Computer Age Management Services Limited (CAMS) is a leading mutual funds transfer agency in India, providing comprehensive investor services, distributor services, and support to asset management companies (AMCs). CAMS plays a pivotal role in India’s mutual fund ecosystem by offering seamless transaction processing, record-keeping, and other value-added services to market participants.

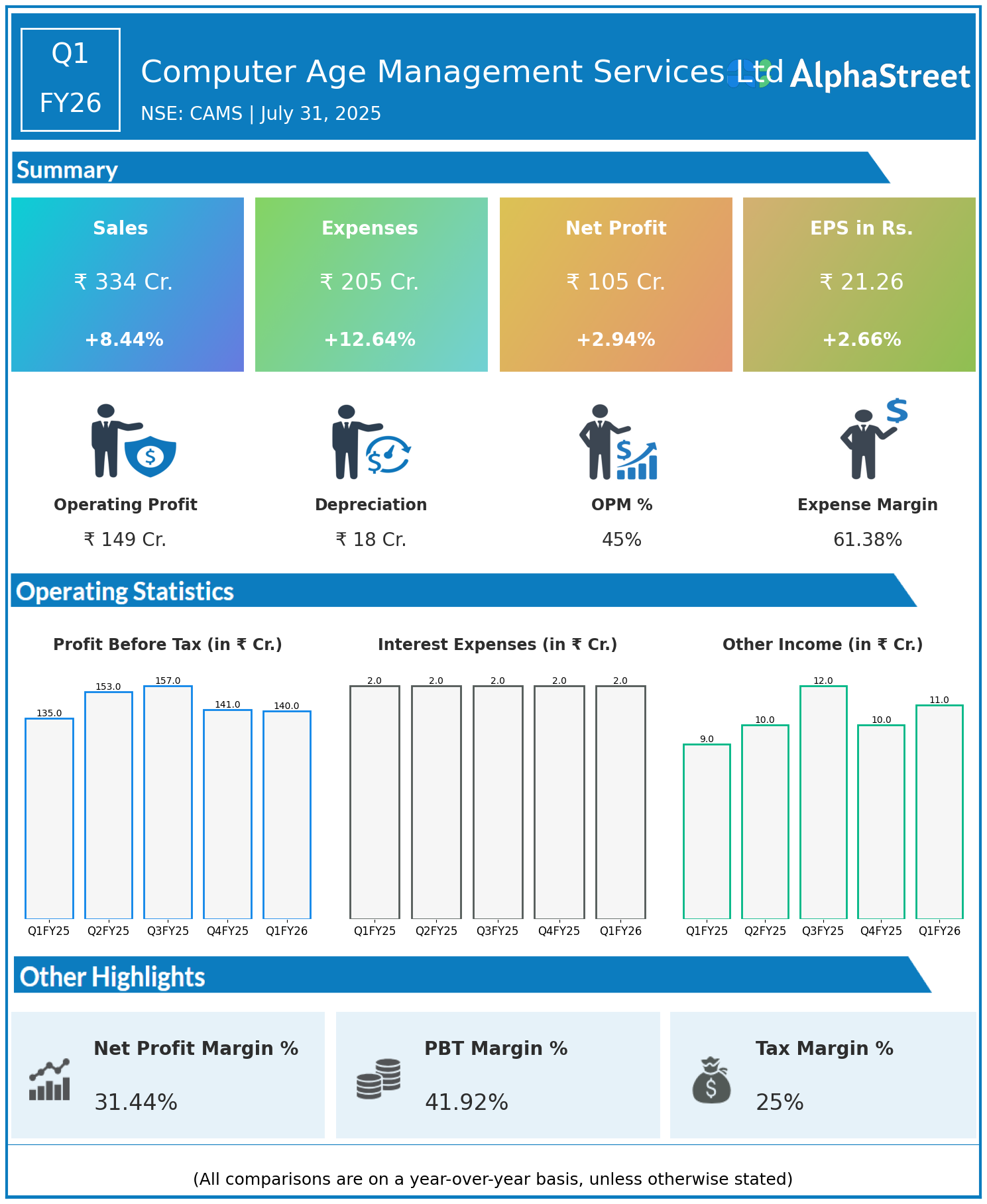

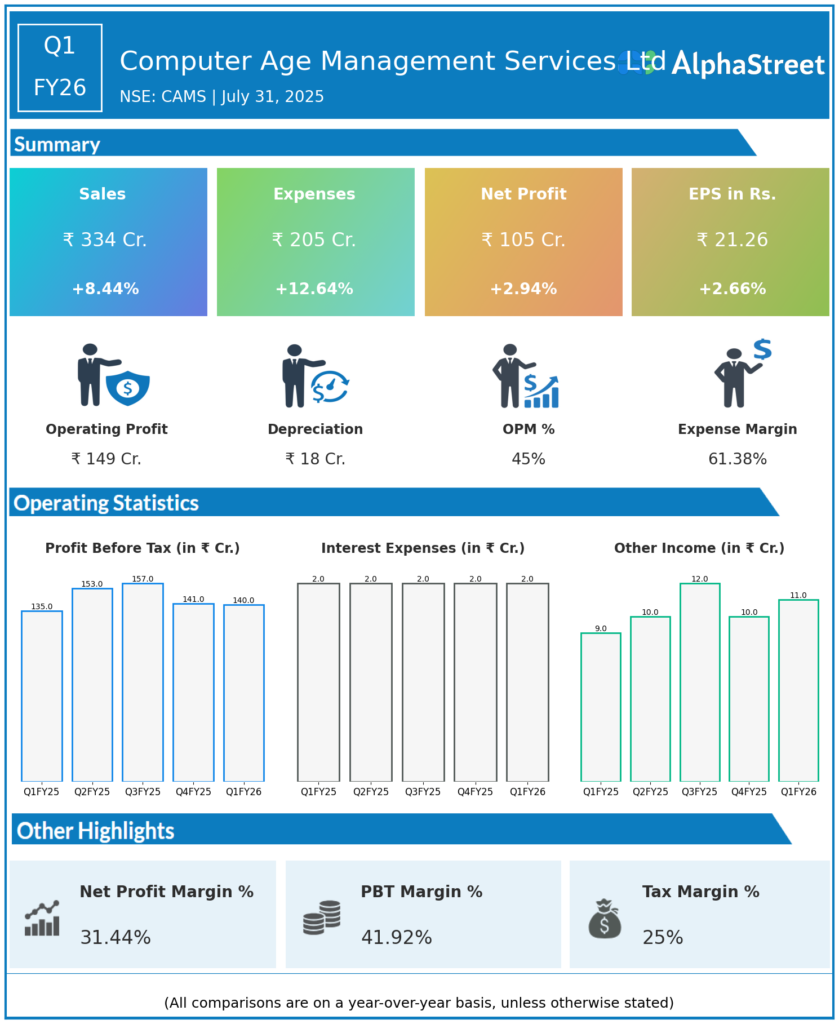

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹334 crore, up 8.44% year-on-year (YoY) from ₹308 crore in Q1 FY25.

- Total Expenses: ₹205 crore, up 12.64% YoY from ₹182 crore.

- Consolidated Net Profit (PAT): ₹105 crore, up 2.94% from ₹102 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹21.26, up 2.66% from ₹20.71 YoY.

Operational & Strategic Update

- Revenue Growth: The healthy increase in revenue reflects growth in transaction volumes, expanded service offerings to AMCs and distributors, and deepening penetration in the mutual fund industry.

- Expense Rise: Expenses increased moderately, driven by investments in technology infrastructure, regulatory compliance, and operational scaling to support business growth and enhance client servicing capabilities.

- Profitability: Net profit growth, while modest, underscores efficient cost management despite rising expenses and demonstrates resilient earning quality.

- Market Position: CAMS continues to benefit from its dominant position as a trusted transfer agency, leveraging strong client relationships and a growing mutual fund investor base.

- Technology & Innovation: Ongoing investments in digital platforms, automation, and cybersecurity strengthen operational efficiency and improve customer experience.

- Regulatory Compliance: The company remains vigilant in meeting evolving regulatory requirements, ensuring adherence to industry best practices and fostering investor confidence.

Corporate Developments

Q1 FY26 marked a solid quarter for Computer Age Management Services with double-digit revenue growth and steady profit expansion amid rising cost pressures. CAMS’ proactive technology adoption and focus on client servicing underpin its competitive edge in the evolving mutual fund servicing landscape.

Looking Ahead

CAMS is well-positioned to capture future growth driven by increasing mutual fund penetration, enhanced investor awareness, and expanding distribution networks. Continued emphasis on innovation, operational excellence, and regulatory compliance is expected to support sustained revenue and profitability growth throughout FY26 and beyond.