Chalet Hotels are part of Raheja Group. It has its presence in all the key Metros. It operates in Mumbai Metropolitan Region, Hyderabad, Bengaluru, and Pune. The hotel has 2,554 keys, across mainstream and luxury segments, and four commercial spaces, representing 0.9 mnsq.ft. Chalet Hotels Limited is an owner, developer, asset manager and operator of high-end hotels. Each of these Hotels are operated by either Marriott International or The Accor.

Product Portfolio

Mumbai

JW Marriott Mumbai Sahar

The Westin Mumbai Powai Lake

Lakeside Chalet, Marriott Executive Apartments, Mumbai

Four Points by Sheraton Navi Mumbai

Pune

Novotel Pune Nagar Road.

Hyderabad

The Westin Hyderabad Mindspace

Bengaluru

Bengaluru Marriott Hotel Whitefield

Inorbit Mall, Whitefield, Bengaluru

Whitefield Bengaluru (Commercial)

Financial Snapshots

| Rs. Million | Q1FY23 | Q1FY22 |

| Total Income | 2,599 | 732 |

| EBITDA | 1,088 | -31 |

| Adjusted EBITDA | 1,052 | -60 |

| PAT | 286 | -418 |

Total Income stood at Rs. 2.6 billion. EBITDA stood at Rs. 1.1 billion. Revenue increased by 82% to Rs. 2.3 billion. REVPAR increased by 95% to Rs. 5,794. The occupancy rate has increased to 78%.

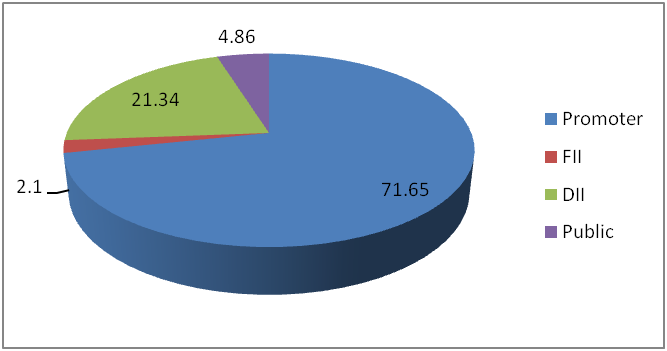

Shareholding pattern (Percentage)

Upcoming Projects- Commercial Tower-1 at Westin Complex of Powai is a premium office space 0.78 msf. The project is expected to be completed by Q4 FY 2023. The Commercial Tower in Marriott Complex in Whitefield, Bengaluru is a premium office space with a leasable area of 0.66 msft. The project is expected to be completed by Q2FY23. Commercial Tower-2 at Westin Complex, Powai a premium office space with 0.75 msft.

Ongoing Projects-It is adding 88 rooms at Novotel Nagar Road Pune expected to be completed by Q2FY23. It is also adding 168 rooms to Westin 2 Hyderabad Mindspace. The project is expected to be commissioned by Q4FY23. 5-star Hotel at Terminal 3, Delhi Airport with 350-400 rooms is expected to be completed by FY26.

It has concentrated on real-estate development in Bengaluru. It has developed 9 residential towers of 10 floors each, 2 residential towers of 11 floors each and a New Commercial block for strata sale. The estimated cost of this project is Rs. 4,250 million. Expected completion date is FY26.

Business Outlook- Chalet Hotels expects to double its revenue per unit of electricity consumed by FY29. The hotel is targeting to introduce Electric Vehicles by FY25 for guest transport. The property will be equipped with Charging points accessible to both employees and visitors. It is anticipated that all properties will move to 100% renewable energy by FY31.

Industry Analysis- The hotel industry in India is expected to reach a value of INR 1,210.87 Billion by the end of 2023. The Indian hospitality industry is set to expand at a pace of 10.35% between the years 2019 to 2028.The hotel industry has adapted to the changing scenario. The industry is affected due to COVID-19. There was very little demand in the hotel sector and there were very few future bookings. The revenue suffered a lot due to this. However the Indian hotels sector recovered by adjusting strategies in the near term and preparing for the future.

Inherent Strengths -The company has a strong brand image. It is backed by leading real estate developer, K. Raheja group. The average occupancy rate is at 70%.FII / FPI or Institutions increasing their shareholding constantly. The stock passes majority of CANSLIM Investment criteria. Due to strong brand presence the brand does not have to spend money for promotion.

Inherent risk- It is a high debted company. The company is acquiring land and is concentrating in further development, which requires significant capital expenditure.Litigation with City and Industrial Development Corporation of Maharashtra Limited, is pending with the Hon’ble Supreme court of India.

ESG Initiative- The chalet group has taken certain ESG initiatives. It has increased contribution of electricity sourced from non fossil fuel-based source. All new projects are LEED certified. To reduce energy consumption/per room. The hotel has also improved its water management facility by reducing water consumption/per room. Concentrate on rainwater harvesting. Introduced Sewage Treatment Plant at every hotel. The company has initiated Waste Management which includes minimizing single use plastic, Organic Waste Composter, Responsible disposal of e-waste and Recycling used cooking oil to generate biofuel.