Dabur India Limited (NSE: DABUR) is a leading Indian consumer goods company that specializes in Ayurvedic healthcare and personal care products. The company product portfolio includes healthcare, personal care, home care, and food products. Dabur India has a strong focus on Ayurveda and natural ingredients, which provides it with a strong competitive advantage in the Indian market. The company’s products are known for their high quality and effectiveness. It has a strong distribution network that spans across India and several other countries. The company’s products are sold through a network of over 6 million retail outlets, including supermarkets, pharmacies, and convenience stores. Moreover, it also has a strong online presence and sells its products through e-commerce platforms and its own online store.

Q3 FY23 Financial Performance

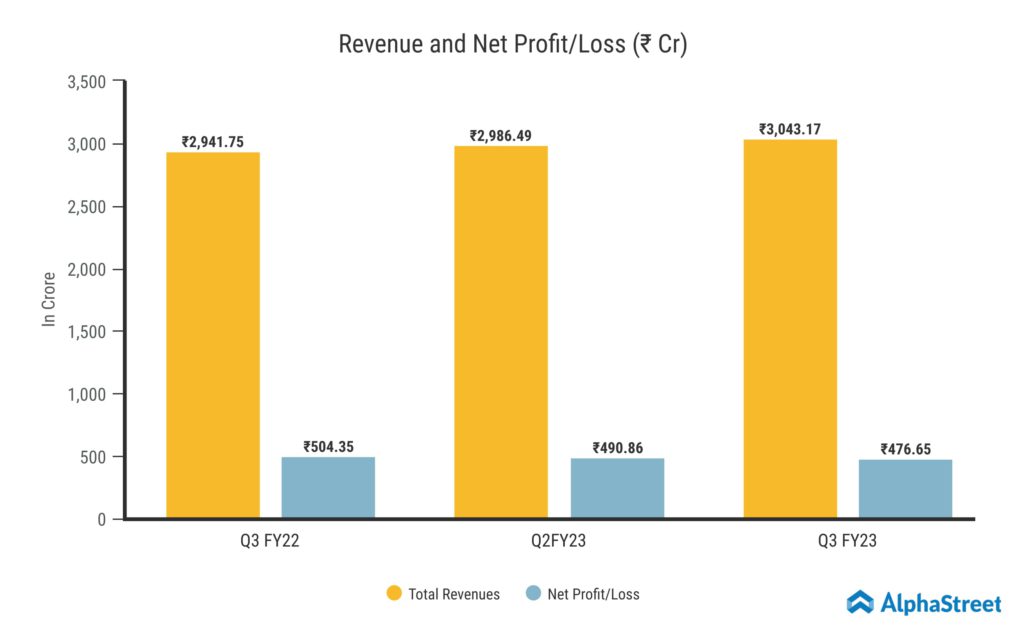

Dabur India Limited reported Revenue from Operations for Q3 FY23 of ₹3,034.17 Crore up from ₹2,941.75 Crore year on year, a growth of 3.1%. India’s business up by 3.3%, while International business increased by 14%. Consolidated Net Profit of ₹476.65 Crore, down 5.5% from ₹504.35 Crore in the same quarter of the previous year. The Earnings per Share is ₹2.68 for this quarter. The quarter was hampered by an inflation-led slowdown in rural markets, uneven monsoon distribution, and consumer downsizing.

Share Price Performance

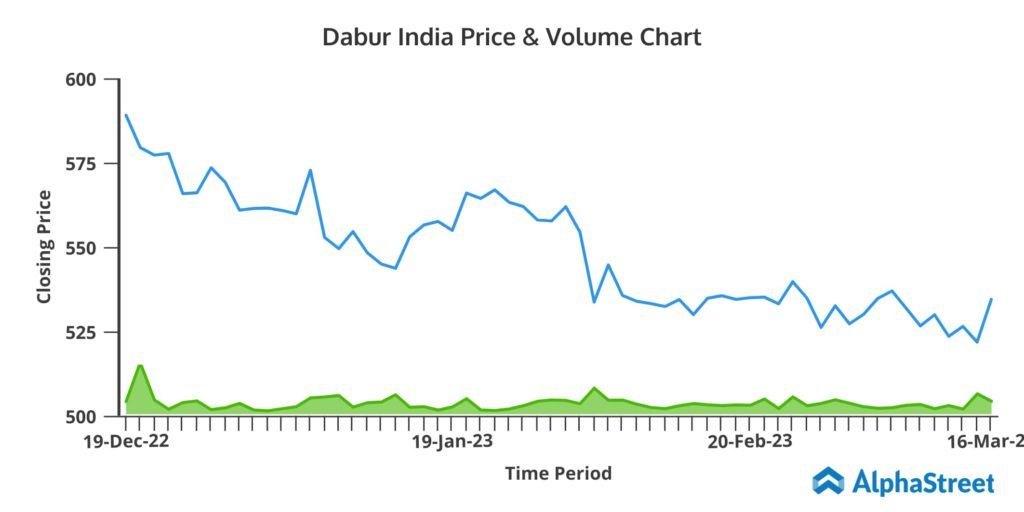

Dabur India Limited announced the results for Q3 FY23 on February 2, 2022. The company’s share price dipped by more than 3% following the results.

Last 1 month: 0.4%

Last 6 months: -2%

Last 12 months: -2.3%

Highest Ever Market Share In Oral Care Segment

Dabur India increased its market share to 15.8% during the quarter, making it the second-largest player in the oral care industry. Dabur Red led the 3.2% growth in the portfolio of toothpastes. The business anticipates continued growth for Dabur Red and Meswak toothpaste in the coming years. Babool, the company’s other toothpaste brand, suffered in this quarter as a result of the widespread rural decline, particularly in Central India. The herbal toothpaste introduced by Dabur, however, has been doing incredibly well in the Southern markets.

While commenting on the Gel market the management said, “Our attempt of relaunching our Dabur Red Gel is also doing very well. This year, we should exit at around Rs. 20 crores in the gel market. If you slice and dice the entire oral care market, what we find is that consumers are down trading at a very rapid pace to LUPs. And there’s a grammage reduction also which is happening by all the key players. And because of that, the gel market, which is a tad lower in terms of pricing as compared to the overall calcium carbonate market, has started showing a lot of growth signs.”

Regarding the Home & Personal Care portfolio, it saw a slight boost of 2.2% despite the volume declines in the important categories of Hair Oils and Toothpaste. Home Care reported an 18% increase, which was primarily the result of strong double-digit growth across Odonil, Odomos, and Sanifresh franchises. Odonil increased its market share by 410 bps in the Gel category and 540 bps in the Aerosol segment. Odomos saw a 220 bps improvement in market share. Shampoo sales increased by 4% on a high base of 21% growth, resulting in a 40 bps increase in market share. The category decline of 4.5% had an impact on hair oils, but our market share increased by 70 bps to reach its highest level ever at 16.2%.

Updates In Food Beverage and Health Care Category

The beverage industry reported growth of 6.4% as it maintains a positive trajectory. Dabur India significantly outperformed the market, with a 250 basis point jump in market share of the Juices & Nectars category. The Fruit Drinks and Milkshake portfolio experienced significant growth and will finish the year with revenues of ₹200 crore. The food industry also did well, growing by 35%. This will be strengthened even more by the acquisition of Badshah, which will be consolidated starting in Q4. Due to the strong performance of the Hajmola franchise, the healthcare portfolio has resumed its upward trajectory, with the Digestive category seeing a strong growth of 11.2%. With Lal Tail, Honitus, and Shilajit putting in strong performances, the Over The Counter portfolio also saw double-digit growth.

Inflation Led Margin Shrinkage

Inflation not only slowed down rural markets, but it also decreased operating and gross margins by 129 and 280 basis points, respectively. This quarter’s overall inflation rate was 8.5%, and the company raised prices by about 6.5% to counteract its impact. The management anticipates that the inflation will increase to levels that are roughly 5.5%.

The management also commented on this situation, “On a consolidated basis, despite the inflation and currency headwinds, we continue to drive our business aggressively and have gained market share across the portfolio. Going ahead, we expect the quantum of inflation to moderate, but commodity-specific nuances will continue to linger, especially in the Food & Beverage basket, which is seeing a pickup in inflation. We are seeing green shoots emerging in the rural markets, especially in the months of November and December. Urban markets are also expected to improve, driven by softening of inflation, buoyancy of new age channels and improved consumer sentiment on the back of reduction in taxes for the Indian middle class.”