CEAT Ltd. is one of India’s leading tyre manufacturers and part of the RPG Group since 1982. Founded in 1958, it is recognized as one of the fastest-growing tyre companies in India and was among the Top 25 best workplaces in Manufacturing by GPTW in 2022.

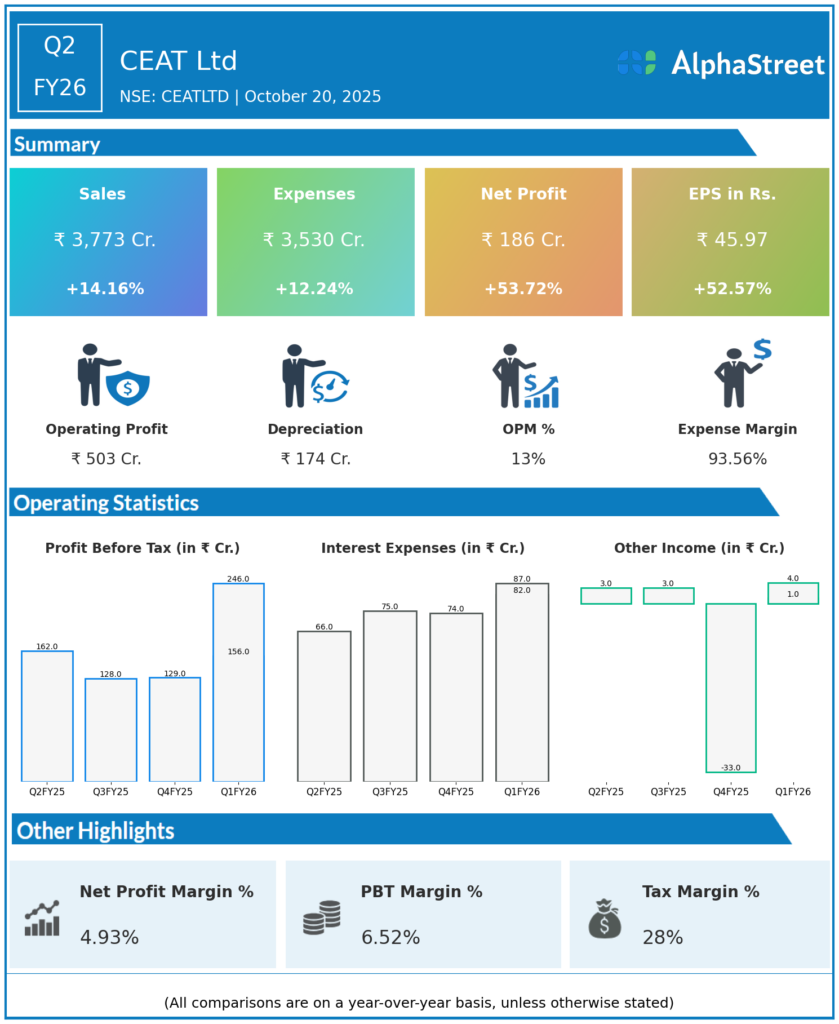

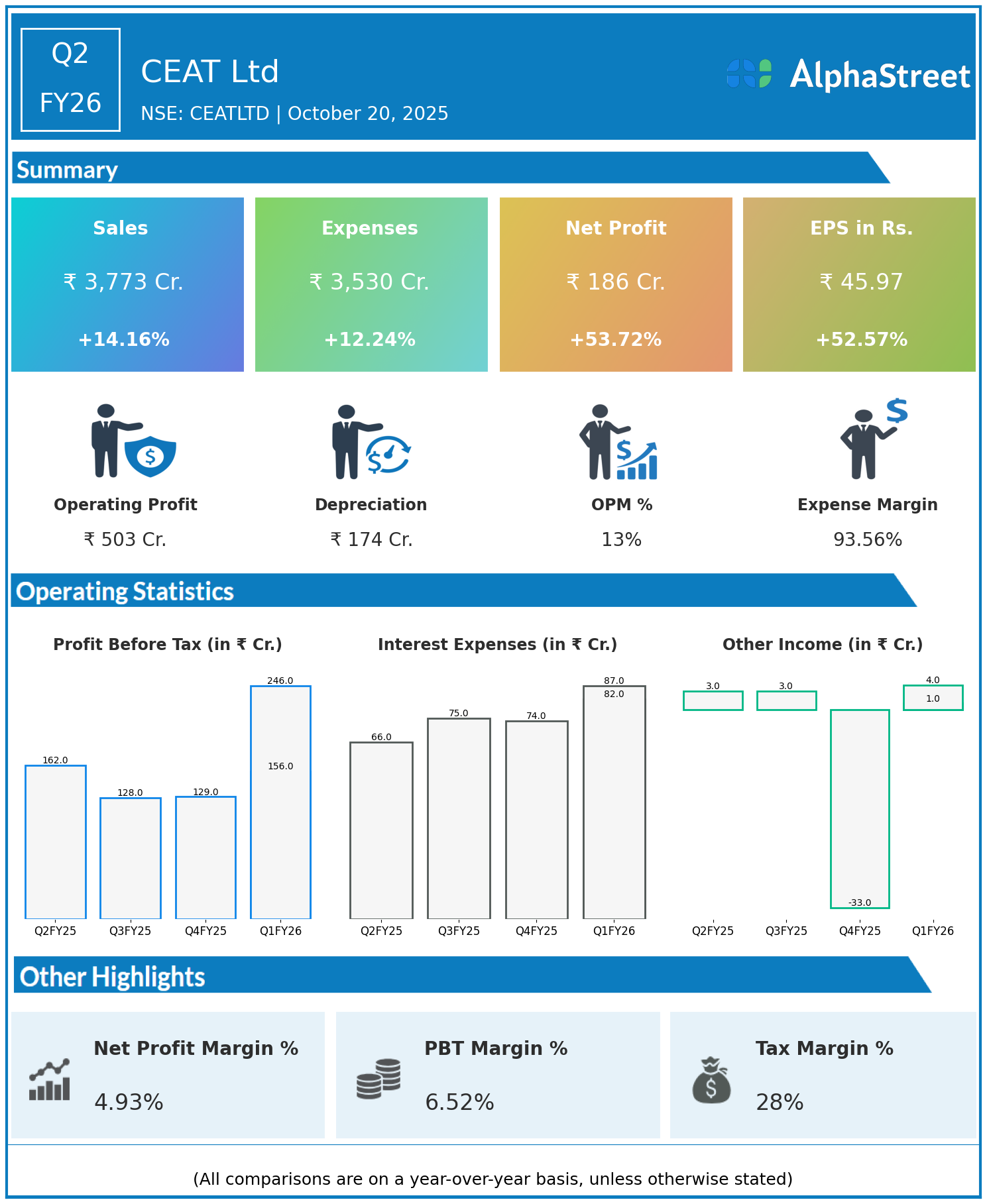

CEAT Q2 FY26 Earnings Summary (Jul–Sep 2025)

Consolidated revenue stood at ₹3,773 crore, up 14.17% year on year, driven by an 11% increase in sales volumes and a 3% rise in average selling prices.

Profit after tax (PAT) rose sharply by 53.72% to ₹186 crore, compared to ₹121 crore in the same quarter a year ago.

Earnings Per Share (EPS) reached ₹45.97, up 52.57% year on year.

EBITDA improved by 39%, with margins expanding to 13.4% from 11% last year, reflecting operational efficiency and cost control.

Operational and Business Highlights

The company benefited from a 5% reduction in raw material costs and improved capacity utilization at manufacturing plants. CEAT’s integration of Camso, its off-highway tyre subsidiary, is progressing well, with capacity expansion and customer transition expected to complete in the next few quarters. Market share gains were seen, especially in passenger vehicle OEM tyres above 17-inch rim size.

GST rate cuts on tyres and vehicles further boosted domestic demand. CEAT continues to focus on premiumization, reducing dependence on price-sensitive segments, and strengthening exports.

Financial Position and Outlook

CEAT maintains a healthy balance sheet with moderate leverage and a net cash position. Return on equity and capital employed showed significant improvement, highlighting efficient asset utilization. Capital expenditure increased to support capacity expansion and compliance with evolving emission norms.

The management expects sustained double-digit revenue growth and margin expansion in the coming quarters, underpinned by domestic demand recovery, export opportunities, and strategic integration of subsidiaries.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.