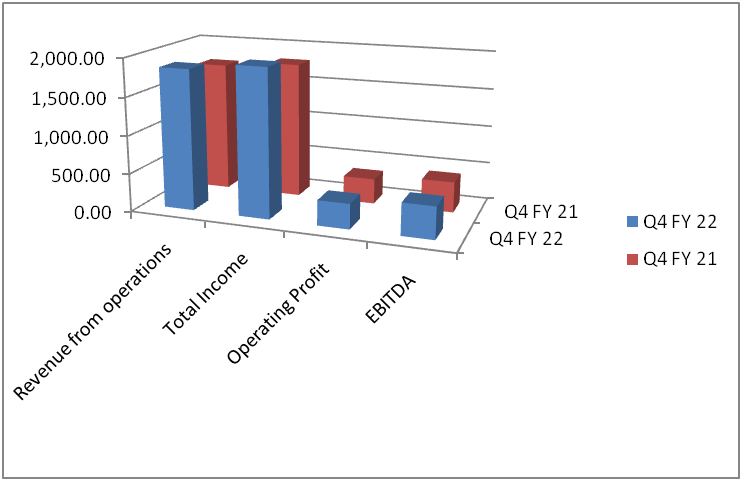

Financial Snapshot

Consolidated revenue for Q4 FY 2022 grew by 7.7% at Rs 2,518 Crore. For FY 2022 total revenue increased by 14% to Rs 10,889 Crores. Net Profit has improved 7.7% jump to Rs 1,824 Crore. However Dabur has achieved a growth of 13.8% in India Business and 10.1% growth in FMCG. Consolidated operating profit shows an improvement of 12.5%. The PBT has improved by 14.5%.PAT grew by 7.7%.

Segmental Revenue

The food a beverage business posted a growth of 34%.The juice and beverage business improved by 35%.The overall Food business performed very well with a growth of 12.5%. The health supplement business reached 9.7% with market share increasing 250 bps for Dabur Chyawanprash’s, and 300 bps for Dabur Honey. In FMCG sector the tooth portfolio reported a growth of 11.3% with an increased market share of 20 bps. Hair oil posted a growth of a 17.1% with an improvement in market share of 70 bps. Shampoos recorded a growth of 22% with an increase of market share of 40 bps. The homecare segment reported a grow of 21%. The skin care business recorded a decline of 10.6%. The international business grew 10.7% on constant currency basis.

Challenges for the Quarter

The major challenges faced in this quarter are highest inflation rate which impacted, gross margin by 130 bps. The inflation also impacted the consumer’s wallet, which is seen in softening of demand.

Management Strategies

The company has recommended dividend of f Rs 2.70 per share, aggregating to Rs. 477.32 Crore. The dividend payout ratio stood at 50.39%. It has even invested in rural coverage added 30,000 new villages to the total count of 90,000 villages.

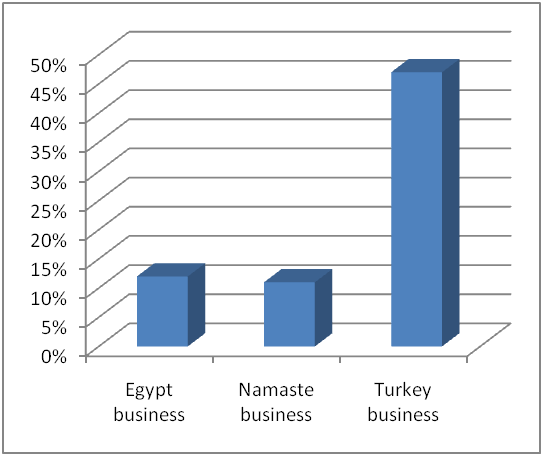

Growth in International Region

The company is doing well in the international markets. Business for the full year has grown by 13% in the Middle East and North Africa. In the U.S. the business is trading at a high single digit growth rate. The business has performed well in MENA, South Africa, East Africa, and West Africa. Business from h Nepal and Bangladesh has grown around 15% for the full year.

Business Growth– The Company anticipates that it would be in a better position for Chyawanprash and Honey in the coming quarters. Dabur has launched Tulsi Drops, Health Juices etc, which will get a high base in the next quarter. The company anticipates a three-year CAGR is in the range of around 12% of the Foods business. Dabur is focused on aggressive innovations around 5% and on Ecommerce the range is around 11% to 12%.