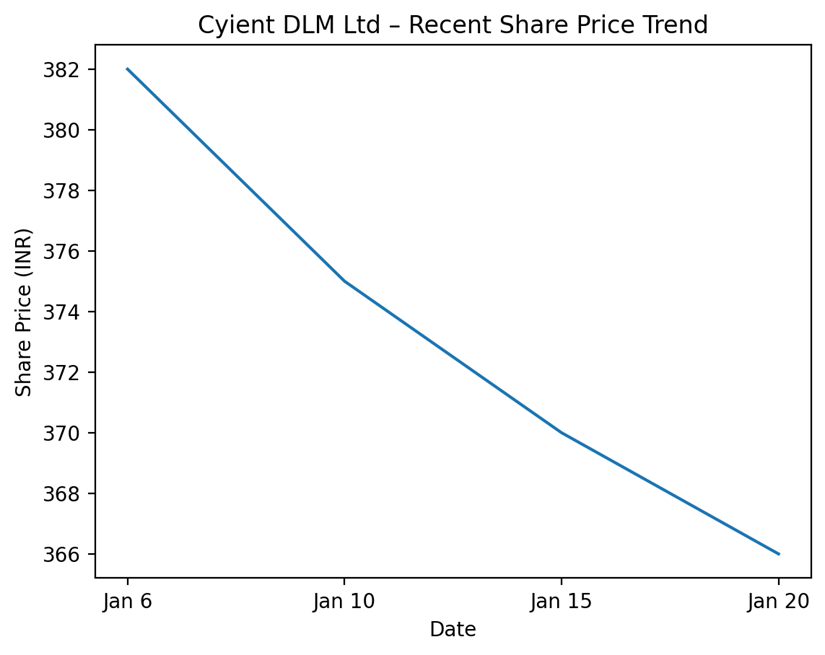

Cyient DLM Ltd (NSE: CYIENTDLM, BSE: 543933) shares closed at approximately ₹366.3 on Wednesday, down about 2.6% from the previous session, after the company reported its third-quarter financial results for fiscal year 2026.

Market Capitalization

At the latest close, Cyient DLM’s market capitalization stood at around ₹2,900 crore.

Latest Quarterly Results

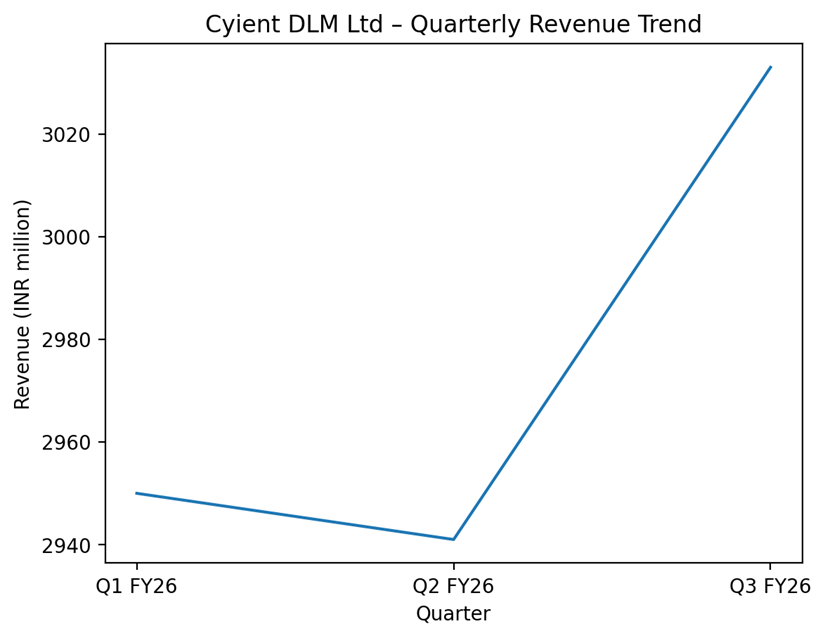

For the quarter ended December 31, 2025, Cyient DLM reported consolidated revenue from operations of ₹3,033.47 million, representing a year-on-year decline of about 31.7%. Consolidated net profit for the quarter was ₹112.33 million, up roughly 2% from the corresponding quarter of the previous year.

For the nine months ended December 31, 2025, consolidated revenue was reported at ₹8,924.08 million, compared with ₹10,890.41 million in the year-ago period. Consolidated net profit for the nine-month period rose to ₹508.41 million from ₹371.71 million a year earlier.

Financial Trends

Business & Operations Update

The board approved the unaudited standalone and consolidated financial results for the quarter and nine months ended December 31, 2025. The company also approved changes relating to the utilisation of IPO proceeds and reconstitution of certain board committees. No regulatory changes, capacity additions, or operational restructuring were announced alongside the quarterly results.

M&A or Strategic Moves

No mergers, acquisitions, or strategic transactions were announced in connection with the Q3 FY26 results.

Equity Analyst Commentary

Publicly available institutional research notes following the Q3 FY26 earnings release focused on reported financial performance and recent share price movement, without publishing ratings, targets, or recommendations.

Guidance & Outlook

The company did not issue financial guidance with its Q3 FY26 earnings release. Market participants continue to monitor demand conditions in the electronic manufacturing services sector and subsequent disclosures from the company.

Performance Summary

Cyient DLM shares declined on the day of the results announcement. The company reported a year-on-year contraction in quarterly revenue and a marginal increase in net profit. Nine-month figures showed lower revenue and higher net profit compared with the prior year.