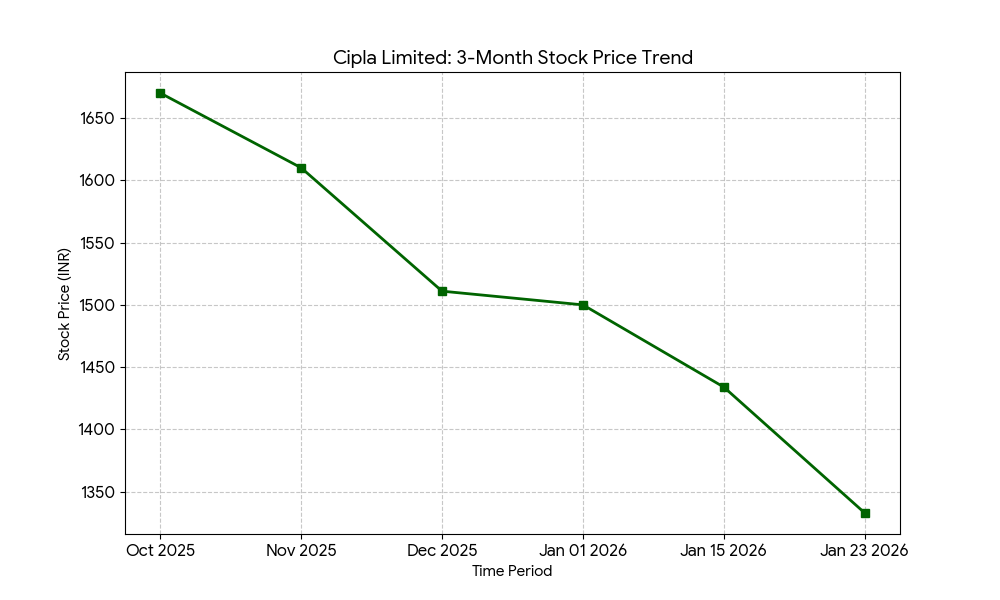

Cipla Limited (NSE: CIPLA; BSE: 500087) shares declined on the National Stock Exchange and BSE today following the release of the company’s third-quarter financial results. The stock was trading at INR 1,333.60, representing an intraday decrease of 2.69% at 13:40 IST. The stock reached a daily high of INR1,384.50 and a low of INR1,322.40 during the session.

The company’s market capitalization was approximately INR1.09 trillion based on current trading levels.

Latest Quarterly Results

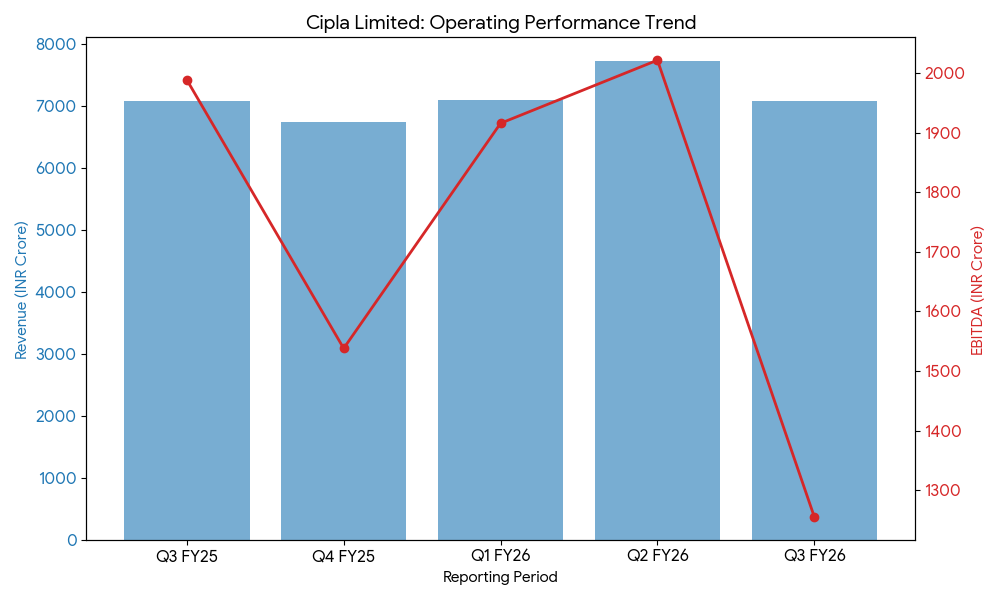

Cipla reported consolidated revenue from operations of INR7,074 crore for the quarter ended December 31, 2025, compared to INR7,073 crore in the same period last year, a change of 0.02%. Consolidated net profit for the quarter was INR676 crore, down 57% from INR1,575 crore in the prior-year period. EBITDA stood at INR1,255 crore, with the EBITDA margin narrowing to 17.7% from 28.1% year-over-year.

Segment performance showed the “One India” business recorded revenues of INR3,457 crore, a 10% increase. The North America segment reported $167 million in revenue, while Emerging Markets and Europe generated $104 million. The One Africa segment revenue was $112 million. Research and development expenditure for the quarter was INR494 crore, accounting for 7.0% of total revenue.

Financial Trends

Full-Year Results Context

For the fiscal year ended March 31, 2025 (FY25), Cipla reported annual consolidated revenue of INR27,548 crore, an increase of 8.2% from INR25,455 crore in FY24. Annual net profit for FY25 was INR5,273 crore, compared to INR4,106 crore in the previous year, reflecting a growth trend in the company’s annual financial performance prior to the current quarter.

Business & Operations Update

The company recorded a one-time charge of INR276 crore during the quarter related to the implementation of the new labour code. In January 2026, the U.S. Food and Drug Administration (USFDA) issued Form 483 with multiple compliance observations to Pharmathen International, a key manufacturing partner for Cipla’s Lanreotide product. The regulator identified gaps in laboratory controls and sterile condition maintenance at the partner facility. Additionally, the company announced the superannuation of members of its senior management team effective December 2025.

M&A or Strategic Moves

Cipla completed the acquisition of a 100% stake in Inzpera Healthsciences Limited, a move aimed at integrating a specialized pediatric and wellness portfolio. The company also entered into an exclusive partnership with Pfizer to distribute and market several brands, including Corex, Dolonex, Neksium, and Dalacin C, in the Indian market.

Equity Analyst Commentary

Institutional research reports attributed the decline in net profit to the non-recurring labour code expenditure and pressure on North American margins. Reports noted that while the domestic branded prescription business maintained double-digit growth in chronic therapies, regulatory developments at partner manufacturing sites in Europe have influenced investor sentiment. Analysts observed that the increased R&D allocation toward the respiratory and peptide pipeline remains a factor in current margin profiles.

Guidance & Outlook

Management indicated that the company is maintaining its focus on the U.S. generic pipeline, including upcoming filings for respiratory assets. Factors to watch include the resolution of manufacturing observations at partner sites and the impact of the Pfizer brand integration on domestic revenue. The company’s net cash position stood at INR10,229 crore at the end of the quarter.

Performance Summary

Cipla shares fell 2.69% today as the company reported a 57% drop in quarterly net profit to INR676 crore. Revenue remained flat at INR7,074 crore, even as the India business grew 10%. A one-time provision for labour code changes and regulatory observations at a partner facility were central to the period’s results.