Chalet Hotels Limited (NSE: CHALET) financial performance has improved year on year and has surpassed the pre-covid level. Even though the foreign travel hasn’t even fully recovered, the company still managed to report such impressive results. The high-end hotel chain has also been successful in lowering expenses and preparing the way for growth by launching new projects in various cities. The company is introducing 88 new keys at the Novotel in Pune and 190 new keys at the Marriot Whitefield in Bengaluru. According to the management, the Novotel project will be finished by Q3, and in that same quarter, the situation with regard to international travel ought to improve. The addition of new keys and improved foreign travel should contribute to the company’s revenue growth in the second half of the current fiscal year.

Business Basics

Chalet Hotels Limited owns, develops, manages, and operates high-end hotels in key Indian metropolises such as Mumbai Metropolitan Region, Hyderabad, Bengaluru, and Pune. From the pre-development phase through the entire asset lifecycle, the Company is committed to maximizing returns on every square foot that is owned and operated while fostering business efficiencies. The portfolio of the company includes four commercial buildings totalling about 0.9 million square feet and seven fully operational hotels with 2,554 keys in the mainstream and luxury segments. The company’s strength is in locating key locations and designing and developing properties effectively, with a focus on gross built-up area and development cost per key.

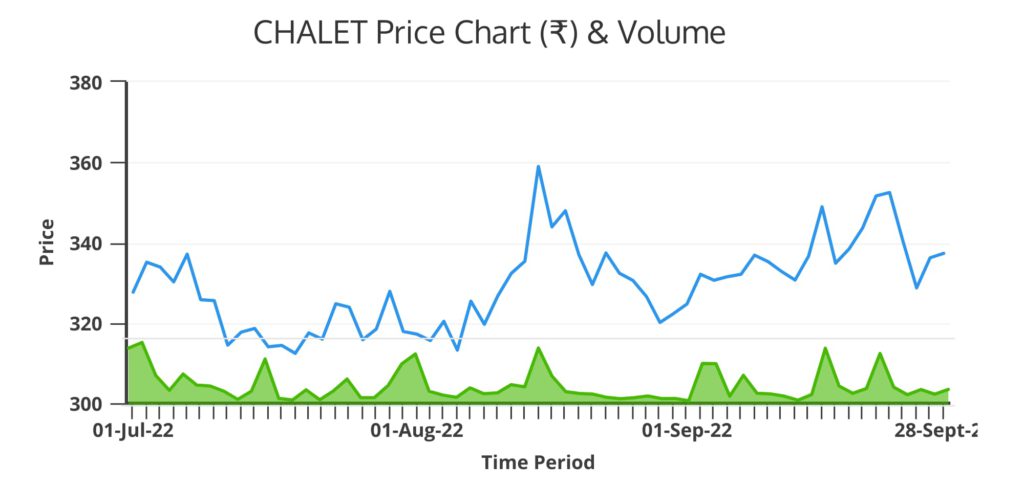

Recent Share Price Insights

- The share price was closed at ₹343 on September 20, 2022, with a one-year high of ₹361.

- The stock has increased by nearly 37% over the course of the year.

- Since the day the results were announced, the share has increased by almost 8%. On hearing that the bid for Delhi Airport’s Terminal 3 had been successful, the price increased a little bit more.

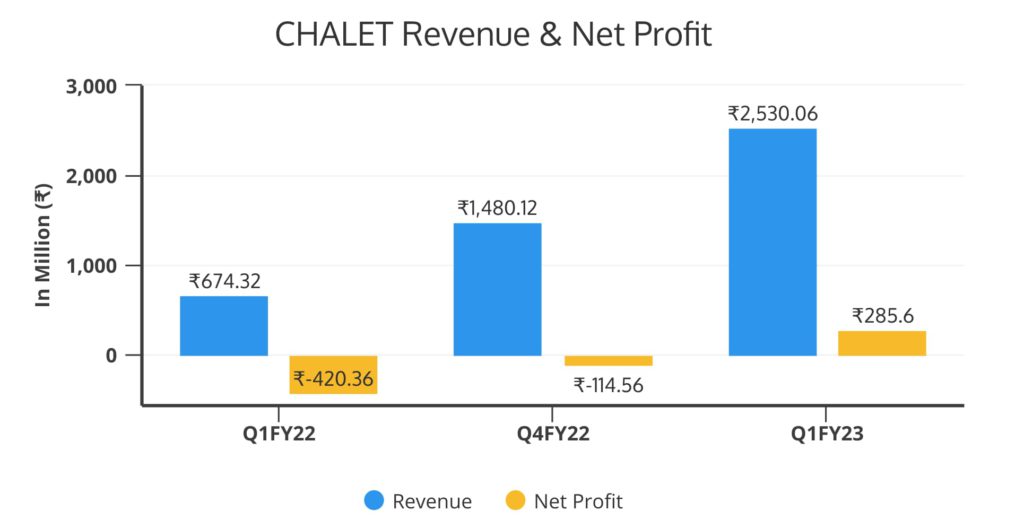

Financial Snapshot

Chalet Hotels Limited reported a surge of 275% in Revenue from Operations year over year, to ₹2,530.06 Million from ₹674.32 Million. The contribution from IPL for the months of April and May was the main driver of this growth. EBITDA margins were 43% as opposed to negative margins in the same quarter last year. For this quarter, the Consolidated PAT totals ₹285.6 Million. The occupancy rose to 78% from 36% year over year. The RevPAR soared by multiple times up to ₹5794 from ₹1252 year on year.

Employee benefits, one of the major cost for the hotel industry, were reduced to 13% of Revenue in the first quarter current year from 33% in the first quarter of FY22. Meanwhile, the cost of Food and Beverages increased to 10% of Revenue from 8% in Q1FY22. The company’s net debt from March 2022 to June 2022 remained constant at Rs. 22.3 Billion, and during that time it spent Rs. 0.9 Billion on capital expenditures.

Recent Highlights

Rashna Kapadi has been appointed as Associate Vice President-Architecture by Chalet Hotels Limited. She previously worked as the Head Design with Mahindra Hotels & Resorts Pvt. Ltd. and the Design Director for IMK Architects. The new AVP has more than 20 years of experience in the fields of interior design, urban planning, and landscape architecture. Rashna Kapadi, AVP – Architecture at Chalet Hotels Limited, commented on her new position said, “I am glad to be a part of the team at Chalet Hotels. The company’s commitment to design and sustainability is truly inspiring, and I look forward to a fruitful association where we are able to cross many milestones together.”

Chalet Hotels Covid Recovery & Developments in Foreign Travel

Every company working in hospitality industries saw a drop in their sales during FY21 due to Covid. However, Chalet Hotels exceed the pre-covid level Revenue by 6% increase in Q1 FY23 when compared to Q1 FY20. Additionally, over the same period, the consolidated PAT increased by two times.

The Revenue growth was driven by Westin Powai, JW Marriott Sahar, and Novotel, Pune which exceeded revenues of Q1 FY2020. Revenue in the F&B and hospitality segments improved by 14% and5%, respectively.

However, compared to the pre-covid era, only about 56% of foreign travel has recovered. The majority of business travel to India came from the US. The US slowdown was caused by difficulties in obtaining visas. To expedite the process of issuing them work visas, this problem is being resolved at the MEA level. Another factor for the longer flights was that because of the conflict between Russia and Ukraine, travelers were unable to enter India via their usual route via the North Pole. Because the airports in Amsterdam, Frankfurt, and London are currently a mess, US travelers did not want to travel through any of those cities. However, some US airlines have confirmed new itineraries for direct flights into Bangalore, Hyderabad, and Mumbai, which will help to improve the situation. The management anticipates that foreign travel will resume to normalcy in the third quarter of this fiscal year.

Chalet Hotels New Project in Pipelines

As of March 2022, the company had 7 hotels in Mumbai, Pune, Bangalore, and Hyderabad, totaling 2554 keys. Few projects are currently in the development stage for the company; once these projects are finished, there will be an increase in the overall number of hotels and keys. According to the management, the brand-new 168-key hotel in Hyderabad should be open by the end of the current fiscal year. In contrast, the Novotel in Pune should finish its 88-key expansion by the third quarter. The 324 keys at Marriott Whitefield will be increased to 190 keys by renovating the Accenture Learning Center building in Bengaluru. This will make it once again the largest hotel in the city with a total inventory above 500 keys.

In order to move the project forward, Chalet Hotels has been named the successful bidder for a terminal hotel at Delhi International Airport’s D3 terminal. The hotel will be positioned in the 5-star luxury segment and have between 350 and 400 keys. The hotel is anticipated to open in or around FY2026. Through this project, the business will gain a solid foothold in North India and access to New Delhi’s crucial market.

Hotel Industry Analysis

The lockdown in every country during COVID had a significant impact on the hotel industry because neither tourists nor business travelers could commute. However, since a year ago, things have started to quickly change and situation returned to normal. Independent hotels in India account for the majority of the country’s hotel industry, which is only 30% dominated by branded hotels. There is therefore plenty of room for businesses like Chalet Hotels & The Indian Hotels to grow.

The majority of domestic leisure travelers worldwide are from India. The number of business travelers is steadily rising as a result of the booming Indian IT industry and the emergence of numerous multinational corporations. By the end of 2023, the hotel industry in India is predicted to be worth ₹1,210.87 Billion, according to marketresearch.com.

Because the Indian hotel industry depends so heavily on the tourism industry for revenue, government programs are essential for promoting the sector’s growth. In the hotel and tourism sectors, FDI is entirely permitted by the government. In order to improve India’s competitiveness as a travel destination, the GST on hotel rooms was reduced in 2019 with rates between ₹1,001 and ₹7,500 per night falling under 12% and those above ₹7,501 falling under 18%. The government intends to introduce a comprehensive national tourism policy prior to the FY2023–24 budget in order to realign the nation’s tourism industry. The hotel industry should also benefit substantially from this policy.