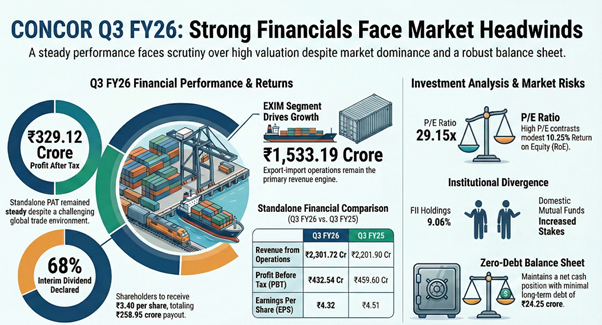

Container Corporation of India Limited (NSE: CONCOR) reported a steady operating performance for the December 2025 quarter (Q3 FY26), with modest year-on-year growth and a sequential recovery in profitability. Revenue from operations on a standalone basis rose to ₹2,301.72 crore from ₹2,201.90 crore in Q3 FY25, reflecting year-on-year growth of about 4.5%. Profit after tax declined marginally to ₹329.12 crore from ₹343.44 crore a year earlier. Earnings per share stood at ₹4.32 versus ₹4.51 in the corresponding quarter last year.

On a consolidated basis, net profit for the quarter increased sequentially to ₹378.70 crore, up 42.08% quarter-on-quarter, while year-on-year growth remained limited at 3.64%. Consolidated net sales rose to ₹2,354.53 crore, up 2.92% year-on-year and 9.33% sequentially.

SWOT Analysis

Strengths:

CONCOR remains India’s largest container logistics operator, with a network of over 60 inland container depots and freight stations. The company has a net cash balance sheet, negligible long-term debt, and majority government ownership, providing financial stability and access to rail-linked infrastructure. Cash flow generation and a consistent dividend payout support balance sheet resilience.

Weaknesses:

Return ratios remain moderate, with ROE near 10% and ROCE in the mid-teens. Operating margins have shown volatility over recent quarters. Asset-heavy operations result in relatively low asset turnover. Year-on-year revenue and profit growth in Q3 FY26 remained limited.

Opportunities:

Growth in containerized trade, recovery in global EXIM volumes, and expansion of multimodal logistics demand provide potential volume support. High cash balances offer flexibility for capital deployment or shareholder returns. Efficiency gains from fleet optimization and terminal utilization could support margins over time.

Threats:

Competitive pressure from private container train operators and road logistics players continues to affect pricing power. Regulatory uncertainty related to land license fees with Indian Railways remains unresolved. Prolonged margin compression or further slowdown in trade volumes could weigh on profitability.

Margins & Costs

Operating margins showed sharp quarter-on-quarter improvement but remained below last year’s levels. Consolidated operating margin excluding other income improved to 24.45% from 20.09% in the previous quarter, but was lower than 25.44% reported in Q3 FY25. PAT margin stood at 15.67%, compared with 16.23% a year earlier. Other income declined year-on-year, contributing to muted bottom-line growth despite higher revenues.

Employee costs remained broadly stable year-on-year, indicating cost discipline. Operating profit before depreciation, interest, and tax, excluding other income, was marginally lower than the year-ago period, reflecting competitive and pricing pressures.

Nine-Month Context

For the nine months ended December 2025, standalone revenue reached ₹6,802.61 crore, with profit after tax of ₹963.58 crore. On a consolidated basis, nine-month PAT stood at ₹956.58 crore. Performance for the period was supported by stable EXIM volumes, while domestic logistics growth remained moderate.

Segment Snapshot

The EXIM segment continued to contribute the majority of revenues, generating ₹1,533.19 crore in Q3 FY26, along with segment profit of ₹365.84 crore. The domestic segment reported revenue of ₹768.53 crore, reflecting slower growth relative to EXIM operations.

Balance Sheet & Accounting Items

CONCOR maintained a strong balance sheet with negligible long-term debt and a net cash position. During the nine-month period, the company provided ₹327.15 crore towards Land License Fee payable to Indian Railways, based on prevailing guidelines, with final determination pending. Due to uncertainty over lease terms, no right-of-use asset or lease liability has been recognized under Ind-AS 116. The company also revised the estimated useful life of its LNG truck fleet from eight years to fifteen years, reducing depreciation expense by ₹4.64 crore over nine months.

Dividend Update

The board declared a third interim dividend of ₹3.40 per share for FY26, amounting to a total payout of ₹258.95 crore. The record date was fixed as February 9, 2026, with payment scheduled thereafter.

Institutional Trends

As of late January 2026, CONCOR shares traded around ₹501.50, down about 15.7% year-on-year and below the 52-week high of ₹652.52. The stock underperformed both the broader market and transport sector indices over one- and two-year periods. Market capitalisation stood at approximately ₹38,062 crore.

Institutional shareholding showed divergent trends. Government of India ownership remained unchanged at 54.80%. Foreign institutional investor holdings declined over recent quarters, while domestic mutual funds increased their stake during Q3 FY26.

Valuation Metrics

The stock was trading at about 29x trailing earnings, with a price-to-book ratio of around 3x. Dividend yield stood near 1.8%. Return on equity was about 10.25%, while return on capital employed was approximately 14%, reflecting moderate capital efficiency relative to peers in the logistics sector.