Stock Data:

| Ticker | NSE: CIGINITITEC |

| Exchange | NSE |

| Industry | TECHNOLOGY |

Price Performance:

| Last 5 Days | +5.24 % |

| YTD | +50.76 % |

| Last 12 Months | +54.92 % |

Company Description:

Cigniti Technologies is a leading global provider of information technology services, specializing in quality engineering and software testing solutions. With a strong focus on digital engineering services, Cigniti empowers businesses to accelerate their digital transformation journeys. Serving a diverse client base across industries, including retail, e-commerce, BFSI, transport, and healthcare.

Critical Success Factors:

1. Resilience in Challenging Market Conditions: Cigniti Technologies has demonstrated remarkable resilience in a challenging market environment. Despite factors like continuous rate hikes and macroeconomic conditions affecting client spending, Cigniti has managed to navigate these obstacles successfully. This ability to adapt and thrive in a tough business landscape speaks to the company’s stability and strategic prowess.

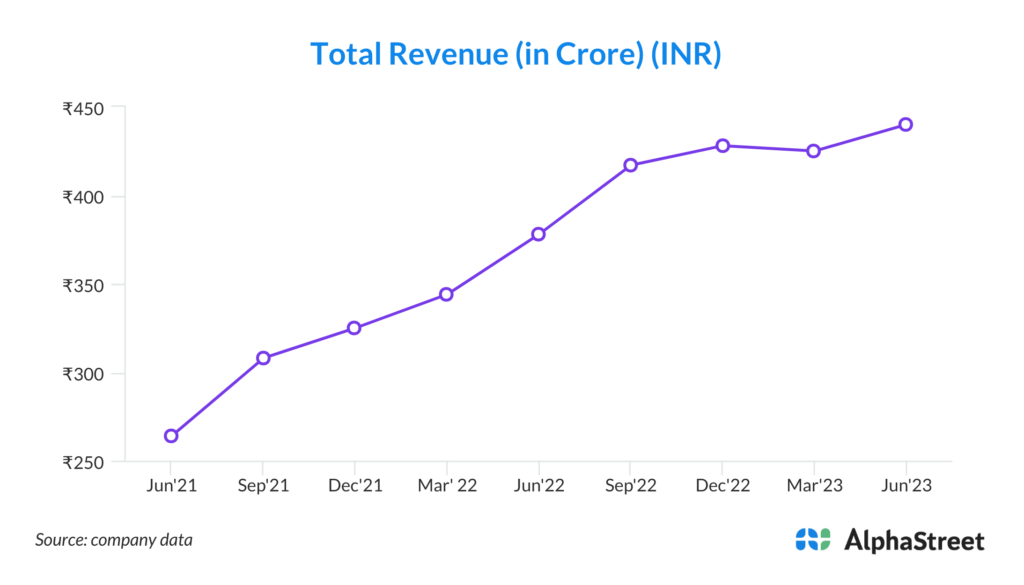

2. Continuous Growth: Even in the face of market challenges, Cigniti has shown consistent growth. In the last quarter, the company achieved a commendable 16% growth compared to the corresponding quarter in the previous year. This impressive growth rate highlights Cigniti’s capability to sustain positive momentum and seize opportunities for expansion.

3. Diverse Client Base: Cigniti Technologies boasts a diverse client base, serving clients across various industries and sectors. The company’s ability to cater to a wide range of clients pursuing digital ambitions demonstrates its adaptability and versatility in meeting diverse business needs.

4. Pipeline of New Deals: Cigniti maintains a healthy pipeline of potential deals. Although the market has been cautious in terms of signing new contracts due to prolonged deal cycles, the company continues to nurture a pipeline of opportunities. The emergence of green shoots in terms of prospective deals indicates a promising future with growth potential.

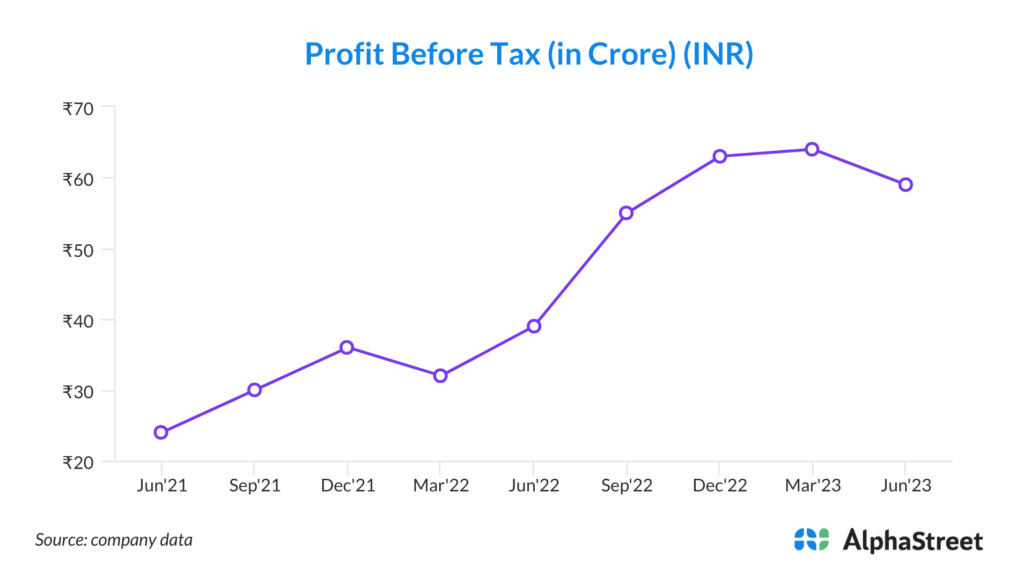

5. Cost Optimization Measures: To ensure sustainable growth, Cigniti has implemented cost optimization measures. These strategic efforts aim to enhance operational efficiency and maintain profitability. By optimizing costs, the company can better weather market fluctuations and economic challenges.

6. Digital Engineering Services Focus: Cigniti Technologies recognizes the evolving market demands for digital transformation. Consequently, the company is strategically focusing on digital engineering services. This strategic alignment positions Cigniti to meet the rising demand for digital solutions, making it a relevant player in the rapidly changing technology landscape.

7. Customer Confidence: Existing clients have expressed strong confidence in Cigniti’s ability to deliver excellence and value. This trust has led to continued engagements and partnerships. High levels of customer satisfaction, as indicated by surveys, reflect the company’s commitment to providing top-notch services and solutions.

8. Focus on Intellectual Property Development: Cigniti is actively investing in the development of intellectual property (IP). Notably, the company’s IP, such as Blue Swan and ZASTRA, has received recognition and awards. These IP assets contribute to the company’s competitiveness and enable cost-effective automation solutions for clients.

9. Global Market Positioning: Cigniti Technologies has positioned itself effectively in the global market. Its strong performance and focus on digital engineering services have garnered recognition and positioned the company as a leader in the global quality engineering and digital assurance space. This market positioning enhances Cigniti’s credibility and competitiveness.

10. Positive Industry Projections: Industry projections offer promising prospects for Cigniti’s growth. Reports from sources like Gartner, Nelson Hall, and IDC indicate significant growth potential in the digital assurance and digital engineering services sectors. Cigniti’s strategic focus aligns well with these industry trends, setting the stage for continued success and expansion.

Key Challenges:

1. Market Volatility: Cigniti operates in a market environment characterized by volatility. Factors like continuous rate hikes and macroeconomic conditions can lead to a cautious approach from clients. Prolonged market instability can impact client spending decisions and project approvals. Extended deal cycles may strain the company’s resources and affect its revenue and profitability.

2. Prolonged Deal Cycles: The company has experienced longer deal cycles, which can be challenging. Delays in client decision-making can lead to increased operational costs and postponed revenue realization. This affects the predictability of revenue streams and overall financial performance.

3. Dependence on North America: Cigniti heavily relies on North America for revenue (83% of total revenue). This dependence exposes the company to risks associated with the region, such as inflationary trends and political instability. Overreliance on a single geographic market increases vulnerability to economic and geopolitical uncertainties.

4. Competition: The IT services industry is highly competitive, with numerous players vying for contracts and clients. Increasing competition can result in pricing pressures and reduced profit margins for Cigniti, impacting its ability to maintain healthy profitability.

5. Digital Transformation Risks: While Cigniti is strategically shifting towards digital engineering services, success in this endeavor relies on the company’s ability to adapt rapidly and deliver high-quality digital solutions. Falling behind in digital transformation trends may lead to missed opportunities and a potential loss of competitiveness.

6. Client Concentration: Cigniti’s revenue is concentrated in specific sectors (retail, e-commerce, BFSI, transport, and healthcare), accounting for 75% of its business. Overreliance on particular industries makes the company vulnerable to sector-specific risks, economic downturns, or disruptions in those sectors.

7. Currency Exchange Rate Fluctuations: Operating globally exposes Cigniti to various currencies. Fluctuations in exchange rates can impact the company’s financial results when translating foreign earnings into its reporting currency. This can affect revenue and profitability unpredictably.

8. Intellectual Property Risks: While the development of IP assets like Blue Swan and ZASTRA is a strength, it carries risks related to IP protection, licensing, and competition. Managing and protecting these assets effectively is essential to maximize their value and avoid potential disputes.

9. Market Sentiment: Cigniti’s growth outlook is influenced by market sentiment and discretionary spending by clients. Negative sentiment or economic uncertainties may lead to delays, cancellations, or reductions in IT project budgets. This, in turn, can impact the company’s financial performance and growth prospects.

10. Global Economic Conditions: Cigniti’s operations are sensitive to global economic conditions. Economic downturns, trade tensions, or unexpected disruptions can influence client spending patterns, project demand, and overall business stability. The company must adapt to changing economic landscapes to mitigate associated risks effectively.