Chambal Fertilisers & Chemicals Ltd is engaged in the production of urea from its own manufacturing plants, and also markets a range of other fertilisers and agri-inputs. The company participates in a phosphoric acid manufacturing joint venture in Morocco and, since FY21, has fully exited its legacy software business. Presenting below its Q1 FY26 Earnings Results.

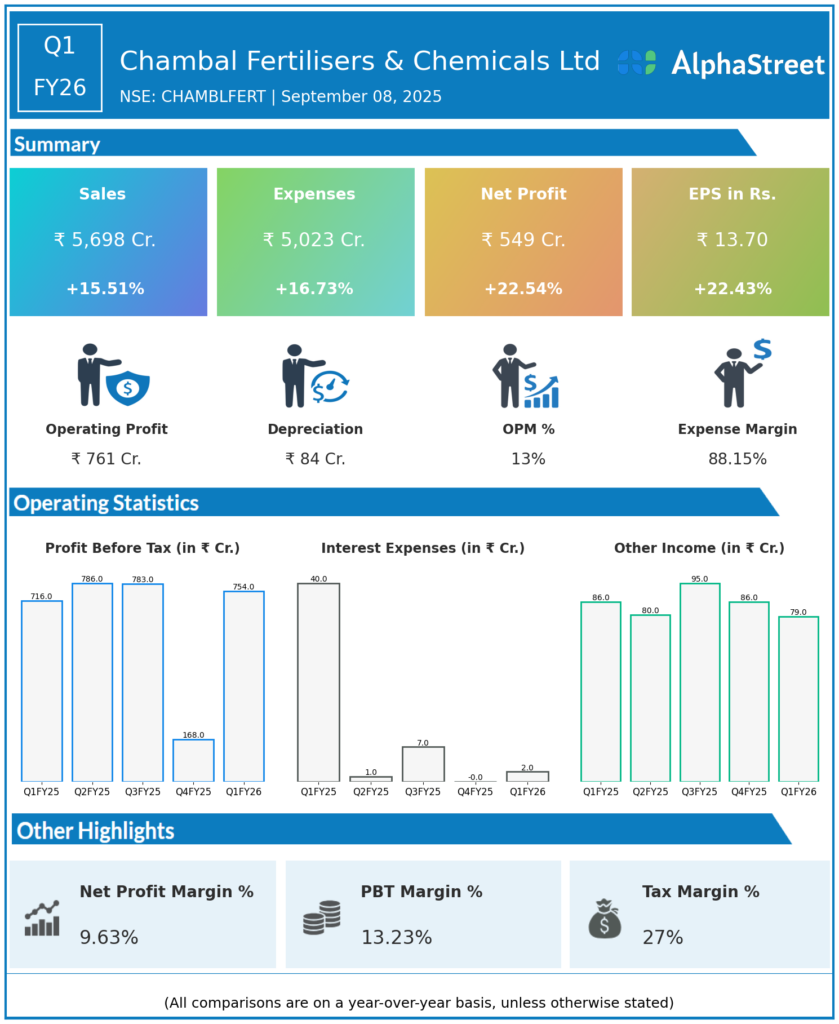

Q1 FY26 Earnings Results:

Revenue: ₹5,698 crore, up 15.51% year-on-year YoY from ₹4,933 crore

Total Expenses: ₹5,023 crore, up 16.73% YoY from ₹4,303 crore

Consolidated Net Profit PAT: ₹549 crore, up 22.54% YoY from ₹448 crore

Earnings Per Share EPS: ₹13.70, up 22.43% YoY from ₹11.19

Operational & Strategic Update:

Revenue Growth: Revenue rose over 15%, driven by healthy sales volumes in urea and improved market conditions for agri-inputs

Cost Trends: Total expenses increased almost 17%, mainly due to higher input costs and logistics expenses in the fertiliser segment

Profitability: Net profit grew over 22%, benefiting from higher realisations, stable demand, and improved contribution from the joint venture in Morocco

Product Mix: Urea production continued as the mainstay, with the company leveraging its distribution reach for cross-selling of other fertilisers and agri-products

Strategic Initiatives: Continued efforts to optimize raw material sourcing, logistics, and enhance supply chain efficiency supported operational strength

Corporate Developments in Q1 FY26:

Chambal Fertilisers & Chemicals achieved robust growth in both revenues and profits in Q1 FY26. The company’s core urea segment remained resilient, while its expanding product portfolio and joint ventures added to profitability.

Looking Ahead:

The company aims to maintain momentum by further improving operational efficiency, expanding its agri-inputs business, and leveraging opportunities in allied sectors. Chambal Fertilisers & Chemicals is positioned to benefit from stable agri-sector demand and efficiency gains in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.