Container Corporation of India Ltd. (NSE: CONCOR) reported a consolidated net profit of ₹378.70 crore for the third quarter of fiscal 2026, supported by a sharp sequential recovery in margins. The logistics provider declared its third interim dividend of the year while facing continued pressure from foreign institutional selling and competition in the multimodal transport sector.

The company posted a consolidated net profit of ₹378.70 crore for the quarter ended December 31, 2025, a 3.64% increase compared to the same period last year. While the company achieved a robust 42.08% profit surge on a quarter-on-quarter basis, its stock continues to trade significantly below its 52-week high, closing at ₹501.50 on January 29, 2026. The company’s market capitalization stands at ₹38,062 crore, reflecting a 15.69% decline in share value over the past year.

Accounting Updates

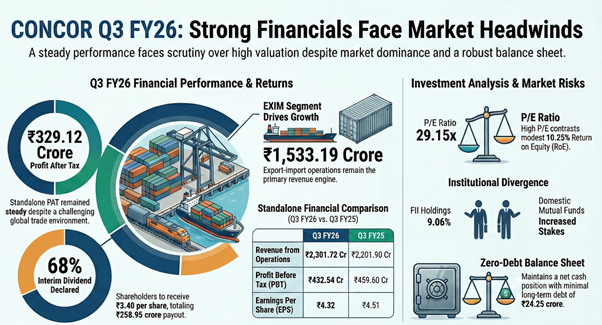

The board approved a third interim dividend of ₹3.40 per equity share, representing 68% of face value, with a total payout of ₹258.95 crore. The record date was set as February 9, 2026.

During the period, the company revised accounting estimates by extending the useful life of its LNG truck and trailer fleet from eight to 15 years, reducing depreciation expense by ₹4.64 crore for the nine months ended December 2025. CONCOR also provided ₹327.15 crore towards land license fees payable to Indian Railways for the April–December 2025 period.

Financial Performance

On a standalone basis, revenue from operations rose to ₹2,301.72 crore in Q3 FY26, up from ₹2,201.90 crore in the year-ago quarter. However, standalone profit after tax (PAT) declined slightly to ₹329.12 crore from ₹343.44 crore in Q3 FY25. Consolidated net sales for the quarter reached ₹2,354.53 crore, growing 2.92% year-on-year. Operating margins (excluding other income) were recorded at 24.45%, representing a 99 basis point contraction compared to the 25.44% reported in the corresponding quarter of the previous year. For the nine-month period ended December 31, 2025, standalone revenue totaled ₹6,802.61 crore with a PAT of ₹963.58 crore.

Operational Overview

The Export-Import (EXIM) segment remains the company’s primary revenue driver, contributing ₹1,533.19 crore to quarterly revenue. Management continues to focus on its multimodal logistics network, which includes over 60 inland container depots and freight stations. However, statutory auditors have raised an “Emphasis of Matter” regarding CONCOR Air Limited, noting material uncertainty about its status as a going concern following the termination of operations at Mumbai airport. Strategically, the company maintains a strong balance sheet with a net cash position and a negative net debt-to-equity ratio of -0.24.

Sector and Macro Context

CONCOR faces intensifying competition from private container train operators and road transport providers, which has pressured its market share and pricing power. While it remains the largest transport services company by market capitalization in India, its Return on Equity (ROE) of 10.25% and Return on Capital Employed (ROCE) of 14.04% trail behind peers like Blue Dart Express and Blackbuck.

Investor Indicators

As of January 2026, the company’s quality grade was downgraded to “Average” from “Good,” and it carries a proprietary investment score of 37/100, which classifies the stock in “Sell” territory. The stock is trading at a trailing price-to-earnings (P/E) ratio of 29.15x, which is considered expensive given a five-year sales compound annual growth rate of 9.07% and a PEG ratio of 26.84. Institutional data shows a divergence in sentiment: foreign institutional investors (FIIs) reduced their holding to 9.06% in the December quarter, while domestic mutual funds increased their stake to 12.58%.