Founded in 2002, Ceigall India Limited is an infrastructure construction company specializing in complex structural projects such as elevated roads, flyovers, bridges, railway overpasses, tunnels, highways, expressways, and runways. The company serves government and private sector clients across India’s infrastructure development landscape.

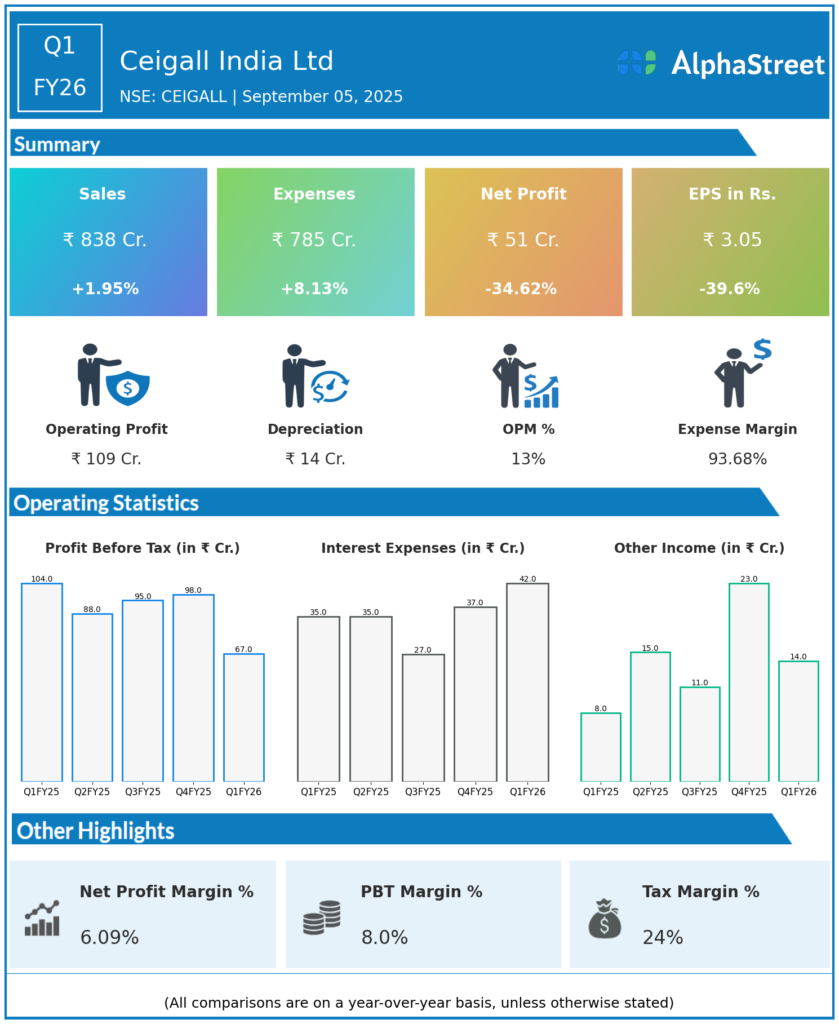

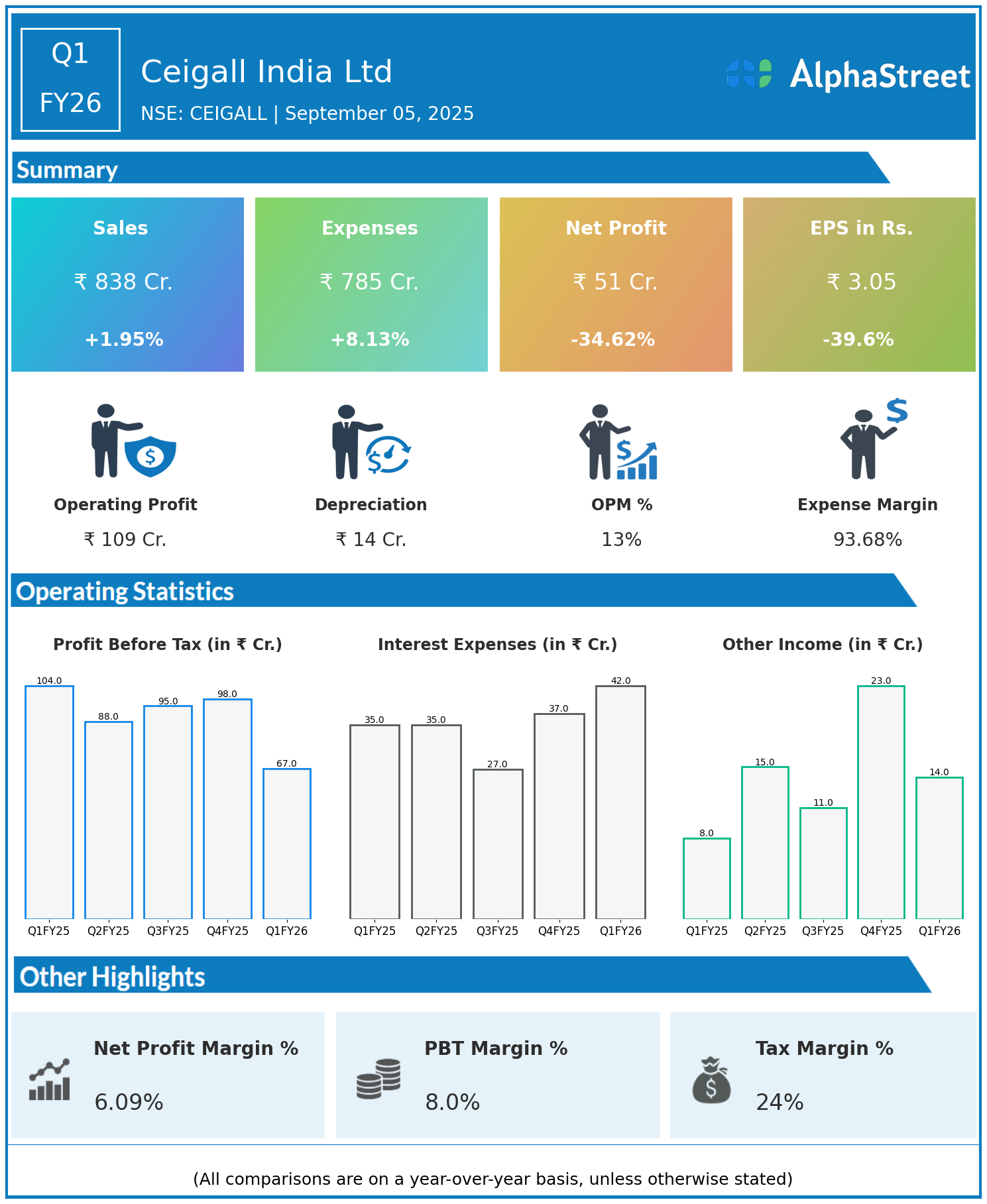

Q1 FY26 Earnings Summary

- Revenue: ₹838 crore, up 1.95% year-on-year YoY from ₹822 crore in Q1 FY25.

- Total Expenses: ₹785 crore, up 8.13% YoY from ₹726 crore.

- Consolidated Net Profit PAT: ₹51 crore, down 34.62% YoY from ₹78 crore in the same quarter last year.

- Earnings Per Share EPS: ₹3.05, down 39.60% from ₹5.05 YoY.

Operational & Strategic Update

- Revenue Growth: Marginal revenue growth driven by steady execution of ongoing infrastructure projects amidst a competitive bidding environment.

- Expense Pressure: Total expenses increased faster than revenue due to higher raw material costs, labor wages, and project completion expenses, leading to margin compression.

- Profit Decline: Net profit declined sharply by 35% YoY reflecting the impact of rising expenses on operating profitability.

- Project Pipeline: The company has a healthy order book in urban infrastructure and highway projects, supported by government initiatives for transportation connectivity.

- Operational Focus: Emphasis on timely project delivery, cost control measures, and strategic procurement to mitigate input cost pressures.

- Strategic Expansion: Expansion into newer segments such as expressways and runway projects to diversify revenue streams and enhance growth prospects.

Corporate Developments

Ceigall India’s Q1 FY26 results highlight the challenges of rising costs in the infrastructure sector, which have negatively impacted profitability despite stable revenues. The company’s strong order book and project execution capabilities provide a foundation for future growth.

Looking Ahead

The company aims to focus on optimizing project costs, improving working capital efficiency, and leveraging government infrastructure initiatives to drive revenue growth and margin recovery in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.