Executive Summary:

Cipla Limited, a leading Indian pharmaceutical company, is currently positioned at a significant juncture driven by global market changes, internal innovation, and strategic product launches. The company reported steady revenue growth and robust profitability in the most recent quarters, maintaining its reputation as a resilient pharma major. While the North America business has faced challenges due to price erosion and the ramp-down of key products, India and other emerging markets continue to deliver stable growth, underpinned by Cipla’s dominance in chronic therapies and consumer health. The company’s financials reveal healthy cash flows, margin discipline, and moderate leverage, supporting ongoing investments in biosimilars and complex generics.

Company Overview:

Corporate Structure

Cipla is a global pharmaceutical corporation, with product registrations in more than 170 countries and a reputation for innovation across multiple therapeutic areas. The company’s leadership team, including CEO Umang Vohra and Chairman Y K Hamied, is committed to advancing operational excellence and research-driven growth. Shareholding is stable, characterized by significant promoter and institutional ownership, with minimal pledge ratios and strong governance track record.

Business Model

The company operates through four primary segments: India Branded (chronic therapies, trade generics, and consumer health), North America (generics and biosimilars), SAGA/Africa (tender-driven branded generics), and EMEU (direct and B2B generics). The India segment remains the principal engine of growth and profitability, accounting for more than 40% of revenues and leading in several key therapeutic areas.

Investment Thesis:

Product Pipeline and Innovation

Cipla’s relentless pursuit of complex generics, biosimilars, and differentiated products shapes its future growth curve. The US product pipeline promises strong launches in respiratory and oncology over the coming years, including biosimilar Filgrastim and peptide drugs. Recent successes in Nano Paclitaxel and Nilotinib, as well as strategic moves in Africa and Europe, should offset near-term headwinds in the US and provide sustained visibility beyond FY27.

Domestic Franchise

Cipla’s domestic business remains anchored by chronic therapies, with strong launches in respiratory, cardiology, diabetes, and pain management. The trade generics and consumer health segments are growing rapidly, led by category-defining brands like Nicotex and Omnigel. Chronic therapies now constitute approximately 62% of India revenues, underpinning stable volume and margin growth. The company has implemented successful cost optimization measures and continues to outperform the industry average growth rate of 8–10% in core segments.

Global Expansion

The Africa and EMEU business lines support Cipla’s international diversification strategy, experiencing double-digit growth through successful tender bids, new launches, and expanding B2B partnerships. South Africa remains a particularly lucrative market for institutional contracts, while direct-to-market branded generics in Europe and emerging regions drive volume expansion and margin support.

Financial Analysis:

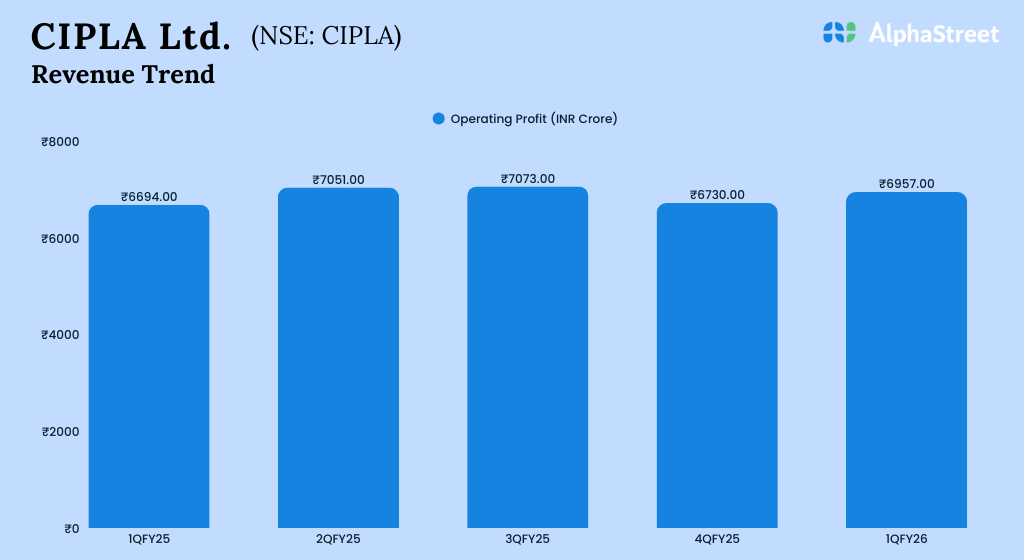

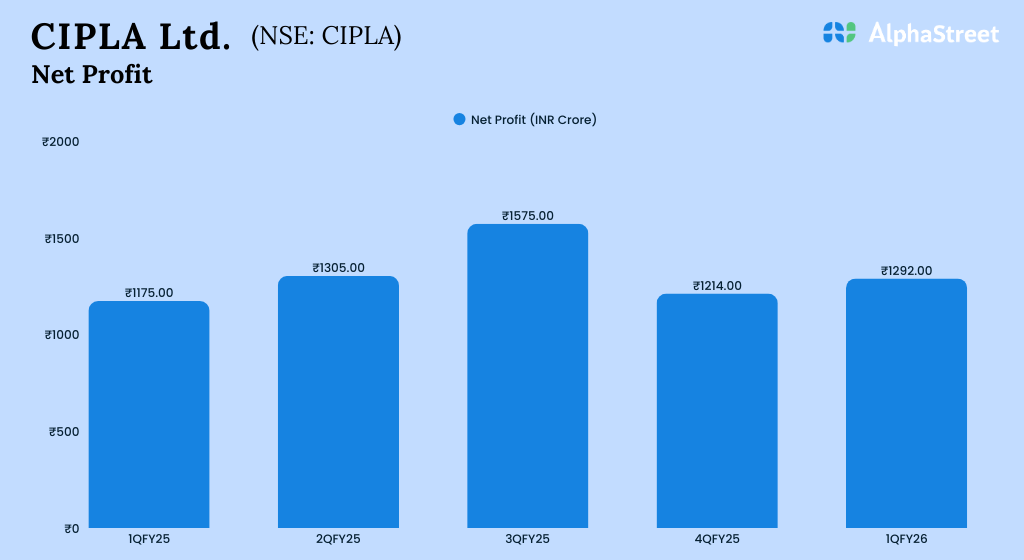

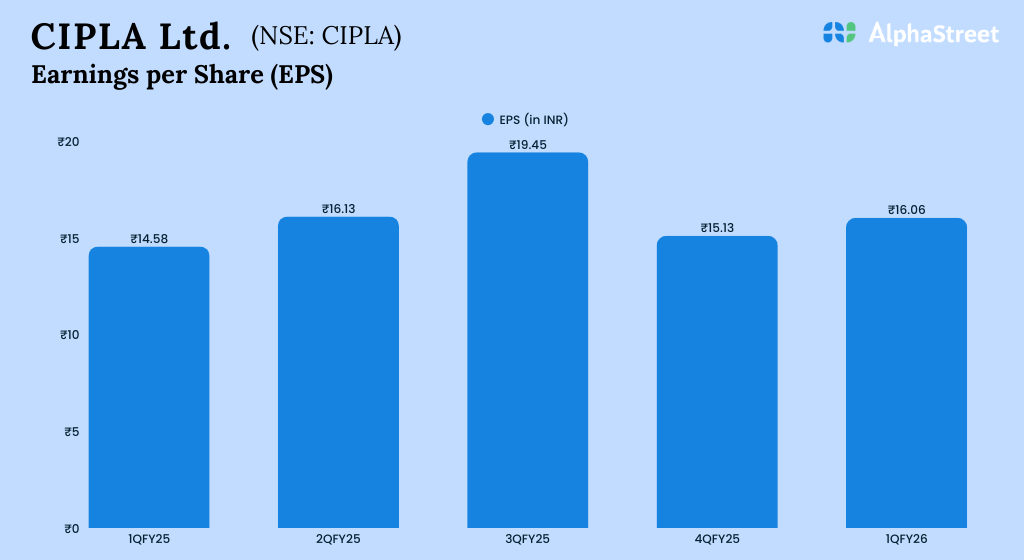

Revenue and Profitability Trends

Recent financials reflect consistent revenue expansion, moderate profit growth, and enduring margin strength. In Q1FY26, Cipla posted revenue of INR 6,957 Crore (up 3.9% YoY) and maintained a healthy EBITDA margin of 25.6%. Consensus expects a revenue CAGR of 6–7% over FY25–FY28E, with EBITDA margins gradually moderating to around 23–24%. This moderation is attributed to the phasing out of Revlimid and changing US market conditions, though strong domestic and emerging market performance helps balance the company’s overall outlook.

Key Financials (in INR Crore)

| Year | Net Sales | EBITDA Margin (%) | Adj. PAT | Adjusted EPS | PE | EV/EBITDA | RoCE (%) | RoE (%) |

| FY23 | 22,753 | 22.1 | 2,802 | 34.6 | 24.4 | 14.3 | 15.7 | 12.6 |

| FY24 | 25,774 | 24.4 | 4,122 | 50.9 | 28.0 | 19.2 | 19.2 | 16.1 |

| FY25E | 27,547 | 25.9 | 5,257 | 65.0 | 22.2 | 16.3 | 19.0 | 16.8 |

| FY26E | 29,566 | 24.2 | 4,909 | 60.7 | 26.0 | 17.8 | 16.6 | 13.8 |

| FY27E | 32,336 | 24.5 | 5,454 | 67.4 | 23.4 | 16.0 | 16.4 | 13.6 |

Segment Performance Review:

- India: Moderate growth, with ongoing leadership in branded Rx and generics. The chronic therapies segment is especially resilient.

- US: Revenue decline due to price erosion and base effect, but pipeline launches in respiratory and biosimilars are poised to restore momentum.

- Africa: Notable double-digit growth, propelled by tenders and tailored product launches.

- EMEU: Growth driven by direct-to-market branded generics and strategic B2B projects.

Balance Sheet and Cash Flow:

Cipla maintains robust free cash flow and self-funded expansion, with capital expenditures directed at biosimilar development and capacity growth. The company’s leverage is low, and ROE/ROCE have remained stable in the 13–17% range over recent years. Strong operating cash flow supports consistent dividend payouts, safeguarding long-term shareholder value.

Strategic Outlook:

Management Commentary

Cipla’s strategy focuses on launching innovative products, maintaining margin discipline, and investing in biosimilars and high-value complex generics. The company targets USD 1 billion revenue from North America by FY27E, with key launches in respiratory and oncology leading the charge. In the Indian market, the company is set to benefit from new chronic therapy introductions and expansion in consumer health. Growth in Africa and EMEU will continue to be driven by institutional contracts and emerging partnerships. While management guides for stable EBITDA margins in the short term, investors are cautioned about margin contraction as the product mix evolves with US market transitions.

R&D Initiatives

A major part of Cipla’s future growth will arise from biosimilar and complex product launches, supported by increased R&D expenditure (over 6% of Q1FY26 revenue). This sustained investment in innovation is expected to yield margin accretion and reinforce the company’s competitive position, albeit with a near-term profit drag.

Risk Factors:

US Portfolio Challenges

Price erosion, high base effects, and the winding down of Revlimid hamper the US segment’s growth and profitability. These factors are compounded by regulatory delays, particularly USFDA compliance reviews at major manufacturing facilities.

Regulatory and Currency Risks

New product launches face uncertainty due to slower USFDA clearances and unresolved trade tariffs, while global operations remain exposed to currency volatility. The sector’s continuing valuation overhang further curtails immediate upside, as earnings multiples revert to longer-term norms.

Margin Pressures

A post-FY26 contraction in margins is likely, following phase-out of high-contributing legacy products and transition to new launches that require time to ramp up. Cost control and business diversification remain central to offsetting these risks.

Valuation:

Cipla presently trades within its historical valuation averages (PE 23–26x on FY26E–27E EPS), relative to sector peers and market expectations. The stock is viewed as moderately valued, supported by strong financial durability and capacity for long-term innovation-driven growth, but tempered by short-term execution concerns and sector normalization trends. Compared against top pharma peers, Cipla stands as a durable, innovation-focused player, offering a balanced risk-reward profile at current levels.

Shareholding Trends

Institutional and promoter ownership remains robust, though recent quarters have seen minor reductions. Insider trading patterns are stable and do not indicate governance concerns, though continued monitoring is warranted as the sector cycle evolves.

| Shareholder | Stake (%) |

| Promoters | 29.2 |

| FIIs | 25.2 |

| DIIs | 29.3 |

| Others/Public | 16.3 |

SWOT Analysis:

- Strengths: Diversified product portfolio, leadership in chronic therapies, robust R&D pipeline, strong cash flow, low leverage.

- Weaknesses: US business exposure to price erosion, regulatory risks, margin contraction during strategic transition, slight moderation in institutional holdings.

- Opportunities: Biosimilars and complex generics launches, expansion in branded and consumer health segments, strategic partnerships, sector M&A.

- Threats: Competitive intensity in US generics, regulatory and currency volatility, domestic price controls, sector valuation compression.

Conclusion:

Cipla presents a fundamentally durable investment proposition, defined by its market leadership across India, expanding global reach, and systematic approach to innovation. While the company faces near-term challenges in its US business and sector-wide valuation headwinds, its strength in chronic therapies, consumer health, and its evolving biosimilar pipeline lay the groundwork for margin recovery and sustainable growth over the coming years. Cipla is well placed to capture long-term value once key launches materialize and operational headwinds begin to recede, making it a compelling pick for portfolios focused on the Indian pharmaceutical sector’s structural growth story.