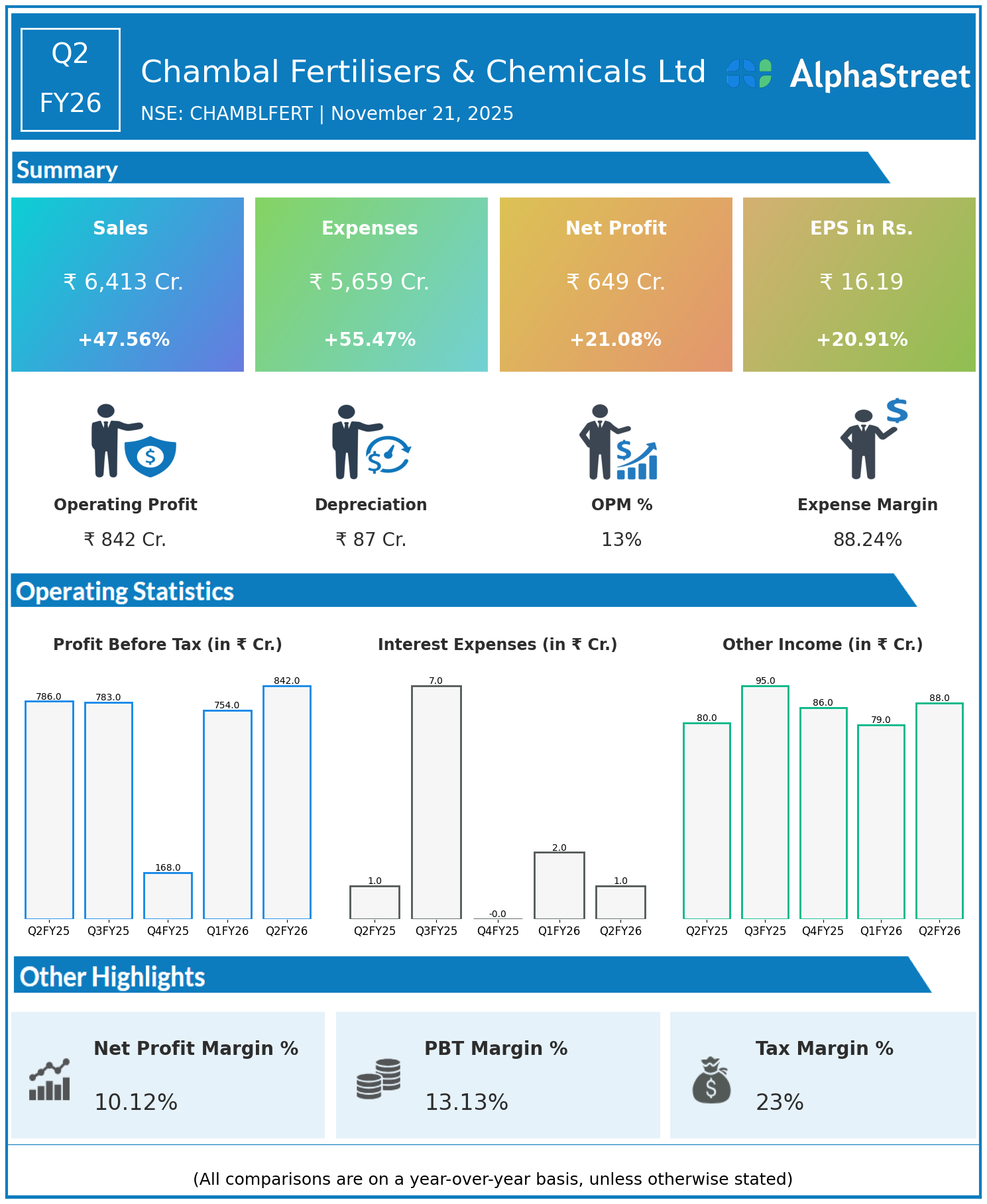

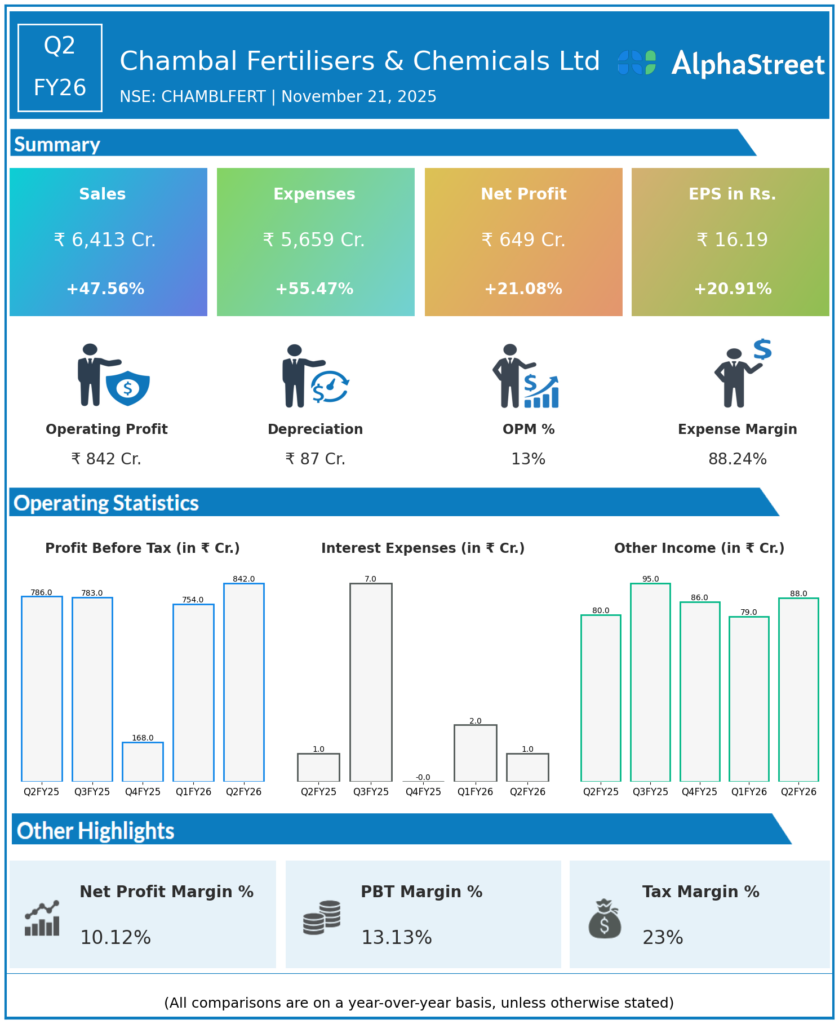

Chambal Fertilisers & Chemicals Ltd , engaged in the production of urea and marketing of other fertilizers and agri-inputs, including a joint venture for phosphoric acid manufacturing in Morocco, reported solid financial results for Q2FY26.

Financial Highlights:

- Revenues surged 47.56% year-on-year to ₹6,413 crore from ₹4,346 crore.

- Total expenses rose 55.47% to ₹5,659 crore from ₹3,640 crore.

- Consolidated net profit increased 21.08% to ₹649 crore from ₹536 crore.

- Earnings per share improved 20.91% to ₹16.19 from ₹13.39.

The profit growth was driven by strong sales growth, aided by increased fertilizer demand and operational scale, despite higher expenses.

Outlook:

Chambal Fertilisers & Chemicals Ltd is focused on expanding manufacturing capacity, improving input costs, and broadening its product portfolio to sustain growth and margin improvement.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.