CG Power & Industrial Solutions Ltd is a global enterprise that provides end-to-end solutions for utilities, industries, and consumers, focused on the efficient and sustainable management of electrical energy. The company operates through two core business segments: Power Systems and Industrial Systems.

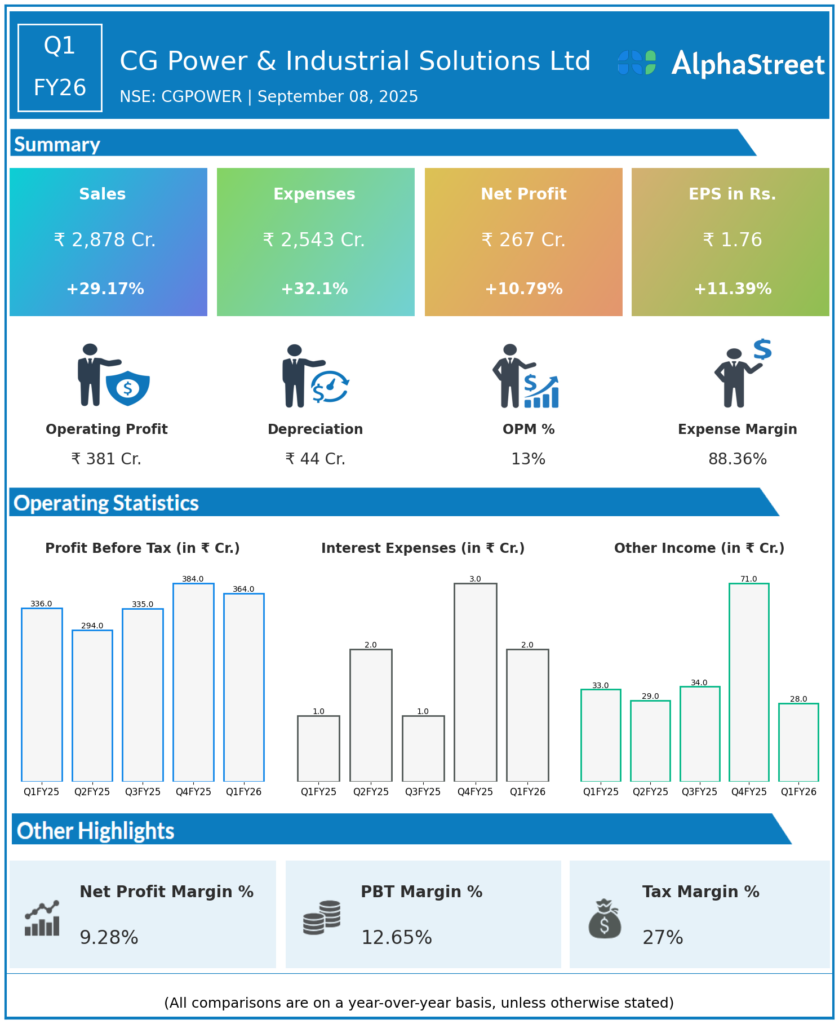

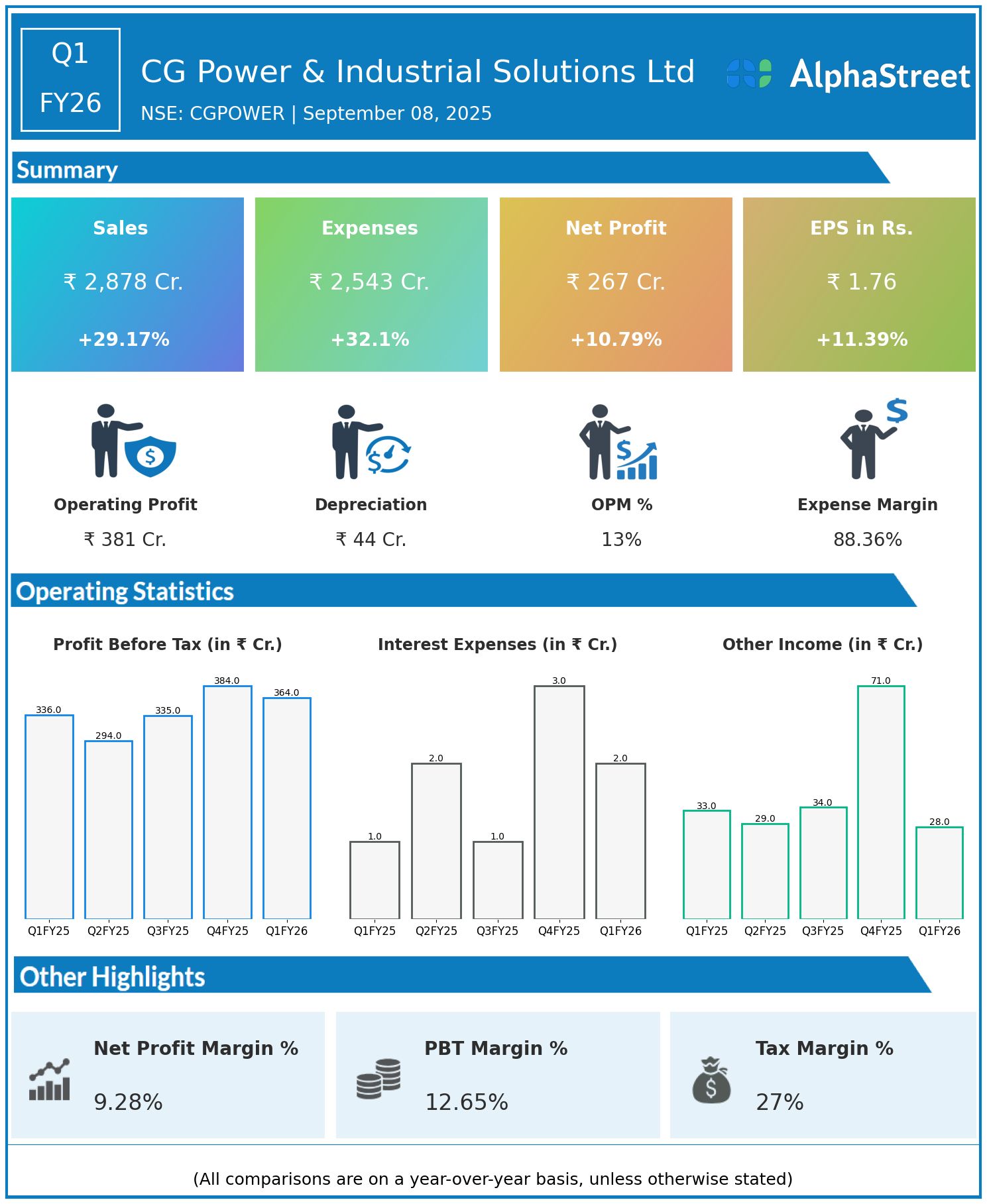

Q1 FY26 Earnings Results:

Revenue: ₹2,878 crore, up 29.17% year-on-year YoY from ₹2,228 crore

Total Expenses: ₹2,543 crore, up 32.1% YoY from ₹1,925 crore

Consolidated Net Profit PAT: ₹267 crore, up 10.79% YoY from ₹241 crore

Earnings Per Share EPS: ₹1.76, up 11.39% YoY from ₹1.58

Operational & Strategic Update:

Revenue Growth: Revenue jumped over 29%, led by strong order execution and robust demand in both Power Systems and Industrial Systems segments

Rising Expenses: Total expenses outpaced revenue growth, particularly due to higher input and project execution costs

Profitability: Net profit grew 11% YoY, supported by top-line gains, although rising costs led to a moderation in margin expansion

Segment Drivers: The Power Systems segment benefited from major utility and industrial orders, while the Industrial Systems division saw healthy demand for energy-efficient solutions

Strategic Initiatives: The company continued investments in new product development, digitization, and expanding its sustainable solutions portfolio for global markets

Corporate Developments in Q1 FY26:

CG Power & Industrial Solutions delivered strong revenue growth for Q1 FY26 but faced cost pressures that limited overall margin expansion. The business remains well positioned in its core segments with a focus on sustainable electrification and global competitiveness.

Looking Ahead:

CG Power will focus on operational efficiency, expanding its sustainable product lineup, and leveraging demand for efficient power management across global utility and industrial markets. Continued innovation and cost discipline are expected to support sustainable growth in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.