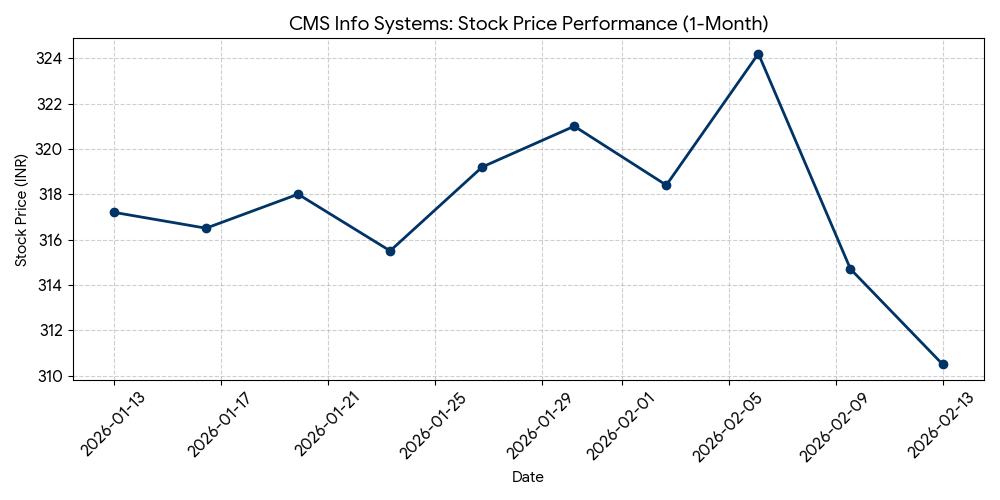

CMS Info Systems (NSE: CMSINFO / BSE: 543441) shares closed at ₹310.50 on Friday, representing an intraday decline of 1.32% following the release of its third-quarter financial results. The stock fluctuated between a high of ₹312.00 and a low of ₹302.45 during the session.

Market Capitalization

The company’s market capitalization stood at ₹5,103.11 crore (approximately $615 million) as of the market close on February 13, 2026.

Latest Quarterly Results

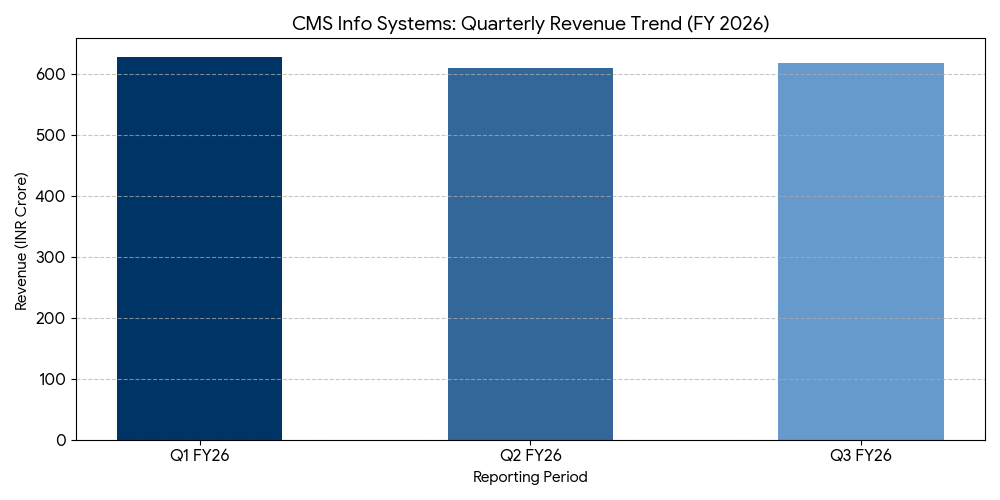

For the quarter ended December 31, 2025 (Q3 2026), CMS Info Systems reported consolidated revenue of ₹618.22 crore, a year-over-year increase of 6.3% from ₹581.49 crore in the corresponding quarter of the previous year. Consolidated net profit for the period was ₹57.40 crore, a decline of 38.4% compared to ₹93.19 crore in Q3 2025.

Segment Performance:

- Cash Management Services: Revenue was ₹384.27 crore, compared to ₹381.1 crore in the previous year.

- Managed Services & Technology Solutions: Revenue stood at ₹295 crore, reflecting growth in banking automation and remote monitoring.

- Card Services: Revenue contributed ₹24.91 crore to the consolidated top line.

Profitability was impacted by a one-time exceptional expense of ₹11.11 crore related to the implementation of new labor wage codes.

FINANCIAL TRENDS

Nine-Month Results

For the nine-month period ended December 31, 2025 (9M FY26), consolidated revenue grew to ₹1,854.25 crore, up 2.7% from the prior year. However, cumulative net profit for the nine months saw a contraction of 18.4%, totaling ₹224.33 crore. The financial trajectory for the fiscal year indicates revenue stability accompanied by a contraction in net margins due to increased operating costs and regulatory-led employee expenses.

Business & Operations Update

CMS Info Systems secured a 10-year contract from the State Bank of India (SBI) valued at ₹1,000 crore for integrated cash solutions across 5,000 ATMs. The company reported that its order books for ICICI Bank and India Post are currently 75% live. Furthermore, the company’s HAWKAI enterprise AI solution is now operational at a leading public sector bank, deploying 16 distinct AI use cases.

M&A or Strategic Moves

The company increased its stake in Securens Systems Private Limited to 99.50% following an investment of ₹44.1 crore. Additionally, CMS Info Systems has signed a term sheet for a business transfer agreement with a managed services provider, with an estimated transaction value between ₹100 crore and ₹125 crore.

Q&A Session Focal Points

During the analyst conference call, discussions centered on the margin compression observed over the last two quarters. Management addressed the ₹11.11 crore impact of the new wage code, identifying it as a non-recurring regulatory cost. Inquiries were also made regarding the execution timeline of the ₹1,000 crore SBI contract and the scalability of the AI-based HAWKAI platform. Management indicated that the current quarter represents a “financial bottom” for the company, with improvements expected as the large order wins transition to the execution phase.

Guidance & Outlook

The company has reiterated its revenue target of ₹2,800 crore for FY2027. Points of focus for the upcoming periods include the stabilization of margins following one-time wage adjustments, the operationalization of the remaining 25% of the ICICI and India Post contracts, and the integration of newly acquired managed services assets.

Performance Summary

CMS Info Systems stock ended 1.32% lower at ₹310.50 following Q3 results. While revenue rose 6.3% to ₹618.22 crore, net profit fell 38.4% to ₹57.40 crore due to exceptional items. The Managed Services segment showed growth, supported by a significant ₹1,000 crore contract win from SBI.