Company Description:

Cosmo First Ltd., a pioneer since 1981 in India’s BOPP Films sector, holds a distinctive position by blending specialty and commodity films. It ranks among the top four global players in BOPP Specialty films and is a significant player in BOPET, thermal, coated specialty, metalized, and CPP films. The company also ventures into specialty chemicals and operates the D2C pet care platform “ZIGLY.” Cosmo Firsts emphasizes R&D, boasting over 100 years of collective experience and multiple patents. Cosmo is a leading producer of thermal lamination, specialty label, and industrial application films. The company is ambitiously building India’s largest pet care ecosystem through an omni-channel approach.

Critical Success Factors:

- Resilience in Speciality Films Segment:

Cosmo Films exhibits resilience in the face of industry challenges due to its strong focus on specialty films. With over two-thirds of its revenue derived from BOPP specialty films, the company stands well-equipped to navigate margin pressures better than its competitors. By expanding its specialty portfolio, including innovative products like shrink label and sun shield films, Cosmo strengthens its margins and enhances its ability to withstand potential future margin fluctuations. This strategic emphasis on specialization allows the company to maintain its leading position in the market. - Growth in Petcare Vertical:

The company’s pet care vertical, Zigly, is rapidly expanding and demonstrates remarkable growth potential. Zigly has achieved impressive monthly revenue (GMV) with a run rate of Rs. 3 crores, driven by strategic retail expansion, innovative sales promotions, and a growing online presence. The acquisition of Petsy, an online venture in the pet care space, further bolsters its position. This successful foray into the pet care industry diversifies Cosmo’s business portfolio, creating additional avenues for growth and revenue generation. - Leadership in Sustainable Practices:

Cosmo Films excels in sustainable practices, contributing to both environmental conservation and responsible production. The company’s commitment to mono-material poly-olefin films promotes ease of recycling and reduces plastic consumption. By designing heat-resistant BOPP films as an alternative to BOPET, partnering with global brands for structure rationalization, and offering oxo-biodegradable films, Cosmo champions innovative eco-friendly solutions. Furthermore, the company’s focus on recycling manufacturing waste for film production, utilization of solar power, and other energy-efficient practices demonstrates its dedication to reducing its environmental footprint. - Strategic Focus on Speciality Chemicals:

Cosmo Films strategically diversifies its business through the foray into speciality chemicals. The company’s masterbatch plant, along with planned expansions, positions it to capitalize on this emerging market. The expansion of coating chemicals and complimentary adhesive business aligns with the evolving needs of packaging, lamination, and labels industries. By aiming for a 25%+ return on capital employed (ROCE) in this segment, Cosmo’s commitment to growth, diversification, and profitability remains evident. - Advanced R&D and Innovation:

A significant strength lies in Cosmo Films’ robust research and development capabilities. With a team of highly qualified polymer and chemical scientists, the company’s R&D focuses on innovation and sustainability. The existing patents and upcoming patent pipeline highlight the company’s commitment to advancing technology and maintaining a competitive edge. By investing in specialized BOPET lines, CPP lines, and ongoing research, Cosmo reinforces its position as an industry innovator, enabling it to lead in both existing and emerging film markets.

Key Challenges:

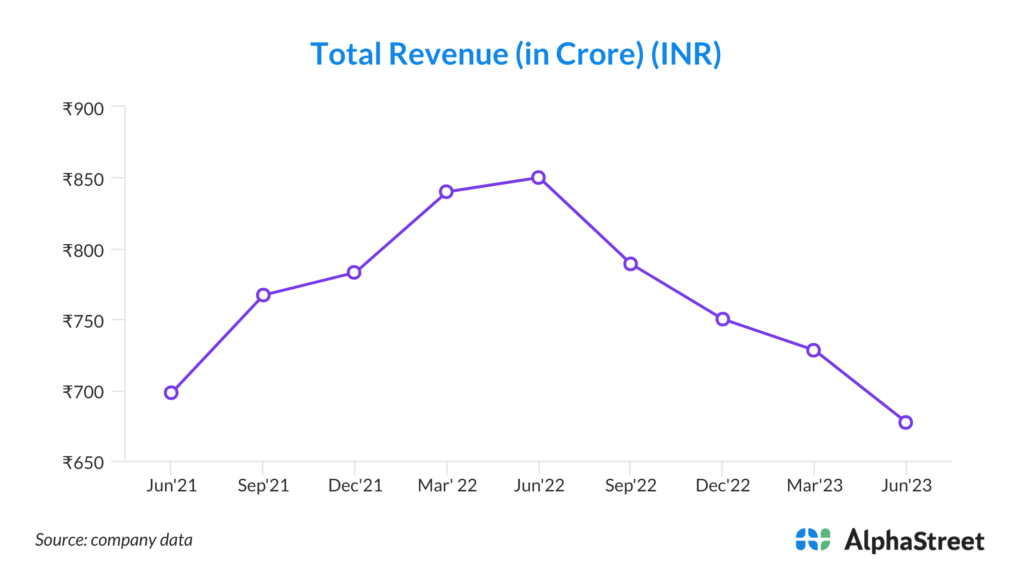

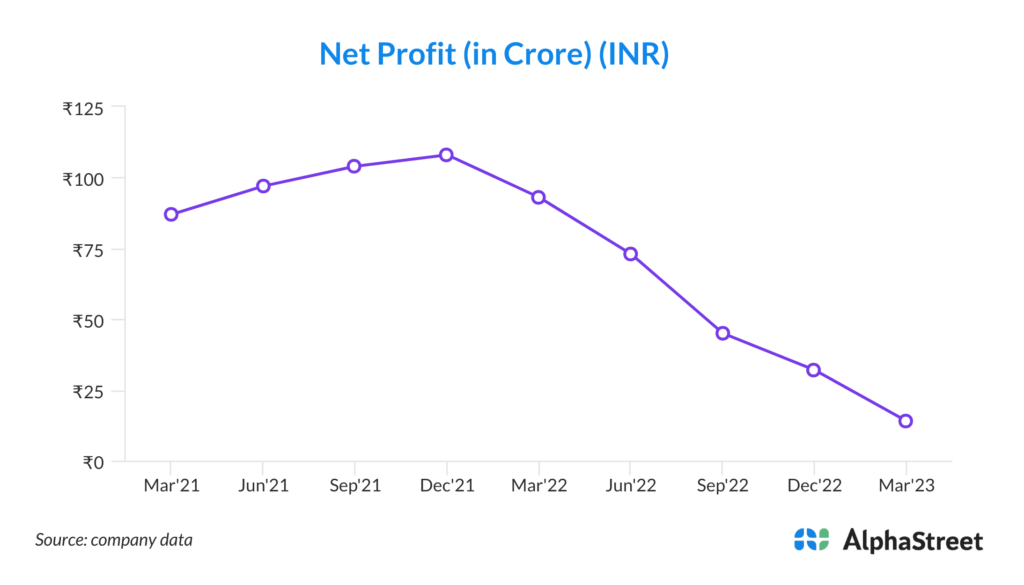

- Market Volatility and Margins:

The company’s exposure to market volatility in raw material prices poses a significant risk. Fluctuations in prices could impact margins and overall profitability, especially when non-repetitive inventory losses occur due to sharp drops in raw material prices. Developing effective hedging strategies and closely monitoring commodity prices are essential to manage this risk and safeguard the company’s financial performance. - Competitive Landscape:

Despite its leading position in various film segments, Cosmo Films operates in a highly competitive industry. Rivalry among global players and potential new entrants could intensify, pressuring market share and pricing power. The need to continually invest in R&D, innovation, and operational efficiency is crucial to staying ahead and maintaining a competitive edge. Failure to adapt to changing market dynamics could lead to loss of market share and reduced profitability. - Market Dependency and Cyclicality:

Cosmo Films’ vulnerability to market cyclicality, particularly in segments like BOPET with oversupply issues, poses a risk. If the demand-supply balance remains unfavorable for an extended period, sustained margin pressure could impact profitability. The cyclical nature of industries the company operates in necessitates proactive planning, diversification, and strategic moves to ensure resilience during market downturns and minimize the impact on financial performance. - Global Economic Factors:

Cosmo Films’ international operations expose it to global economic uncertainties. Economic downturns, trade disputes, currency fluctuations, and geopolitical tensions could disrupt international supply chains and impact the company’s export-driven business model. An adverse global economic environment might result in decreased demand for its products, affecting revenues and profitability. To mitigate this risk, diversification of markets and proactive risk management strategies are crucial. - Regulatory and Environmental Compliance:

The stringent regulatory landscape, particularly in the chemicals and plastics industry, poses a risk for Cosmo Films. Non-compliance with environmental, safety, and quality standards could lead to fines, legal actions, and reputational damage. The company’s commitment to sustainability and environmental responsibility will be tested by evolving regulations. Developing robust compliance protocols, staying updated on regulatory changes, and implementing sustainable practices are crucial to mitigate potential legal and reputational risks.