Executive Summary

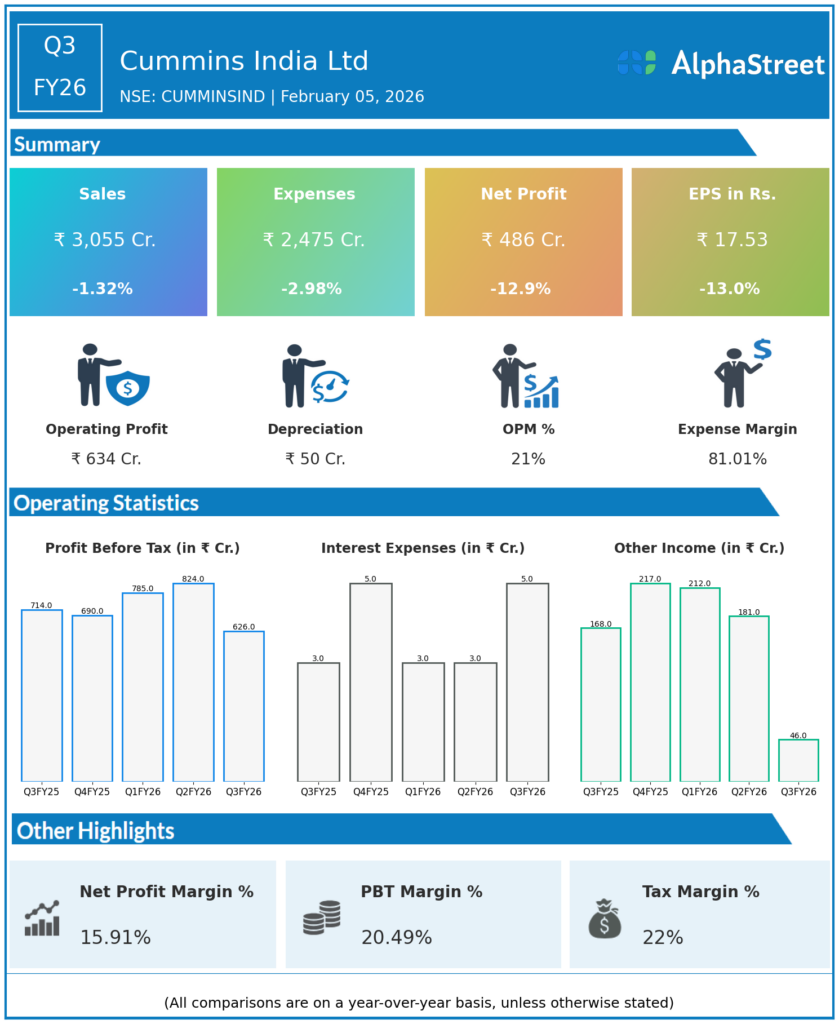

Cummins India Ltd reported Q3FY26 revenues of ₹3,055 crore, down 1.32% YoY, with consolidated net profit declining 12.9% to ₹486 crore. Engine demand softened across powergen and industrial segments while expenses fell proportionally, reflecting broader market cyclicality.

Revenue & Growth

Revenues contracted slightly to ₹3,055 crore from ₹3,096 crore YoY amid 1.32% decline across diesel engines and generator sets. Total expenses decreased 2.98% YoY to ₹2,475 crore, providing modest operating leverage despite volume pressures.

Profitability & Margins

Consolidated net profit fell 12.9% YoY to ₹486 crore from ₹558 crore as topline weakness offset cost controls. Basic EPS declined 13% to ₹17.53 from ₹20.15, highlighting margin compression in Cummins’ Indian power systems portfolio.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

EBITDA margins unavailable; sequential revenue patterns suggest Q3 seasonality typical for engine manufacturers. Alternative fuel and export engine traction may support recovery amid domestic industrial slowdown.