Dabur India Limited is one of India’s leading FMCG companies specializing in Ayurvedic and natural healthcare products. With a strong heritage and expansive distribution network across India and global markets, Dabur continues to focus on innovation, quality, and consumer trust in its diverse product portfolio.

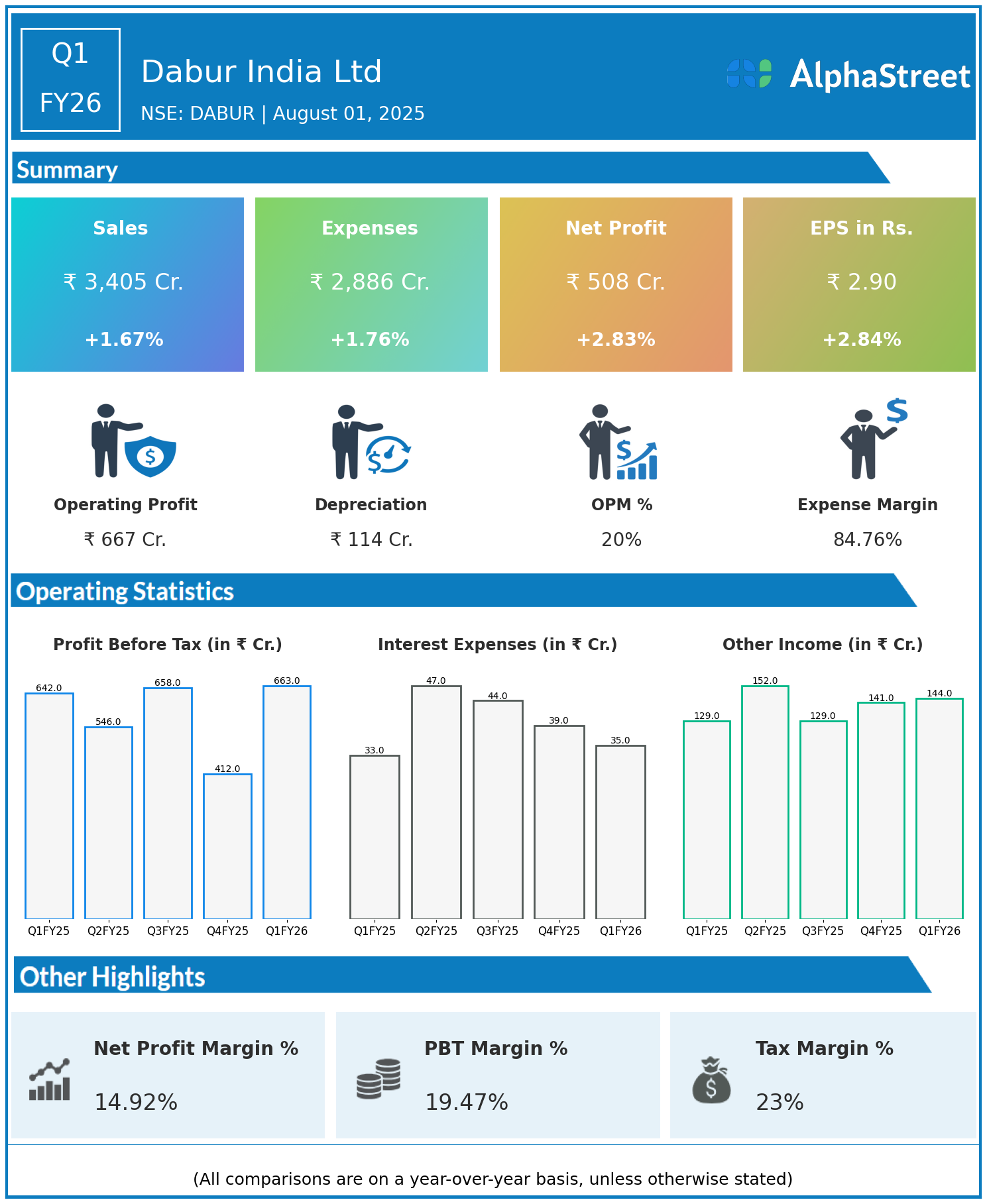

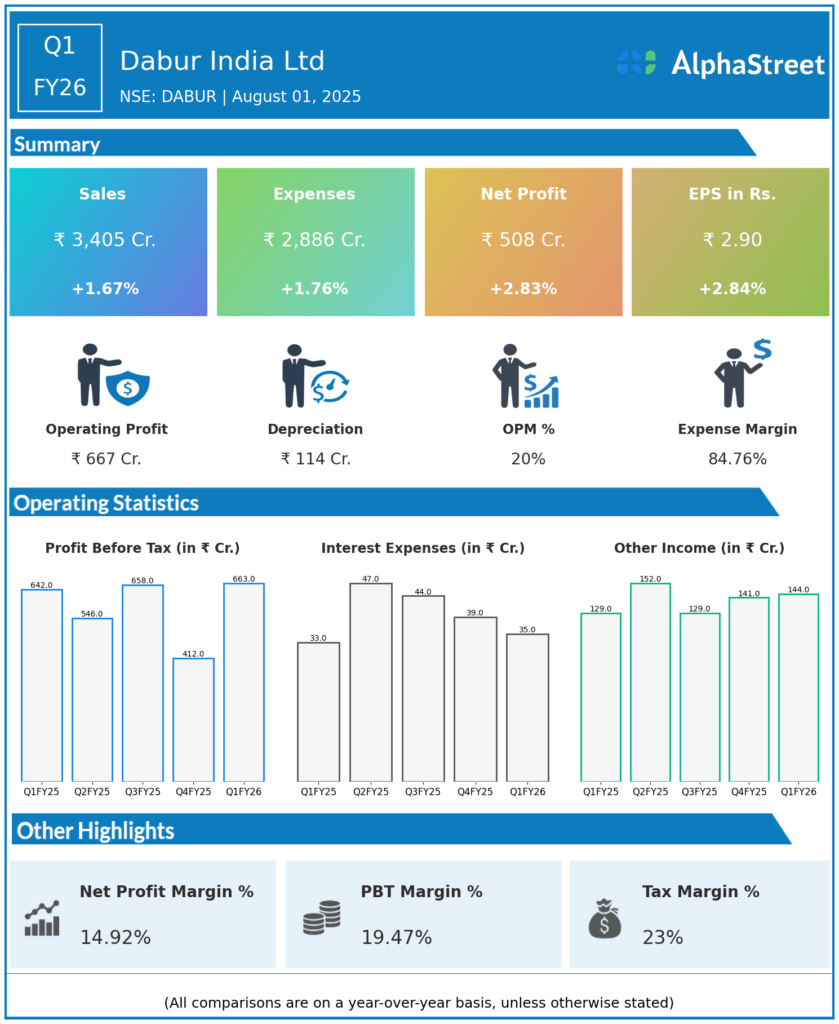

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹3,405 crore, up 1.67% year-on-year (YoY) from ₹3,349 crore in Q1 FY25.

- Total Expenses: ₹2,886 crore, up 1.76% YoY from ₹2,836 crore.

- Consolidated Net Profit (PAT): ₹508 crore, up 2.83% from ₹494 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.90, up 2.84% from ₹2.82 YoY.

Operational & Strategic Update

- Moderate Revenue Growth: The slight increase in revenue reflects steady demand across key product categories including health supplements, personal care, and natural healthcare segments.

- Expense Management: Total expenses increased marginally, keeping pace with revenue growth, indicating effective cost controls and operational efficiencies.

- Profitability Improvement: Net profit and EPS growth moderated, driven by stable top-line performance combined with focused margin management and supply chain optimization.

- Product Focus: Dabur continues to strengthen its Ayurvedic and natural health portfolio, expanding market penetration in both urban and rural areas while innovating in high-growth categories.

- Market Expansion: Strategic investments in branding, e-commerce, and rural distribution channels are enhancing reach and consumer engagement.

- Sustainability Initiatives: The company emphasizes sustainable sourcing, eco-friendly packaging, and social responsibility aligned with its natural product ethos.

Corporate Developments

Dabur India’s Q1 FY26 results demonstrate steady financial performance amidst a competitive FMCG landscape. Its diversified portfolio and consumer trust help sustain growth even in challenging macroeconomic conditions, supported by disciplined cost management.

Looking Ahead

With a solid foundation in Ayurvedic and natural health care segments, Dabur is well-positioned to capitalize on increasing consumer preference for wellness products. Continued focus on innovation, premiumization, digital expansion, and supply chain efficiencies will support sustainable growth and value creation through FY26 and beyond.