CESC Ltd, incorporated in 1978, operates in the business of generation and distribution of electricity. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results:

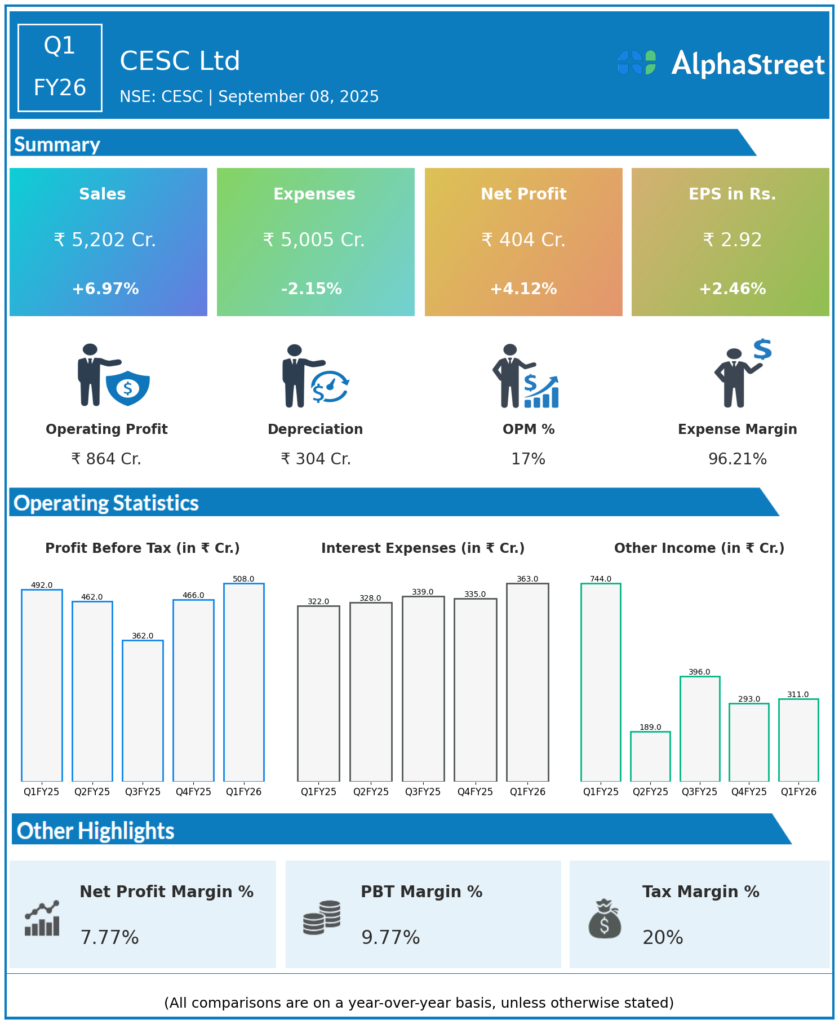

Revenue: ₹5,202 crore, up 6.97% year-on-year YoY from ₹4,863 crore

Total Expenses: ₹5,005 crore, down 2.15% YoY from ₹5,115 crore

Consolidated Net Profit PAT: ₹404 crore, up 4.12% YoY from ₹388 crore

Earnings Per Share EPS: ₹2.92, up 2.46% YoY from ₹2.85

Operational & Strategic Update:

Revenue Growth: Revenue rose nearly 7% on the back of strong demand for electricity and continued operational stability in core markets

Cost Management: Total expenses declined by over 2%, reflecting effective cost control and operational efficiency despite inflationary pressures

Profitability: Net profit increased 4%, supported by the combination of higher revenue and successful expense management

Business Focus: The company’s core focus remains on reliable power generation, robust distribution networks, and customer-centric initiatives

Strategic Initiatives: CESC continues to invest in technology upgrades for improved grid management and sustainable power operations

Corporate Developments in Q1 FY26:

CESC’s Q1 FY26 results reflect both revenue growth and cost efficiency, enabling a steady improvement in profitability. The company’s ongoing investments in infrastructure and technology reinforce its leadership in the electricity sector.

Looking Ahead:

CESC aims to strengthen its distribution capabilities, enhance digital infrastructure, and pursue renewable energy opportunities to support long-term, sustainable growth and value creation in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.