C E Info Systems Limited (“MapmyIndia”) was incorporated on February 17, 1995. The company is a data and technology products and platforms company, offering proprietary digital maps as a service (“MaaS”), software as a service (“SaaS”), and platform as a service (“PaaS”). They are India’s leading provider of advanced digital maps, geospatial software, and location-based IoT technologies. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

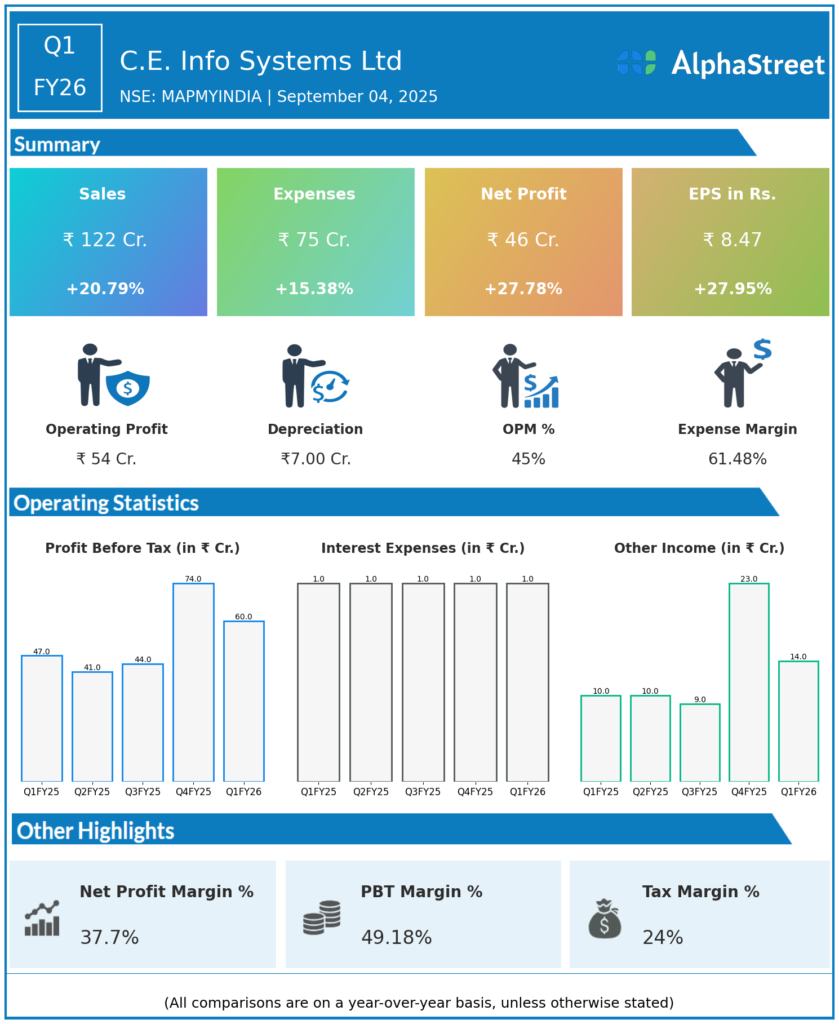

Revenue from Operations: ₹122 crores, up 21% YoY (Q1 FY25: Approx. ₹101 crores); down 15% QoQ (Q4 FY25: ₹144 crores).

-

EBITDA: ₹55 crores, up 31% YoY.

-

EBITDA Margin: 46%, up from 42% YoY; map-led business margin at 54.8%.

-

Profit After Tax (PAT): ₹46 crores, up 28% YoY (Q1 FY25: ₹36 crores); PAT margin at 33.9%.

-

Earnings Per Share (EPS): Approx. ₹8.47, up from ₹6.62 YoY.

-

Profit Before Tax (PBT): ₹60.3 crores, up 27.8% YoY.

-

Key Segments: Digital map data, GPS navigation, location-based services, and IoT contributed 93% of revenue, up 23% YoY to ₹114 crores; devices segment contributed ₹8 crores.

-

Growth Drivers: Automotive and mobility tech revenue up 24.4% YoY; map-led business grew 26% YoY.

-

Recent Investments: Raised stake in IoT subsidiary Gtropy Systems to 96% (₹25 crores investment), plus ₹25 crores for 0.049% stake in Zepto, deepening quick-commerce presence.

-

Cash/Investments: ₹676 crores as of June 30, 2025.

Management Commentary & Strategic Highlights

-

Management emphasized margins above 35% for FY26, ongoing focus on enterprise clients, and continued innovation in fleet-tech and telematics.

-

The order book includes a major ₹233 crores e-commerce deal driving revenue outlook for coming quarters.

-

Q1 reflected strong demand for map-led solutions, sector penetration for EVs, and stability in the IoT business (expected to improve post-management transition).

-

Strategic innovation in digital twins, govt tech, and international expansion are flagged as future growth areas.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹144 crores.

-

PAT: ₹49 crores.

-

EBITDA Margin: 47%, up 8.6 percentage points QoQ.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.