“The new structure that is now settled with teams that are now primed, the continued large deal wins, strong executable order book, a resilient deal pipeline, anticipated broad-based growth across our core businesses gives us confidence that we shall continue to drive robust, sustained, and profitable growth in FY’24. For FY24, our revenue growth guidance is 13% – 16% growth in constant currency terms. On the profitability front, we expect our gross margin to increase by about 50 bps in FY24 and adjusted EBITDA margin to remain at similar levels as FY23.”

-Sudhir Singh, CEO

Stock Data

| Ticker | COFORGE |

| Industry | IT |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | 5.3% |

| Last 6 Months | 18.5% |

| Last 12 Months | 31.4% |

Business Basics

Coforge Limited is a leading global IT solutions and services company that specializes in providing transformative digital solutions to clients across various industries. With a rich heritage of over 30 years, Coforge has built a strong reputation for its innovative and customer-centric approach. The company focuses on delivering value to its clients by combining domain expertise, technology capabilities, and a deep understanding of business processes. Coforge offers a comprehensive portfolio of services that encompass various aspects of digital transformation, including consulting, application development and management, infrastructure services, business process management, and enterprise integration. The company’s services are designed to help organizations optimize their operations, improve customer experiences, and drive growth in a rapidly evolving digital landscape.

Coforge operates across multiple industry verticals, including banking and financial services, insurance, healthcare, manufacturing, and travel and transportation. It has established long-standing partnerships with leading global corporations, enabling it to deliver customized solutions that address specific business challenges. The company’s key strengths lie in its deep domain expertise, strong technical capabilities, and a robust delivery framework. Coforge leverages emerging technologies such as artificial intelligence (AI), machine learning (ML), cloud computing, and automation to develop innovative solutions that drive business agility and efficiency.

Q4 FY23 Financial Performance & Analysis

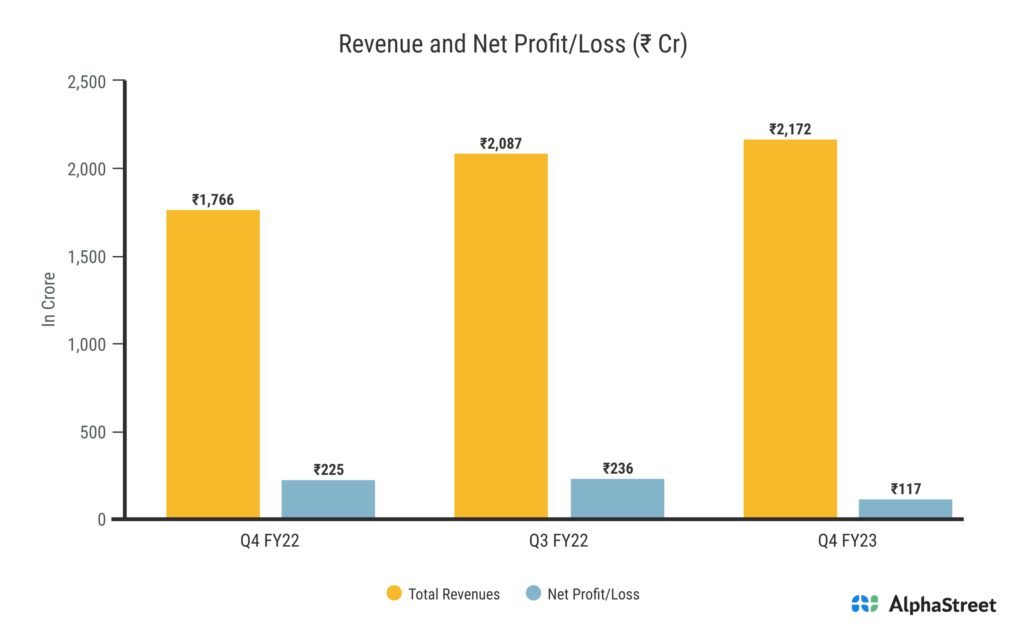

Coforge Limited Reported Total Income for Q4 FY23 of ₹2,172 Crore up from ₹1,766 Crore year on year, a growth of 23%. Consolidated Net Profit of ₹117 Crore, down 48% from ₹225 Crore in the same quarter of the previous year. The Earnings per Share is ₹ 18.80 for this quarter.

According to management, the company’s growth during the quarter was a result of a very strong execution engine and deep client relationships that remain resilient, which aided in the closing of large deals. Strong client relationships led to growth in Coforge’s top 5 and top 10 clients that increased year over year by 23.9% and 26.6%, respectively, and contributed 23.0% and 35.5% to revenue. The PAT metrics were down due to two off expenses. The first is due to costs associated with the $1 billion milestone celebrations, particularly the gifting of an Apple iPads to all 21,000+ employees as a memento of the occasion. The second is due to provisions made for ADR expenses already incurred.

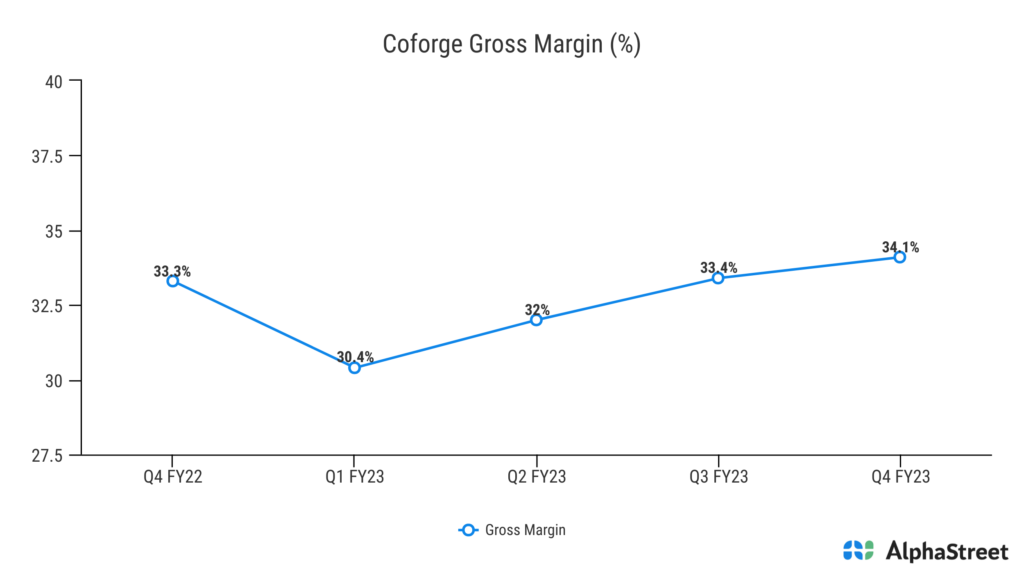

In terms of margins, Q4 gross margins sequentially rose by 71 basis points (bps), following a sequential rise of 133 bps in Q3. Q4’s gross margin was 34.1%.

Services Provided By Coforge

Coforge leverages digital technologies to help organizations reimagine their business models, enhance customer experiences, and drive innovation. This includes services such as digital strategy consulting, user experience design, mobile application development, and digital marketing. Coforge also helps clients unlock the value of their data through advanced analytics and business intelligence solutions. The company provides services such as data integration, data management, data visualization, predictive analytics, and data science to drive data-led decision-making and insights. The company enables process automation and optimization through Appian, Pega, and Outsystem. These services help streamline business processes, improve productivity, and reduce operational costs.

It also offers a comprehensive suite of services around the Salesforce platform, including implementation, customization, integration, migration, and support. These services enable organizations to leverage Salesforce’s capabilities for sales, marketing, customer service, and analytics. Coforge helps organizations harness the power of cloud computing by providing cloud consulting, migration, and management services. The company also offers infrastructure management services to optimize IT infrastructure, ensure high availability, and improve scalability. In Cybersecurity Services, it focuses on protecting organizations from cyber. This includes services such as vulnerability management, threat intelligence, phishing analysis, identity-access managment, and risk management.

Coforge delivers end-to-end business process solutions to help organizations streamline their operations and achieve operational excellence. These solutions encompass areas such as finance and banking, insurance, mortgage, and customer experience. The company provides wide range of quality engineering and testing services to ensure the reliability, performance, and security of software applications. This includes test strategy and planning, test automation, performance testing, and security testing. Coforge provides a range of services around SAP, one of the leading enterprise resource planning (ERP) systems. Moreover, it also explores the potential of emerging technologies such as blockchain, Internet of Things (IoT), and augmented reality (AR)/virtual reality (VR) to create immersive experiences and drive business transformation. By leveraging artificial intelligence (AI) and cognitive technologies, the company builds intelligent systems that automate tasks, enhance decision-making, and improve customer interactions. These services include natural language processing (NLP), machine learning (ML), and chatbot development.

Coforge’s Record High Order Intakes

The company ended FY23 with the highest ever recorded yearly order intake of $1.3 billion, which resulted in strong performance for Q4. Intake of orders totaled $301 million in the fourth quarter. This is the fifth quarter in a row that the company have received more than $300 million in orders. Additionally, Coforge signed two sizable deals during the quarter from the BFS and the Travel verticals. The total value of locked orders for the next 12 months is reflected in the executable order book, which has reached a record US$ 869 million. A year ago, this amount was $ 720 million. The business completed 11 sizable deals in FY23, of which 2 were worth more than $50 million and 5 were worth more than $30 million.

As per the management, “Our deal pipeline continues to be both robust and resilient as exemplified by our current quarter performance. We expect this deal momentum to continue in Q1FY24 as well.”

Outlook of India’s IT Industry

Given the rapid rates of industrialization and globalization, India’s IT sector has a very promising future. Research predicts that the Indian IT sector will be worth $350 billion by 2025. According to the most recent prediction from Gartner, Inc., India’s IT spending will increase 2.6% in 2023. In the upcoming year, Indian companies will keep increasing their investments in important information technology sectors. The cost advantage India provides compared to developed countries is one of the major factors fostering the expansion of the IT sector in that nation.

The IT-BPM industry will contribute 7.4% of India’s GDP in FY 2022. The IT and BPM industries are expected to generate $245 billion in revenue in FY 2023. The IT industry is anticipated to produce $194 billion in export revenue and $51 billion in domestic revenue in FY 2023. As of March 2023, 5.4 million people worldwide are employed in the IT-BPM sector. Indian IT companies offer solutions that are affordable without compromising quality. This cost advantage has been a major factor in the growth of offshore IT outsourcing and has given Indian businesses a competitive advantage overseas.