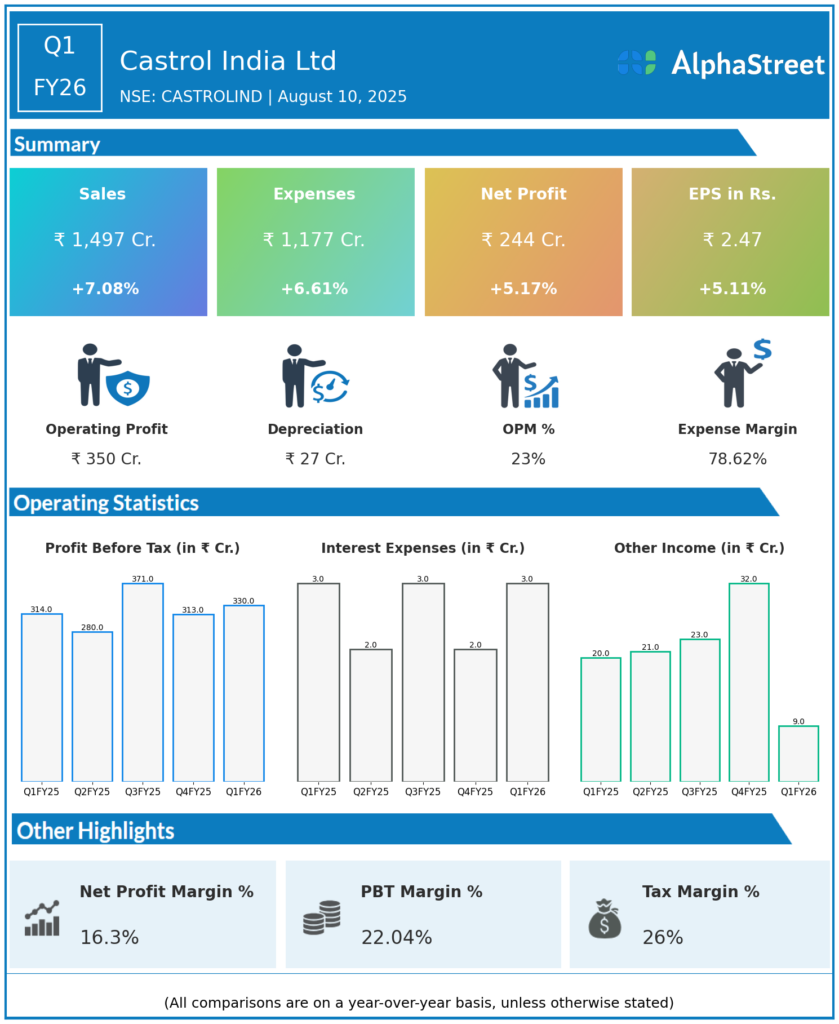

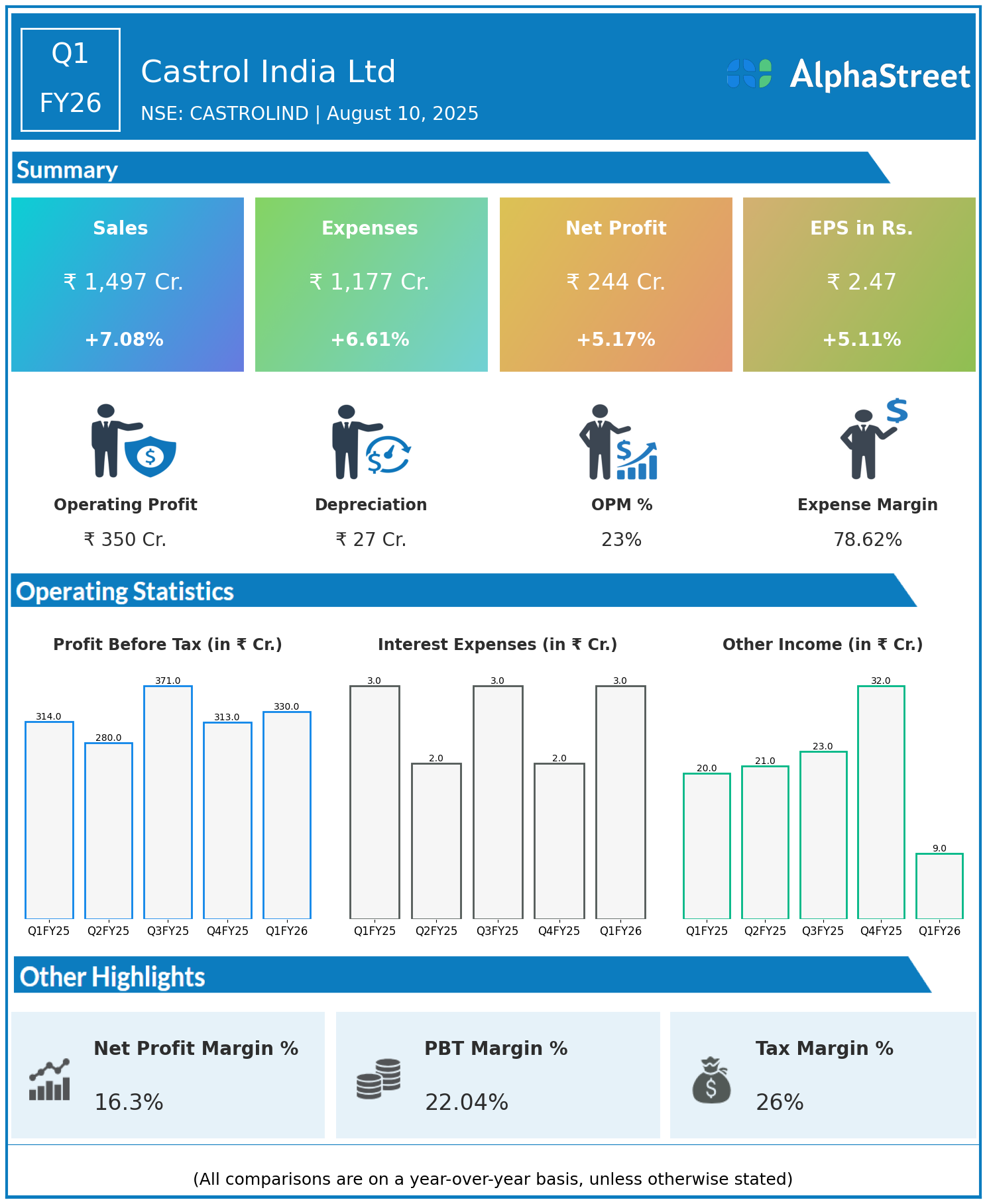

Castrol India Limited is principally engaged in the business of manufacturing and marketing automotive and industrial lubricants and related services. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹1,497 crore, up 7.08% year-on-year (YoY) from ₹1,398 crore in Q1 FY25.

- Total Expenses: ₹1,177 crore, up 6.61% YoY from ₹1,104 crore.

- Consolidated Net Profit (PAT): ₹244 crore, up 5.17% from ₹232 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.47, up 5.11% from ₹2.35 YoY.

Operational & Strategic Update

- Consistent Revenue Growth: The 7% increase in revenue was primarily driven by higher demand for lubricants in both automotive and industrial segments, along with expanding reach in rural markets and a growing presence in the industrial sector. Positive traction with OEM partnerships also contributed.

- Disciplined Cost Management: Total expenses rose in line with business growth but remained well-controlled through ongoing operational efficiencies and expense management, supporting margin stability despite input cost volatility and competitive pressures.

- Profitability Expansion: Net profit and EPS posted a 5% increase, reflecting improved operational leverage, supply chain efficiencies, and a strong focus on maintaining profitability even amid higher input costs.

- Market & Segment Strategy: Castrol India continues to strengthen its brand and product portfolio, focusing on premium lubricants and expanding its distribution in both urban and rural regions. The company’s industrial business is identified as a long-term growth area.

- Strategic Focus: Investments in expanding workshop networks, product innovation, and deepening associations with OEMs remain at the core of the company’s growth strategy. Technology initiatives and digital transformation are expected to enhance end-to-end solutions for customers.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 reflects a steady performance for Castrol India, with solid topline growth and continued resilience in profits despite rising costs and a challenging business environment. The company maintained its goal of a 21–24% EBITDA margin and announced an interim dividend of ₹3.5 per share, reaffirming its commitment to shareholder value.

Looking Ahead

Castrol India Ltd remains optimistic about growth prospects in both industrial and rural markets. The company’s focus on product innovation, expanding its network, and strengthening customer relationships is set to drive further value creation and profitability through FY26 and beyond. Shareholders can expect sustained growth as the company leverages its brand, operational excellence, and strategic initiatives in India’s evolving lubricants market.

Explore the company’s past earnings and latest concall transcripts, Click Here to visit the AlphaStreet India News Channel.