Century Enka Limited (NSE: CENTENKA) The Indian synthetic yarn producer maintains net profit growth as operational efficiencies and renewable energy offset volume pressure from low-priced imports. Management eyes FY’27 for commercial entry into polyester tire cord market.

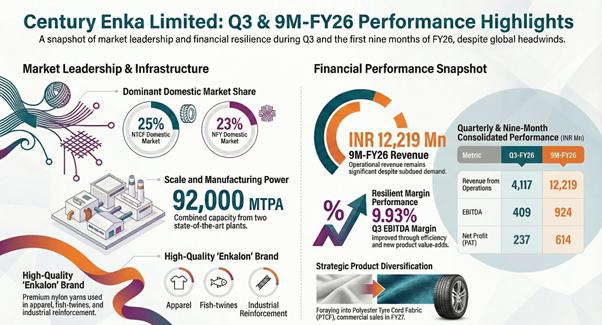

The company reported a consolidated net profit of ₹237 million for the third quarter ended December 31, 2025, representing a 69.3% increase over the same period in the previous year. This growth in the bottom line occurred despite a 16.6% year-on-year decline in operational revenue, which fell to ₹4,117 million. The company expanded its EBITDA margins by 442 basis points to 9.93% during the quarter, driven by cost-control measures and a shift toward renewable energy sources at its manufacturing sites.

Market Data (as of December 31, 2025)

Stock Price:

₹442.30

Market Capitalization:

₹9,664.52 million

Valuation:

Based on a nine-month EPS of ₹28.12, the valuation reflects a cautious market stance toward the synthetic yarn sector.

Key Development

The company’s Board of Directors approved the unaudited financial results on February 6, 2026. A primary factor impacting the results was the continued influx of low-priced imports from China and Free Trade Agreement (FTA) countries, which pressured capacity utilization and margins on commodity products. Additionally, the company recorded an exceptional item of ₹37 million during the quarter, representing the statutory impact of new labor codes related to additional gratuity costs.

Product Highlights

Century Enka is currently progressing through the approval process for Polyester Tire Cord Fabric (PTCF), intended for passenger vehicle tire reinforcement. Management expects regular commercial sales for this product to commence in FY’27. In its existing portfolio, the company has introduced new Mother Yarn and Value-Added Products (VAPs) to sustain margins in the filament yarn segment. The Enkalon brand remains the company’s flagship for high-quality nylon yarns used in apparel and activewear.

Financial Performance

The third quarter saw total expenses decrease by 20.5% year-on-year to ₹3,708 million, reflecting improved operational efficiency. For the nine-month period ended December 31, 2025, revenue from operations reached ₹12,219 million, a 21.6% decrease from the ₹15,577 million recorded in the corresponding period of the prior year.

Key financial metrics include:

- Net Profit: ₹237 million for Q3 FY26 vs. ₹140 million in Q3 FY25.

- EPS: Basic and diluted EPS for the quarter rose to ₹10.86 from ₹6.40 year-over-year.

- Balance Sheet: As of the end of the first half of FY26 (September 30, 2025), net worth stood at ₹14,359 million. The company reported a net surplus cash position of ₹3,653 million.

- Margins: Nine-month EBITDA margins improved to 7.56% from 6.81% in the prior year.

Business Outlook & Strategy

Management’s stated strategy focuses on lowering power costs through renewable energy utilization at the Bharuch plant, with additional capacity scheduled to commission in FY27. To counter low-price dumping from China, the industry is actively pursuing anti-dumping duties (ADD). Management expressed optimism for improved demand in the fourth quarter, citing recent GST cuts on tires and automobiles and the onset of the summer and marriage seasons, which typically drive fabric demand.

Major Market Challenges

- Low-Priced Imports and Dumping: A significant challenge is the continued pressure on margins due to cheap imports from China and Free Trade Agreement (FTA) countries. This specifically impacts capacity utilization for Tire Cord Fabric and margins for commodity Filament Yarn products. In response, the industry is pursuing Anti-Dumping Duties (ADD) to counter this dumping.

- Rising Raw Material Costs: After a period of decline, the price of Caprolactam (a key raw material) has increased following industry-wide production cuts in China.

- Regulatory and Legal Pressures: The company is managing the financial impact of New Labor Codes, which resulted in an exceptional item cost of ₹3.7 crores this quarter due to additional gratuity requirements. Furthermore, a long-standing excise duty dispute involving a demand originally totaling ₹22,927 lacs (later re-determined to ₹730 lacs) remains pending before the Supreme Court.

- Subdued Seasonal Demand: Following the festival season, demand for Fabric and Yarn was subdued in Q3, though management expects a recovery in Q4.

Upcoming Growth & Strategic Initiatives

- Expansion into Polyester Tire Cord Fabric (PTCF): The company is moving into the passenger vehicle tire market with PTCF. The approval process is currently progressing, and regular commercial sales are expected to begin in FY27.

- New Product Development and VAPs: To sustain margins against commodity competition, the company is focusing on New Mother Yarn and Value-Added Products (VAPs).

- Energy Cost Reduction: Century Enka is increasing its use of renewable energy to control power costs. While currently implemented at the Bharuch plant, additional renewable power is scheduled to be commissioned in FY27, which is expected to further lower operational costs.

- Leveraging Trade and Policy Shifts: Management is optimistic that GST cuts on tires and automobiles will improve demand. Additionally, recent tariff developments with the USA and a trade deal with the EU are seen as positive indicators for future demand in the Tires and Yarns sectors.

- Efficiency Improvements: There is a continuous internal focus on efficiency improvements to bolster overall margins.