Coal India Limited (CIL), the world’s largest coal producer, plays a vital role in India’s energy landscape by supplying coal to major sectors such as power and steel, in addition to serving cement, fertilizers, and other core industries. The company operates extensive coal mining activities and several coal washeries, ensuring a steady flow of energy resources to fuel the country’s growth.

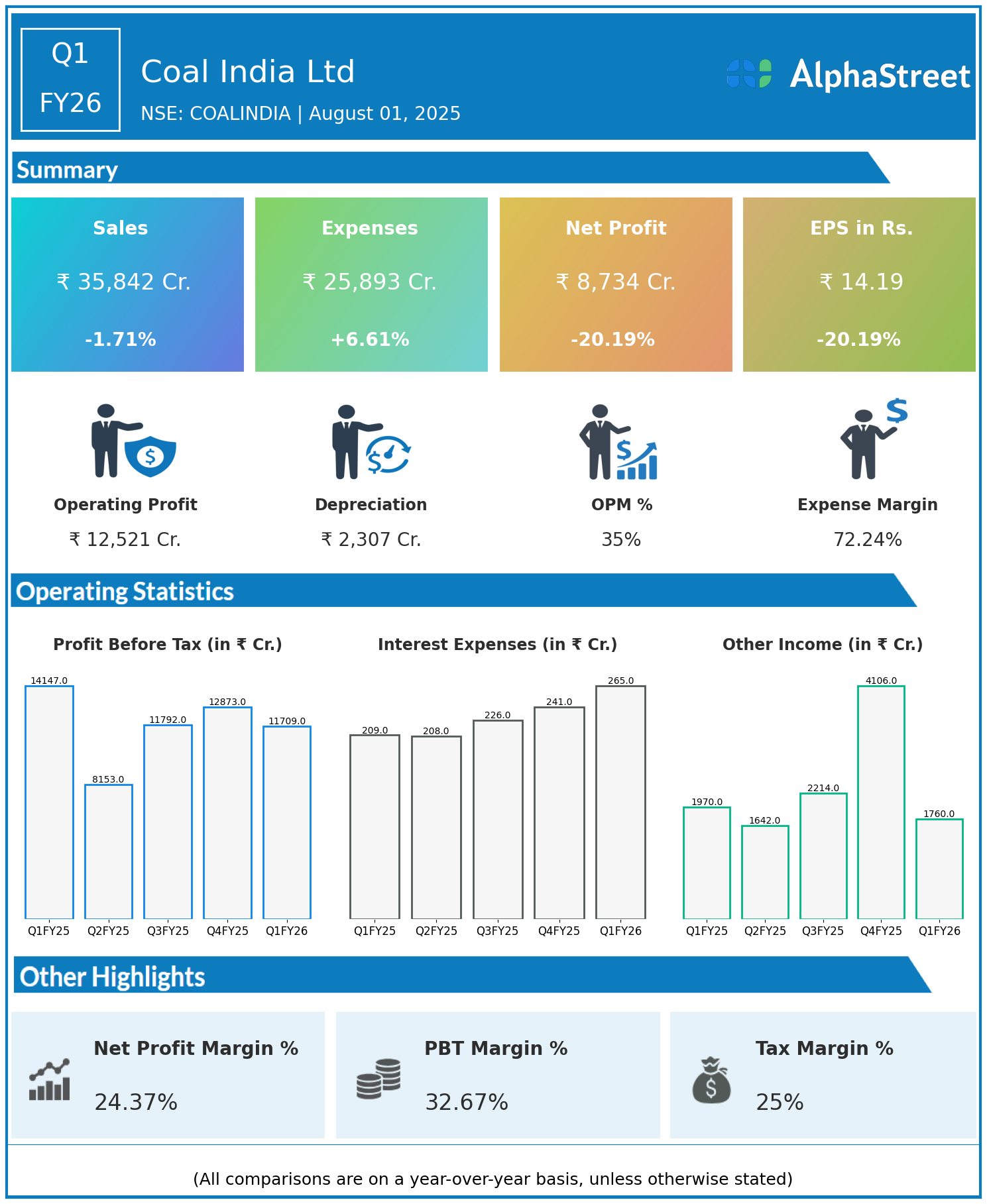

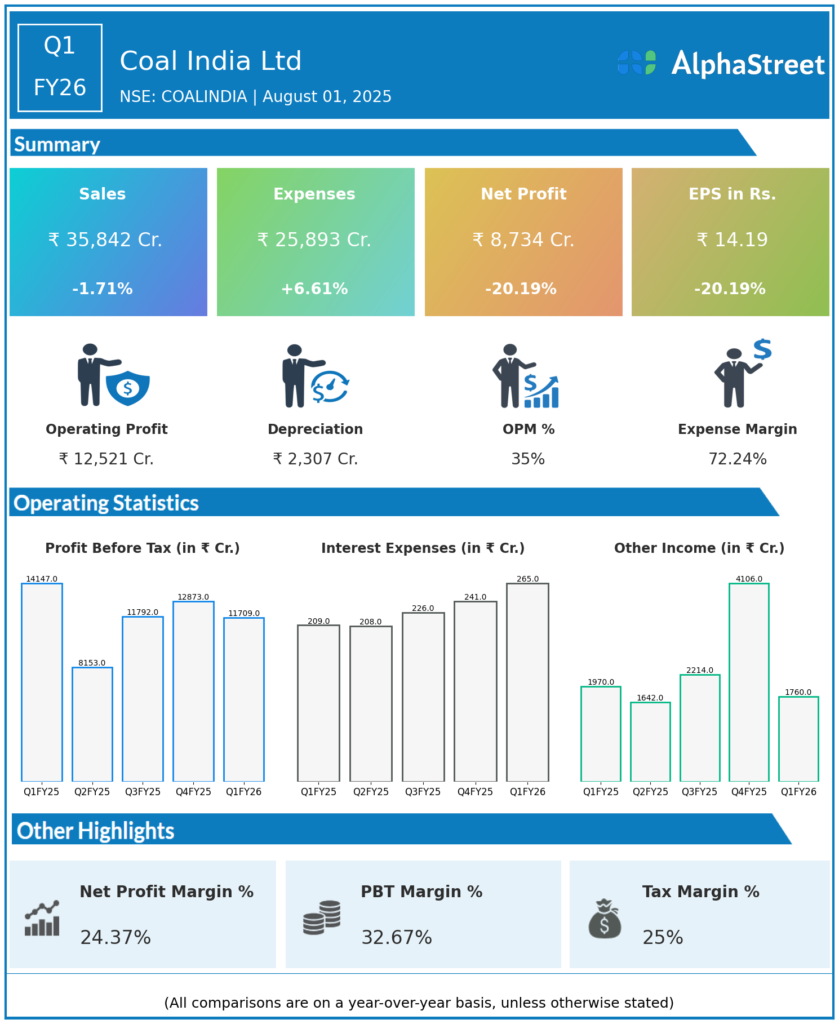

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹35,842 crore, down 1.71% year-on-year (YoY) from ₹36,465 crore in Q1 FY25.

- Total Expenses: ₹25,893 crore, up 6.61% YoY from ₹24,287 crore.

- Consolidated Net Profit (PAT): ₹8,734 crore, down 20.19% from ₹10,944 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹14.19, down 20.19% from ₹17.78 YoY.

Operational & Strategic Update

- Topline Stability, Cost Headwinds: Revenue remained broadly stable with only a marginal decline, reflecting steady offtake from power, steel, and core sectors. Demand resilience was offset by pricing or volume pressures.

- Rising Expenses: Expenses increased significantly, outpacing revenue growth. Higher wage costs, input prices, and provisioning contributed to cost escalation, putting pressure on margins.

- Profitability Decline: The double-digit drop in net profit and EPS highlights margin compression from rising costs, even as core sales volumes remained robust.

- Segment Focus: CIL’s coal mining operations continue to underpin India’s energy and industrial sectors. Expansion in coal washeries aims to improve coal quality and efficiency for key consumers.

- Market Position: As a government-majority-owned enterprise, Coal India maintains a dominant position in domestic coal supply, supporting national energy security and industrial output.

- Operational Initiatives: The company continues to modernize mines, improve safety standards, and invest in mechanization and digital solutions to drive productivity.

Corporate Developments

Q1 FY26 was a challenging quarter for Coal India Ltd, with stable revenues but heightened cost pressures eroding profitability. Despite this, CIL’s massive scale and strategic importance ensure ongoing support for power and manufacturing sectors, especially amid the energy transition and rising industrial demand.

Looking Ahead

Coal India Ltd continues to focus on enhancing operational efficiencies, managing input costs, and exploring cleaner coal technologies. As India’s energy mix evolves, CIL aims to remain at the forefront by strengthening supply chain reliability and supporting the country’s power infrastructure. Margin management and cost competitiveness will be key priorities for recovery and sustained value creation in FY26 and beyond.