Chennai Petroleum Corporation Limited (CPCL) is engaged in the refining of crude oil to produce and supply a wide range of petroleum products, along with the manufacture and sale of specialty lubricating oil additives. As a key player in the Indian energy sector, CPCL operates one of the country’s largest refineries and maintains a consistent focus on product quality, operational excellence, and meeting the nation’s energy needs.

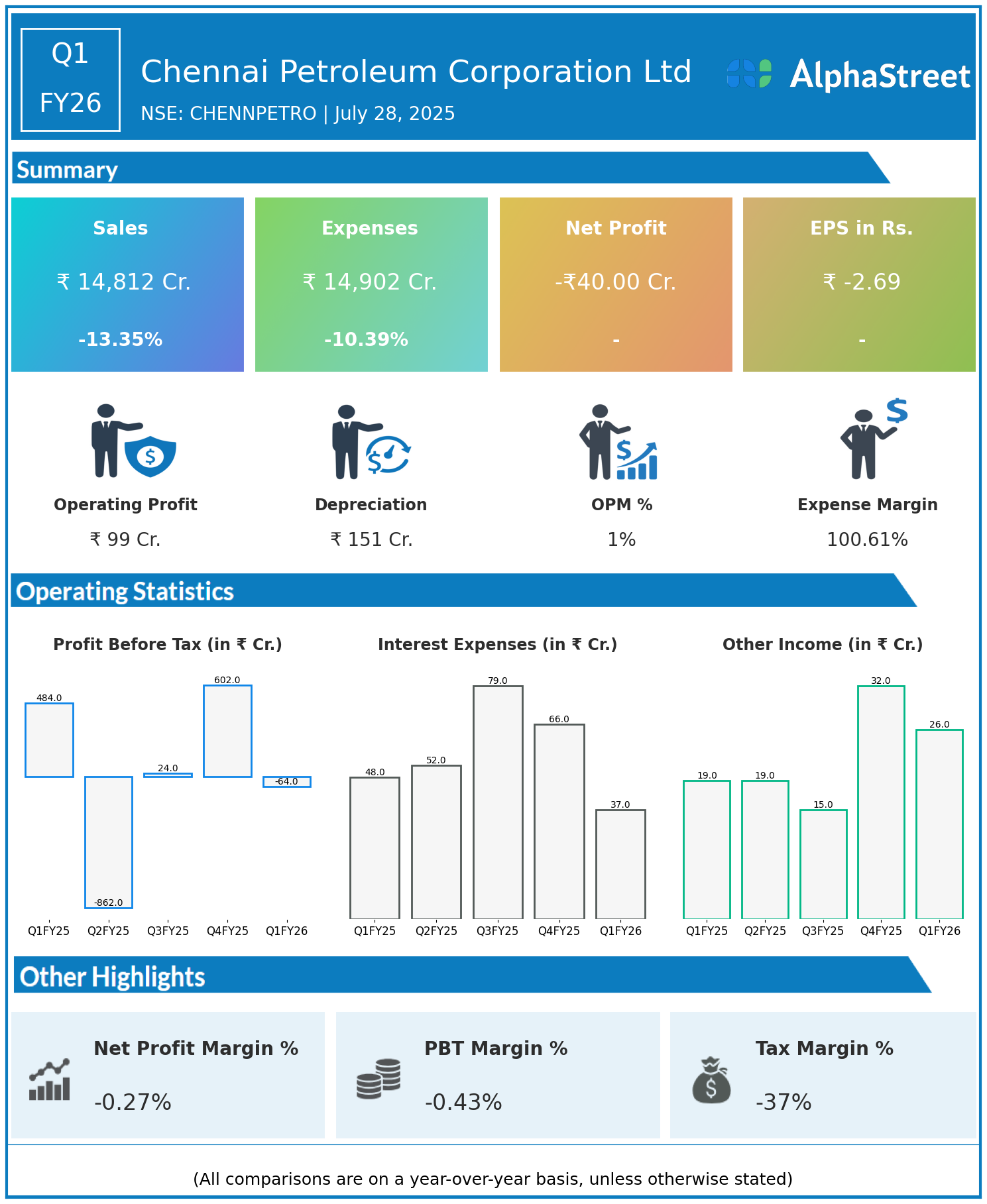

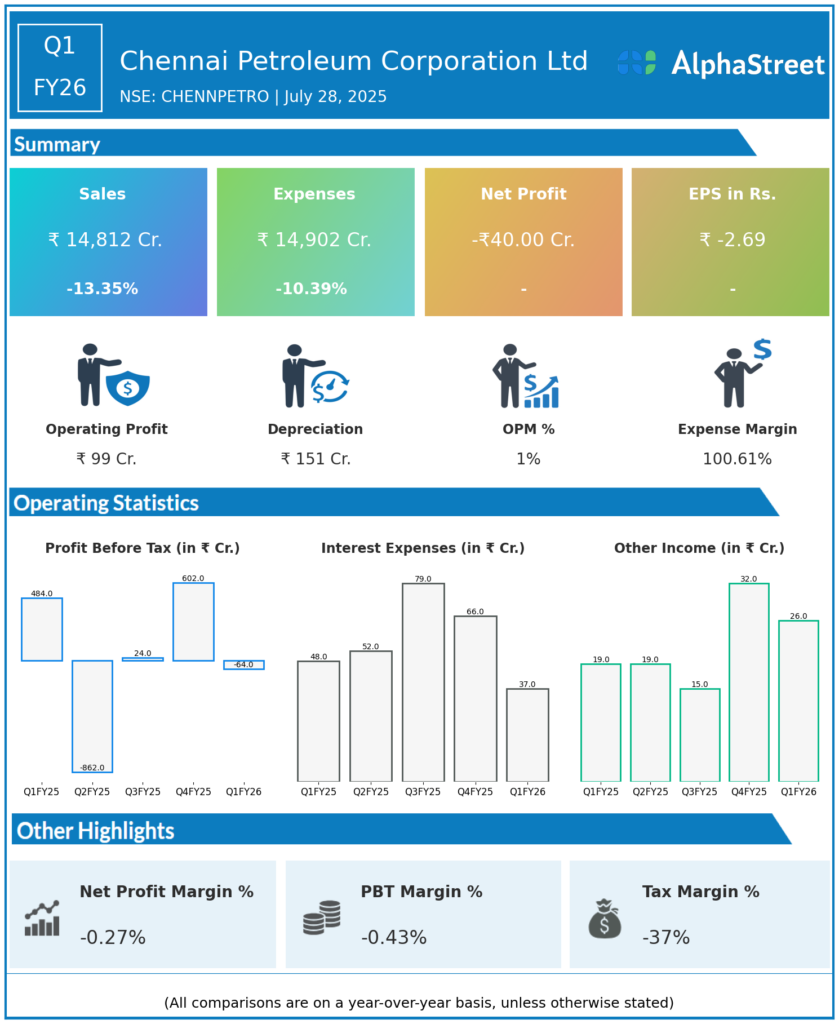

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹14,812 crore, down 13.35% year-on-year (YoY) from ₹17,095 crore in Q1 FY25.

-

Total Expenses: ₹14,902 crore, down 10.39% YoY from ₹16,630 crore.

-

Consolidated Net Profit (PAT): -₹40 crore, compared to a profit of ₹357 crore in Q1 FY25, indicating a swing to loss.

-

Earnings Per Share (EPS): -₹2.69, versus ₹23.98 YoY.

Operational & Strategic Update

-

Business Performance: The YoY decline in revenue and expenses reflects subdued crude prices, lower throughput, and softer demand for petroleum products.

-

Profitability Challenges: Elevated input costs and adverse margins contributed to the quarterly loss despite reductions in operating expenditure.

-

Operational Efficiency: Continuous focus on optimizing refinery processes and reducing energy consumption to mitigate margin pressures.

-

Product Mix: CPCL remains a major supplier of essential fuels—like diesel, petrol, naphtha, and aviation fuel—across South India, and continues to grow its market for lubricating oil additives.

-

Sustainability Initiatives: Increased efforts toward cleaner fuel production and investment in emission reduction technologies to align with national environmental goals.

-

Strategic Outlook: The company is exploring opportunities to further diversify its product portfolio and consider partnerships that enhance operational resilience.

Corporate Developments

Q1 FY26 marked a challenging quarter for CPCL, with revenues and profits significantly impacted by volatile crude oil markets and weak product demand. However, operational cost controls and strategic investments in sustainability and efficiency provide a framework for long-term competitiveness.

Looking Ahead

Despite the current headwinds, Chennai Petroleum Corporation Limited is committed to strengthening its operational base, sustaining investments in technology, and delivering value to stakeholders. Focus remains on elevating process efficiencies, expanding the specialty chemicals segment, and positioning itself for recovery in subsequent quarters.