Central Depository Services (India) Limited (CDSL) is a premier Market Infrastructure Institution (MII) that plays a vital role in India’s capital market ecosystem. As a key facilitator, CDSL provides efficient and secure services to market participants including exchanges, clearing corporations, depository participants (DPs), issuers, and investors. It enables holding of securities in dematerialised form and smooth execution of securities transactions across the market.

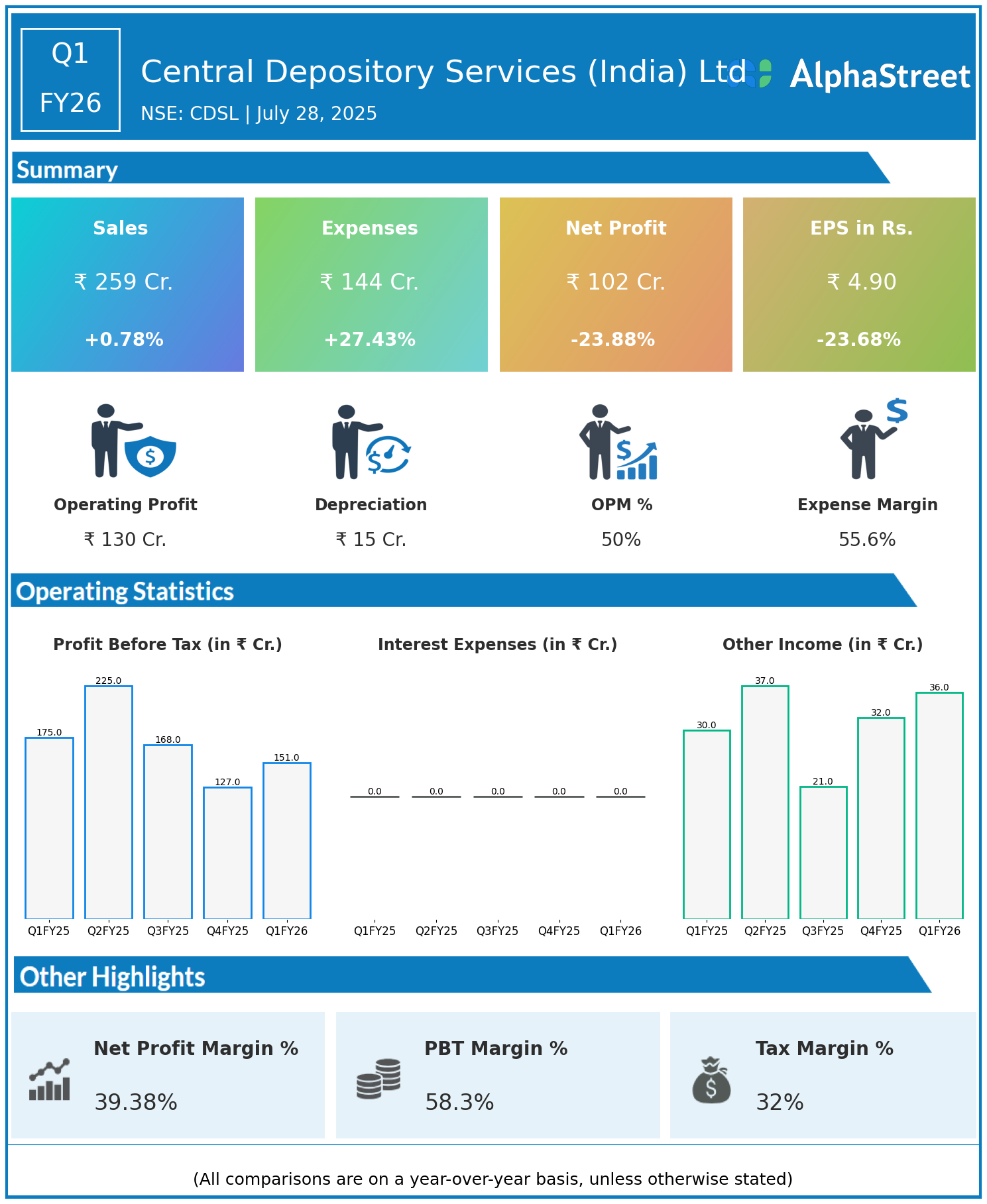

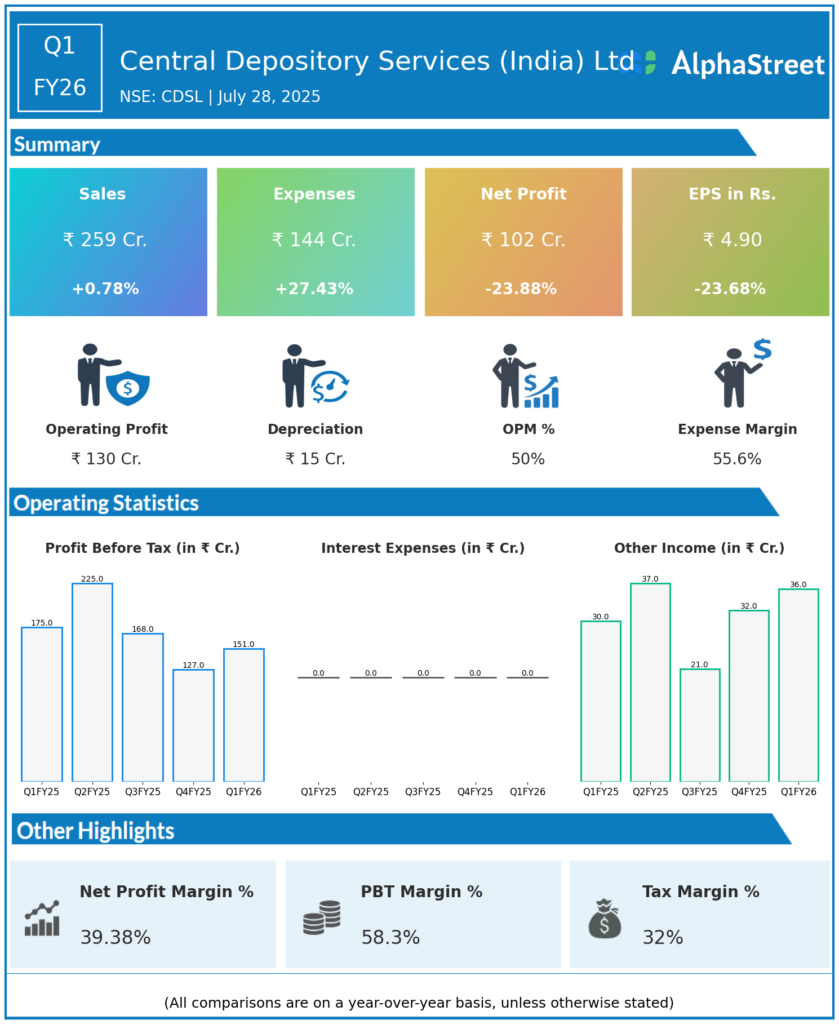

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹259 crore, up 0.78% year-on-year (YoY) from ₹257 crore in Q1 FY25.

-

Total Expenses: ₹144 crore, up 27.43% YoY from ₹113 crore.

-

Consolidated Net Profit (PAT): ₹102 crore, down 23.88% from ₹134 crore in the same quarter last year.

-

Earnings Per Share (EPS): ₹4.90, down 23.68% from ₹6.42 YoY.

Operational & Strategic Update

-

Business Overview: CDSL continues to strengthen its position as a trusted central securities depository through enhanced technology platforms and improved customer service.

-

Revenue Growth: Modest revenue growth was primarily driven by sustained volumes of dematerialisation and increased transaction activity in securities settlements.

-

Expense Rise: The significant increase in expenses was due to higher investments in IT infrastructure, security, regulatory compliance, and business expansion initiatives.

-

Profitability Impact: Elevated expenses led to a decline in net profit despite stable revenues, reflecting the company’s focus on long-term scalability and robust market infrastructure development.

-

Market Developments: Continued growth in retail investor participation and increasing adoption of demat accounts underpin the company’s core business environment.

-

Innovation & Digital Initiatives: CDSL is actively investing in digital transformation, including enhanced cybersecurity measures and new service offerings like e-voting and mutual fund platforms.

-

Regulatory Engagement: Proactive compliance with evolving regulatory norms in the securities market ensures sustained trust among stakeholders.

Corporate Developments

Q1 FY26 posed profitability challenges for CDSL due to rising operational costs amid steady top-line performance. However, strategic investments in technology and market expansion are expected to support sustainable growth and service excellence in the medium to long term.

Looking Ahead

Central Depository Services (India) Limited remains committed to strengthening the capital market ecosystem by driving innovation, operational efficiency, and stakeholder value. As it navigates through its expansion and infrastructure enhancement phase, the company aims to consolidate leadership in securities depository services while enhancing investor confidence and market transparency.