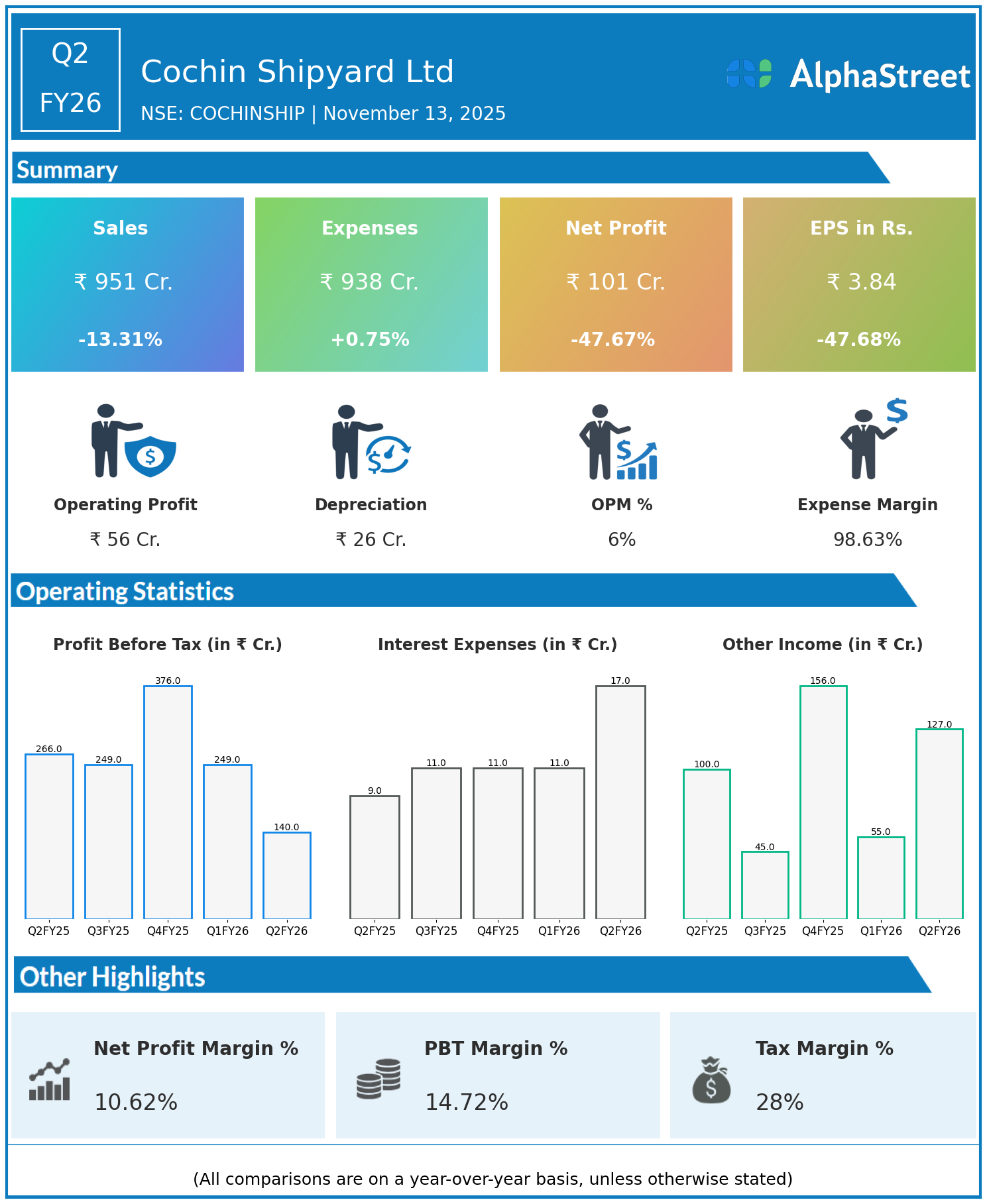

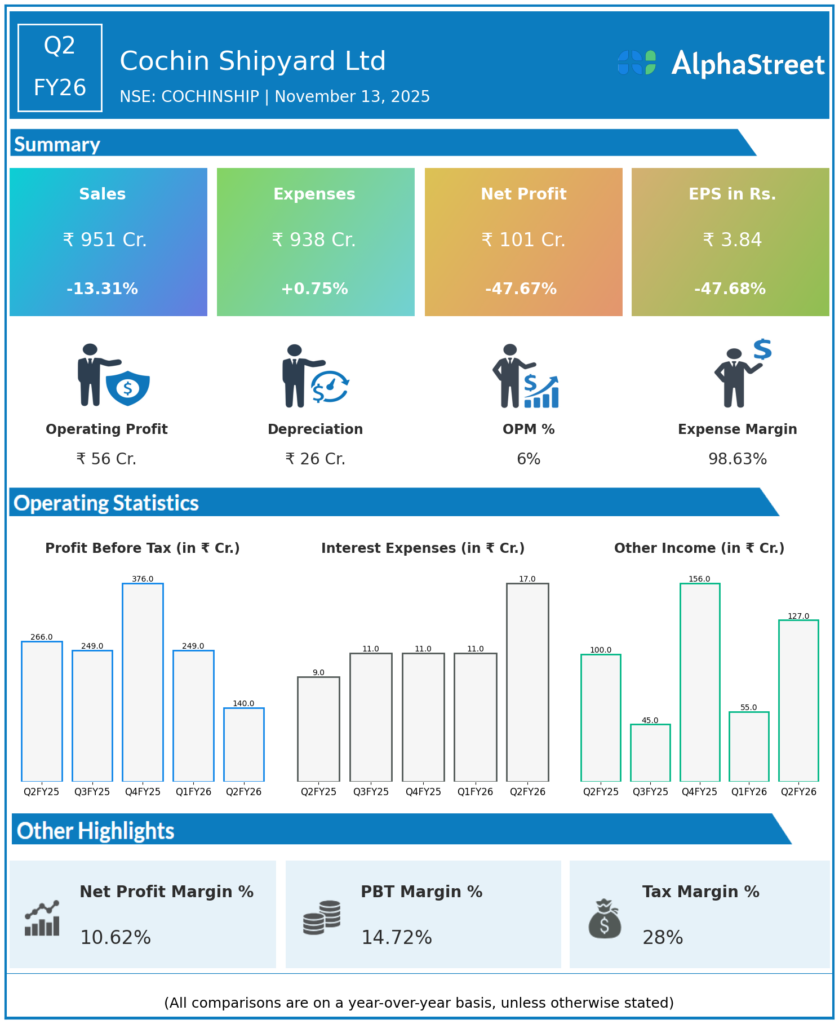

Cochin Shipyard Ltd (CSL), established in 1972 and a key player in ship construction, repairs, and refits including technologically advanced vessels, announced its Q2FY26 financial results with a fall in profitability.

Financial Highlights:

- Revenues declined 13.31% year-on-year to ₹951 crore from ₹1,097 crore.

- Total expenses rose slightly by 0.75% to ₹938 crore from ₹931 crore.

- Consolidated net profit dropped 47.67% to ₹101 crore from ₹193 crore.

- Earnings per share declined 47.68% to ₹3.84 from ₹7.34.

The profit decline was primarily due to lower revenue from shipbuilding activities despite controlled expenses. CSL continues to focus on advanced ship construction and export markets.

Outlook:

Cochin Shipyard is targeting enhanced operational efficiencies, order book growth, and technological innovations to improve its financial performance as market conditions recover.

Follow Cochin Shipyard Ltd’s Q2FY26 performance and updates on the AlphaStreet India News Channel.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.