Coromandel International Ltd is one of India’s leading agri solutions providers, offering a diverse range of products and services across the farming value chain. Its portfolio includes fertilizers, crop protein, bio-pesticides, specialty nutrients, organic fertilizers, and more.

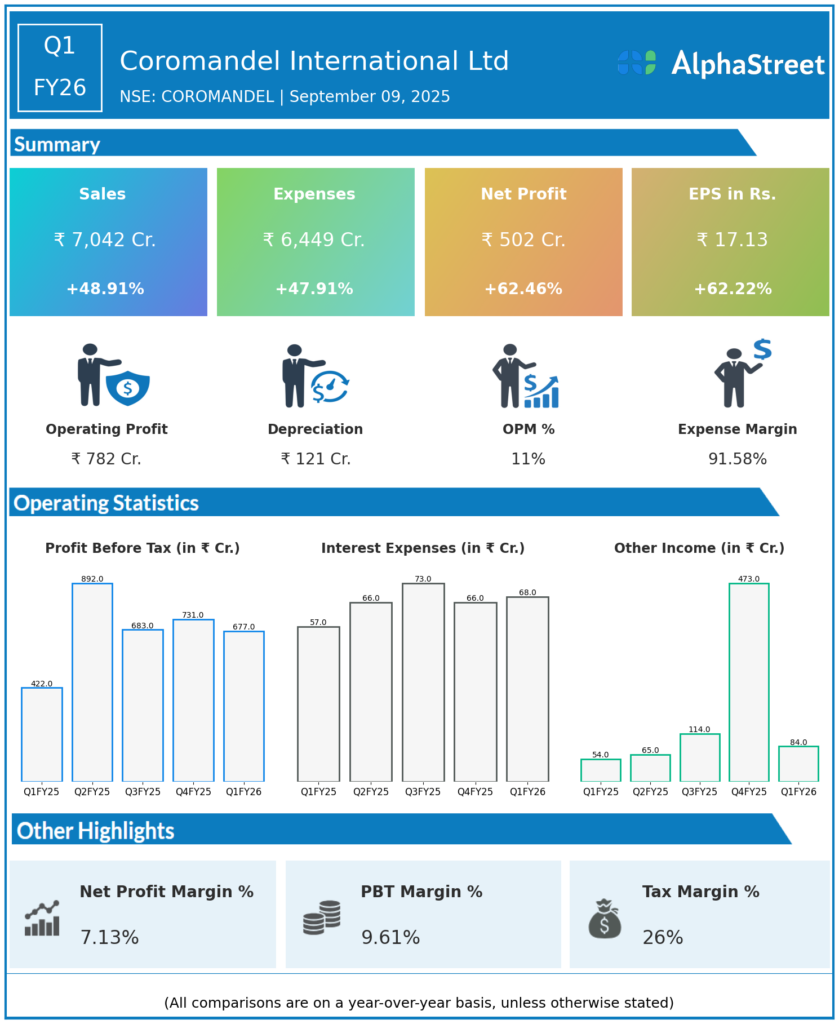

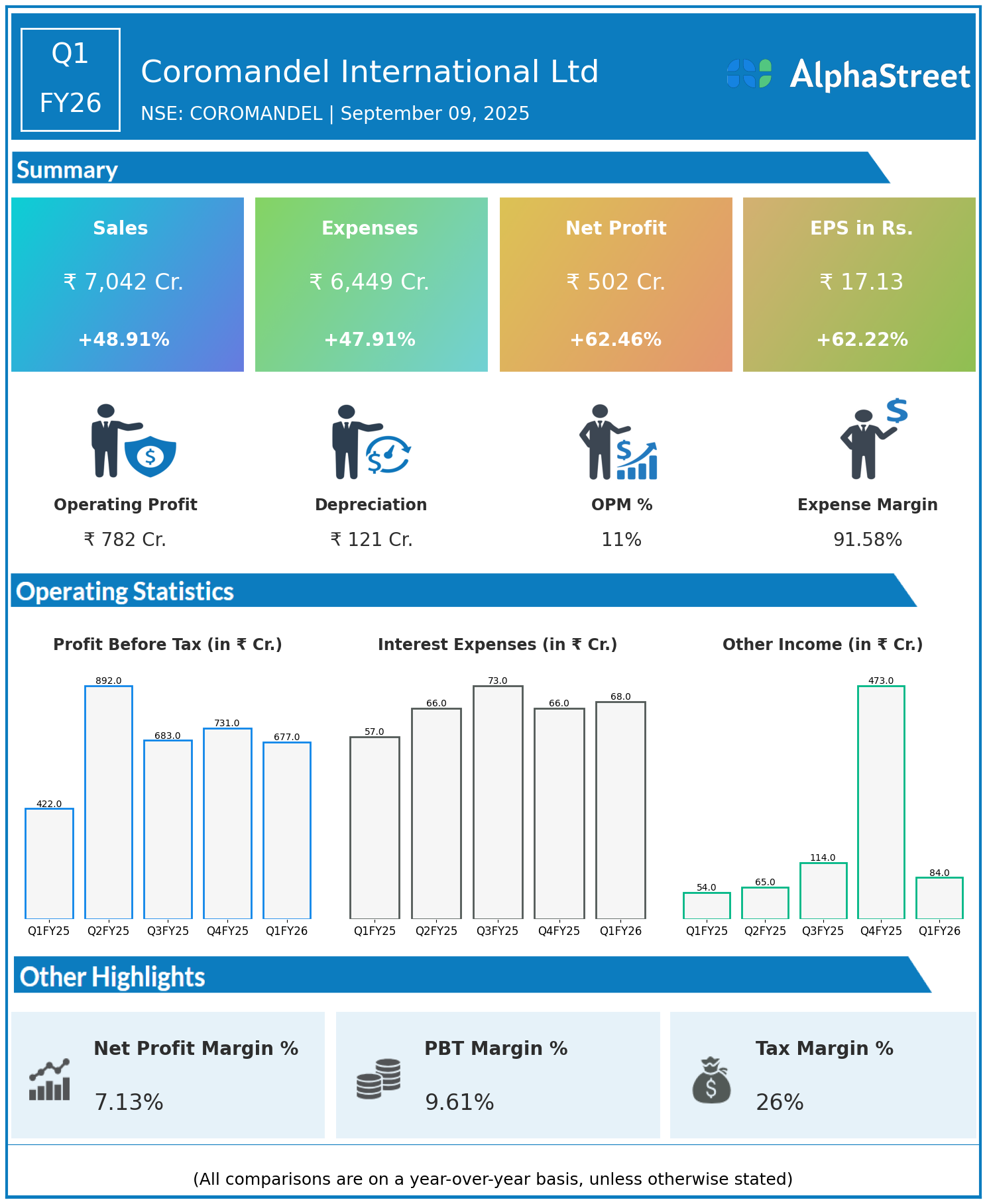

Q1 FY26 Earnings Results:

Revenue: ₹7,042 crore, up 48.91% year-on-year YoY from ₹4,729 crore

Total Expenses: ₹6,449 crore, up 47.91% YoY from ₹4,360 crore

Consolidated Net Profit PAT: ₹502 crore, up 62.46% YoY from ₹309 crore

Earnings Per Share EPS: ₹17.13, up 62.22% YoY from ₹10.56

Operational & Strategic Update:

Revenue Growth: Revenue soared nearly 49%, led by higher volumes and improved realizations across fertilizer and specialty product segments

Cost Trends: Total expenses also increased substantially, primarily due to rising raw material prices and increased sales volumes

Profitability: Net profit surged over 62%, benefiting from operational leverage, improved product mix, and enhanced efficiencies

Segment Contributions: Strong demand for fertilizers, specialty nutrients, and crop protection products drove robust business growth

Strategic Initiatives: The company invested in expanding its specialty crop nutrition portfolio and strengthening distribution networks across India

Corporate Developments in Q1 FY26:

Coromandel International delivered excellent financial performance with strong top-line growth and significant profit expansion. The company’s broad product mix and strategic focus on specialty inputs contributed to the strong results.

Looking Ahead:

The company remains focused on innovation, expanding specialty offerings, and enhancing farmer engagement. Coromandel aims to sustain growth momentum and margin expansion through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel