CRISIL is a globally diversified analytical company providing ratings, research, risk, and policy advisory services. It is India’s leading ratings agency and a foremost provider of high-end research to large banks and leading corporations.

Q2 FY26 Earnings Summary (Jul–Sep 2025)

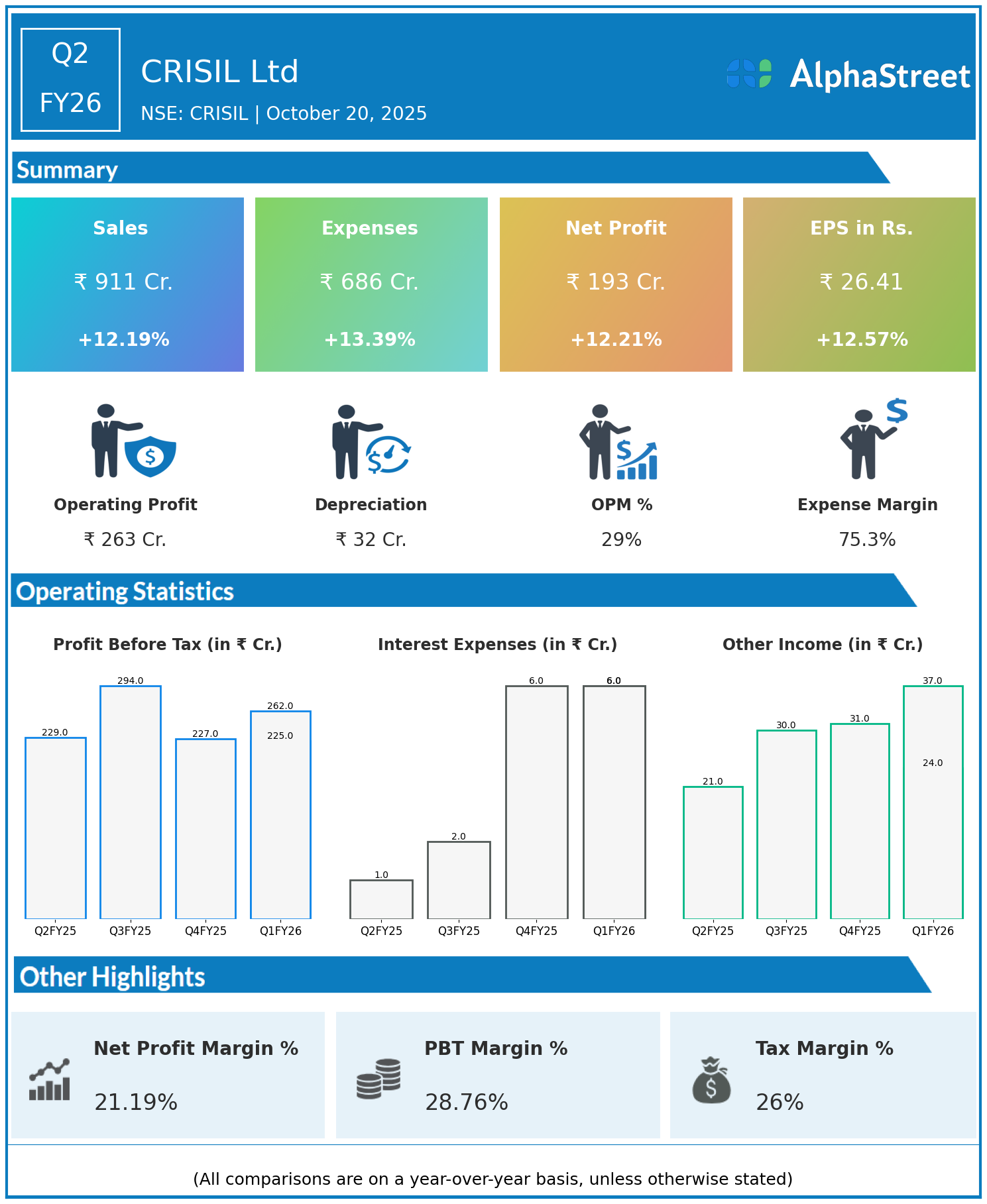

Consolidated Revenue: ₹911.24 crore, up 12.24% year on year and 8.09% sequentially.

Profit After Tax (PAT): ₹193.10 crore, a 12.56% increase year on year and 13% quarter on quarter.

Earnings Per Share (EPS): ₹26.41, up 12.57% year on year.

EBITDA margin improved to approximately 31.6%, reflecting disciplined cost management and operational leverage.

Operational and Business Highlights

CRISIL maintained strong revenue momentum across its ratings and research segments, with broad-based demand growth.

Operating profit margin expanded to 28.89% sequentially as employee cost increases were effectively managed.

The company’s zero-debt balance sheet and strong cash position support financial flexibility and continued investments.

CRISIL’s return on equity reached 28.37%, demonstrating its position as a high-quality, capital-efficient franchise.

Financial Position and Outlook

CRISIL operates with zero debt and a net cash position of over ₹1,300 crore, supporting acquisitions, dividends, and buybacks.

With improving margins, consistent market leadership, and expanding global analytics offerings, CRISIL is positioned for sustained double-digit revenue growth and profitability expansion. The company declared a third interim dividend of ₹16 per share, payable in November 2025.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.