Cipla Limited is a leading global pharmaceutical company dedicated to ensuring access to affordable, high-quality medicines across diverse therapeutic segments, including respiratory, anti-retroviral, and chronic care. Headquartered in India and operating in over 80 countries, Cipla continues to advance innovation and patient-centric healthcare.

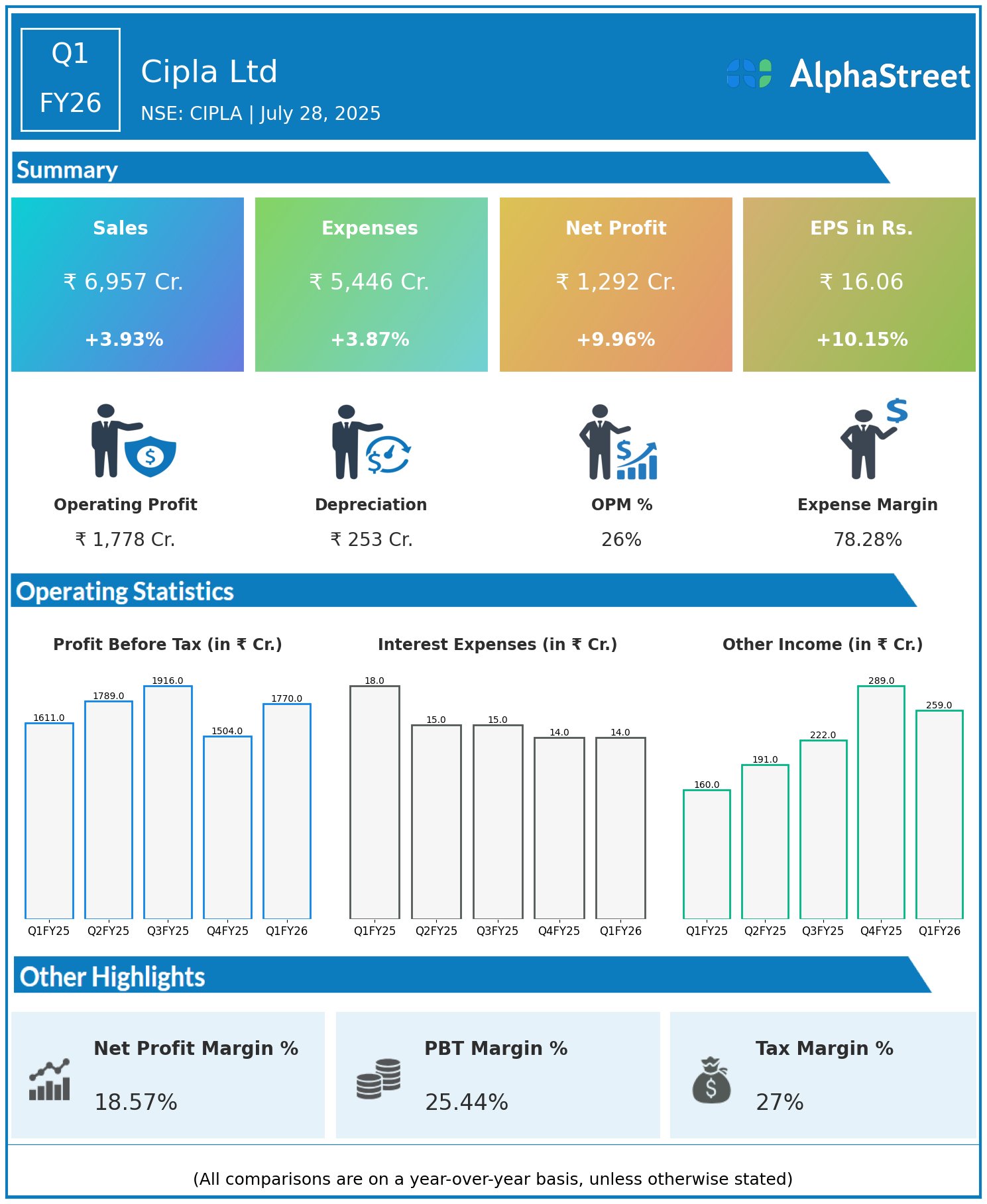

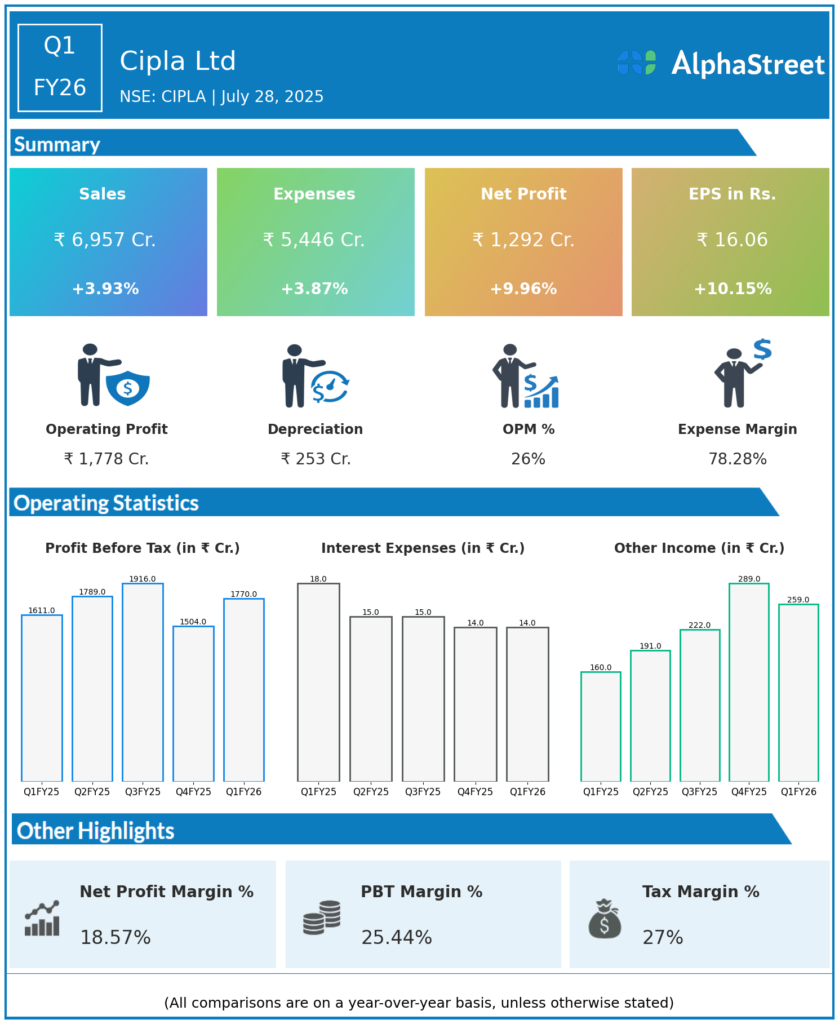

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹6,957 crore, up 3.93% year-on-year (YoY) from ₹6,694 crore in Q1 FY25.

-

Total Expenses: ₹5,446 crore, up 3.87% YoY from ₹5,243 crore.

-

Consolidated Net Profit (PAT): ₹1,292 crore, up 9.96% from ₹1,175 crore same quarter previous year.

-

Earnings Per Share (EPS): ₹16.06, up 10.15% from ₹14.58 YoY.

-

Margin Expansion: Profit and EPS growth outpaced revenue growth, indicating improved operating efficiency.

Operational & Strategic Update

-

Core Business Excellence: Sustained leadership in chronic and respiratory therapy segments, supported by continuous product launches and a strong domestic market position.

-

Innovation & R&D: Ongoing investment in research and development, emphasizing the launch of next-generation inhalers and biosimilars for both Indian and international markets.

-

Digital Transformation: Implemented advanced analytics in manufacturing and supply chain to reduce costs and enhance operational agility.

-

International Growth: Good traction in North America and South Africa, benefiting from a healthy ANDA pipeline and scale-up of key launches.

-

Sustainability: Continued transition toward green manufacturing, with investment in solar energy to reduce the company’s carbon footprint.

-

Market Expansion: Added significant new prescriber coverage in semi-urban and urban India, expanding Cipla’s reach to new patient populations.

-

Strategic Partnerships: Strengthened alliances with global biotech companies to co-develop and commercialize high-potential therapies.

Corporate Developments

Cipla’s Q1 FY26 results highlight resilient financial performance, underscored by notable growth in revenue, profits, and earnings per share. The company achieved this despite a challenging global environment, driven by disciplined cost management and a robust product pipeline. Investments in technology, sustainability, and strategic R&D continue to remain core pillars for future growth.

Looking Ahead

With a commitment to expanding affordable healthcare, Cipla is well-positioned to leverage its innovation-driven product pipeline, digital initiatives, and global partnerships. The company’s continued focus on operational discipline and building on its established leadership in key markets sets a strong course for further growth and value creation in FY26 and beyond.