Coromandel International Ltd (COROMANDEL:NSE), India’s top agri-solutions player with a ₹65,000-crore market cap, has held steady around ₹2,200 despite Q3 margin pressures, buoyed by 30% nine-month revenue growth to ₹25,000 crore and a robust ₹9/share dividend.

Quarterly Results

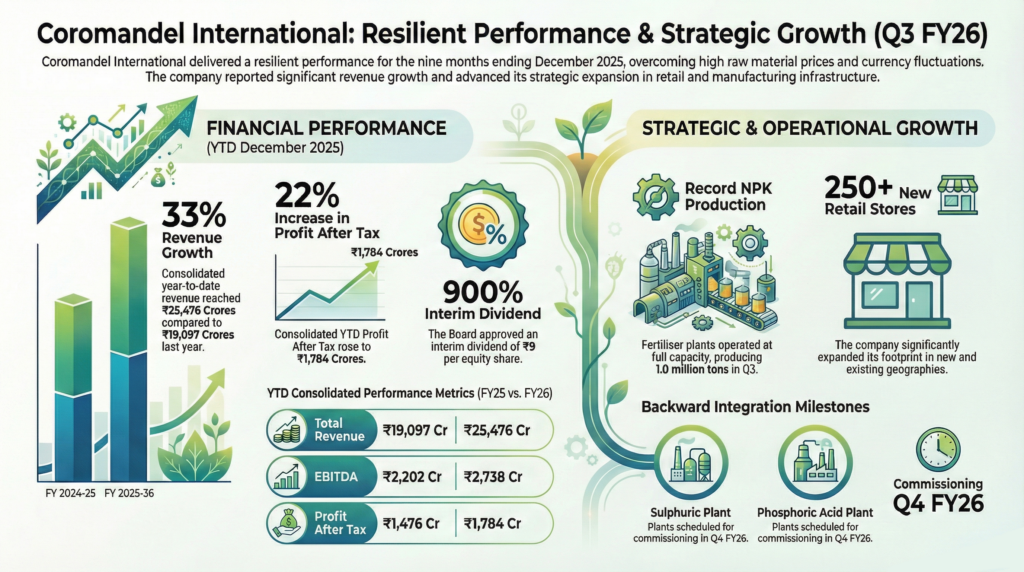

Coromandel International Limited reported consolidated revenue from operations of ₹8,779 Cr for the quarter ended December 31, 2025, up 27% over the ₹6,935 Cr recorded in the same period last year. Consolidated EBITDA for the quarter stood at ₹805 Cr, a 12% rise from ₹722 Cr in the previous year’s corresponding quarter. Net profit after tax for the consolidated entity was ₹488 Cr, reflecting a 4% decrease compared to ₹508 Cr in the prior year. On a standalone basis, total income reached ₹8,537 Cr, up 21% from ₹7,038 Cr. Standalone profit after tax showed a marginal increase of 1% to ₹530 Cr. The Board of Directors approved an interim dividend of ₹9 per equity share.

Annual Performance Context

For the nine-month period ending December 2025, consolidated revenue from operations reached ₹25,476 Cr, a 33% increase from ₹19,097 Cr in the prior year. Consolidated EBITDA for the year-to-date period grew by 24% to ₹2,738 Cr. Profit after tax for the first nine months stood at ₹1,784 Cr, a 21% increase over the ₹1,476 Cr reported for the same period in the previous fiscal year. Standalone total income for the nine-month period was ₹25,133 Cr, representing 30% growth. The company maintained a net debt-to-equity ratio of 0.0 times as of December 2025.

Business and Operations Update

The Nutrient and Allied Business standalone revenue for Q3 FY26 was ₹7,753 Cr compared to ₹6,363 Cr in Q3 FY25. Profit before interest and tax for this segment was ₹615 Cr, down from ₹635 Cr in the previous year. Fertilizer plants achieved record quarterly production of 1.0 million tons of NPKs. The Crop Protection segment standalone revenue rose to ₹785 Cr from ₹631 Cr, with PBIT increasing to ₹158 Cr from ₹91 Cr. NACL Industries Limited became a subsidiary effective August 8, 2025. The retail network expanded by over 250 stores during the year.

Forward Outlook

Commissioning of the backward integration projects for Sulphuric acid and Phosphoric acid plants is scheduled for Q4 FY26. The fertilizer capacity expansion project at Kakinada is currently in progress with completion expected in Q4 FY27. Work has also been initiated for a new water-soluble fertilizer plant at Vizag. Management noted that the quarter was impacted by a late monsoon withdrawal, rising raw material costs, and rupee depreciation.

Performance Summary

Volume growth in the phosphatic fertilizer segment was 10% during the year with cumulative sales of 3.6 million tons. Standalone year-to-date profit before interest and tax reached ₹2,250 Cr for nutrients and ₹431 Cr for crop protection. Consolidated book value per share increased to ₹430 from ₹362. The Murugappa Group, of which Coromandel is a part, reported an annual turnover of ₹90,178 crore. The company operates twenty-one manufacturing facilities across India. The company maintains eight R&D centers.