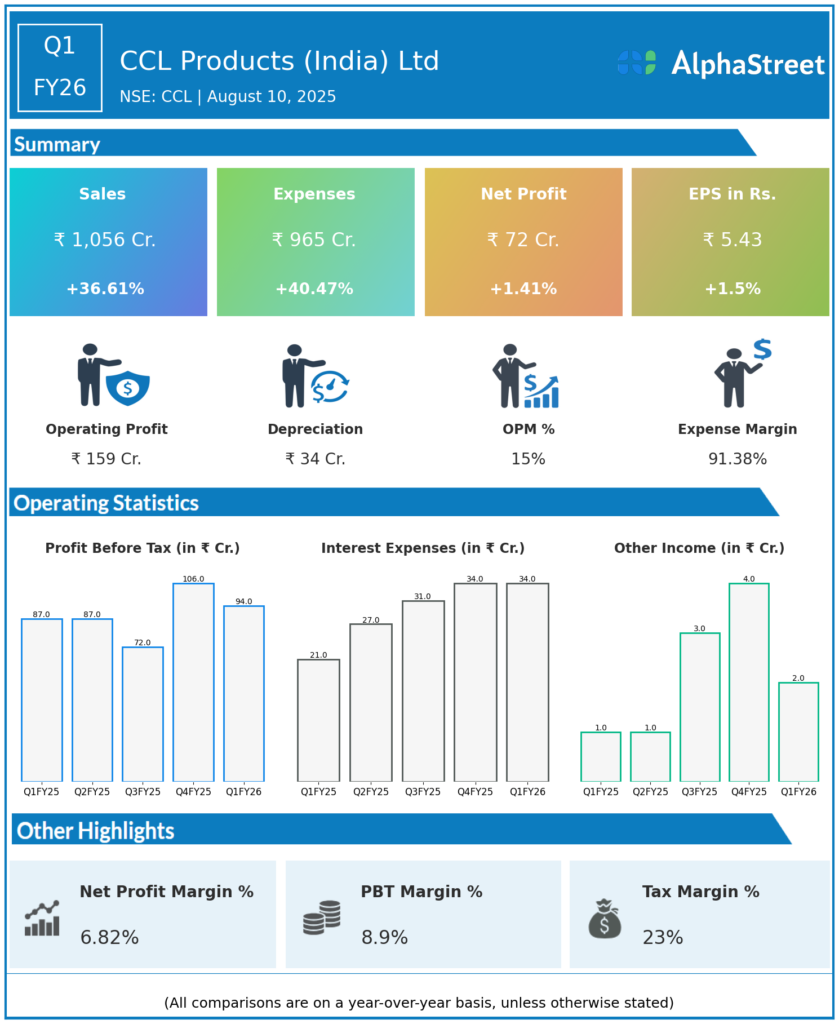

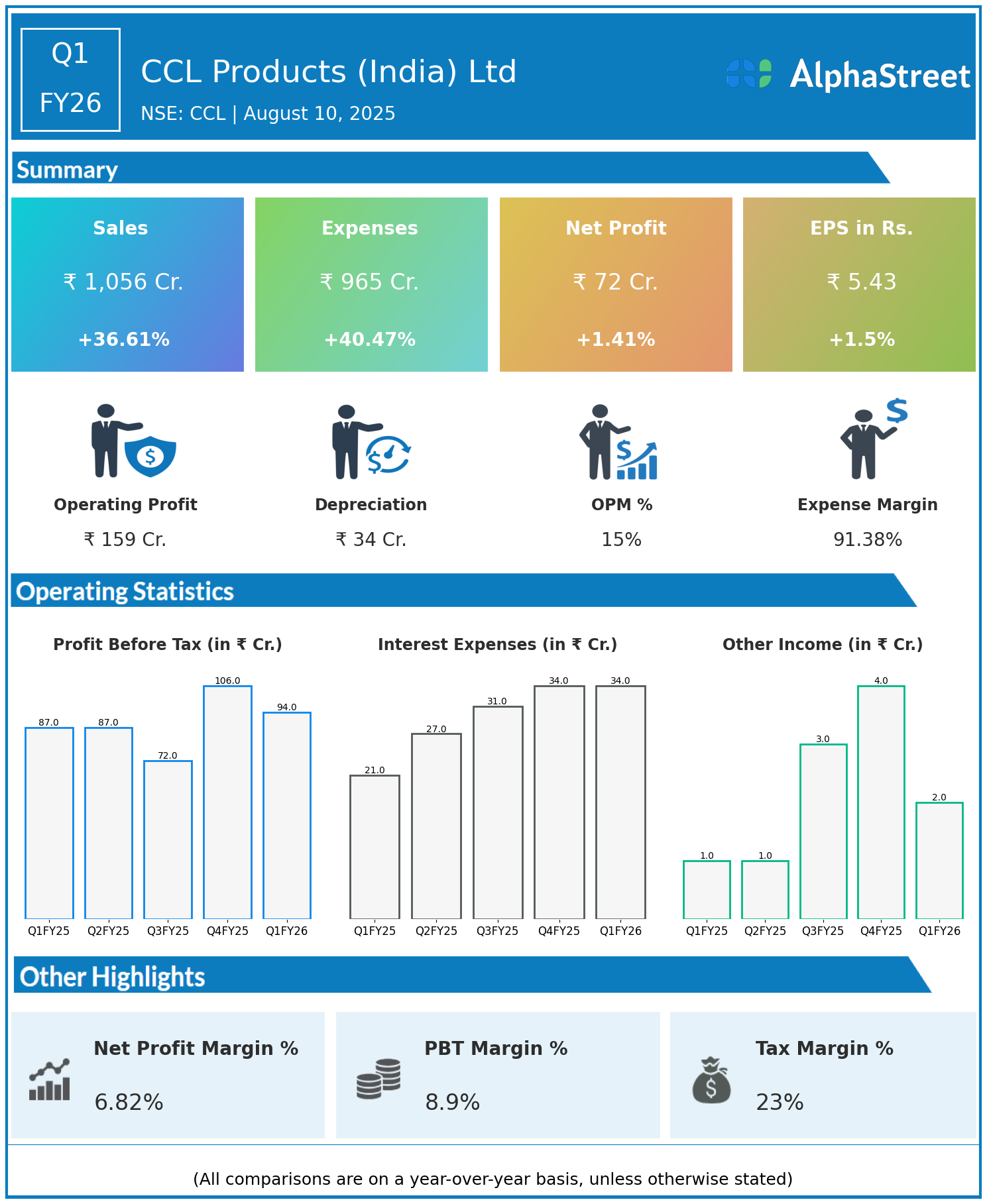

CCL Products (India) Limited is engaged in the production, trading, and distribution of coffee. The company operates primarily in India, Vietnam, and Switzerland. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹1,056 crore, up 36.61% year-on-year (YoY) from ₹773 crore in Q1 FY25.

- Total Expenses: ₹965 crore, up 40.47% YoY from ₹687 crore.

- Consolidated Net Profit (PAT): ₹72 crore, up 1.41% from ₹71 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹5.43, up 1.50% from ₹5.35 YoY.

Operational & Strategic Update

- Strong Revenue Growth: The 37% increase in revenue reflects robust demand across key markets and expanded coffee production and sales volumes, benefiting from the company’s presence in major coffee-growing and consumption regions.

- Expense Growth: Total expenses rose by over 40%, outpacing revenue growth, due to increased input costs, higher operational expenses, and possible inflationary impacts through the supply chain.

- Moderate Profit Growth: Despite the rise in expenses, net profit and EPS showed a slight increase, indicating tight margin management amid cost pressures.

- Market & Business Focus: CCL Products continues to leverage its integrated coffee business model across production, processing, and distribution, with strategic emphasis on quality, innovation, and expanding presence in premium and specialty coffee segments.

- Geographic Diversification: The company’s operations across India, Vietnam, and Switzerland provide geographic balance and access to global coffee markets, supporting resilience and growth opportunities.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reflect solid top-line momentum for CCL Products (India) Ltd, with modest profit growth despite challenges from increased costs. The company’s continued investments in processing technology, product innovation, and market development are pivotal to sustaining its market position.

Looking Ahead

CCL Products (India) Ltd is well-positioned to capitalize on growing global demand for coffee, particularly in specialty and premium segments. Focus on operational efficiency, cost controls, and strategic market expansion is expected to support steady profit growth and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, Click Here to visit the AlphaStreet India News Channel.