CarTrade Tech Limited (NSE: CARTRADE/BSE: 543333) has delivered its best-ever quarterly performance for the period ending December 31, 2025. The company’s Q3 FY26 results highlight a period of “exponential growth,” with all three of its primary business verticals achieving their highest-ever revenue and profits.

Unprecedented Financial Growth

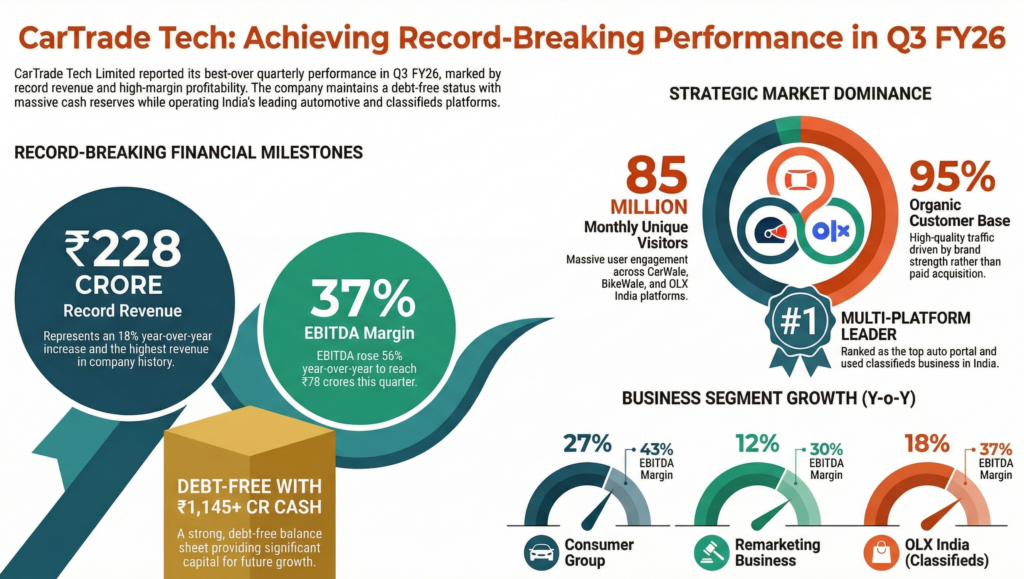

The company reported a record revenue of ₹228 crores for the quarter, representing an 18% year-on-year (Y-o-Y) increase. This growth was accompanied by a significant surge in profitability:

• EBITDA: Rose by 56% Y-o-Y to reach ₹78 crores, with margins expanding to 37%.

• Profit After Tax (PAT): Reached ₹62 crores, a 35% increase over the previous year.

• Adjusted Performance: Excluding the impact of the New Labour Code, PAT stood at ₹68 crores, marking a 49% Y-o-Y growth.

Performance by Business Vertical

CarTrade Tech’s diversified platform approach continues to drive profitability across its segments:

• Consumer Group (CarWale, BikeWale): This segment saw a 27% Y-o-Y revenue increase. It achieved a benchmark EBITDA margin of 43% in Q3 FY26, driven by its massive user base of over 150 million users.

• Remarketing Business: Delivering steady momentum, this vertical saw a 12% revenue growth and an impressive 68% growth in PAT. Its EBITDA margin increased from 23% in the same quarter last year to 30%.

• OLX India (Classifieds): Following its integration, OLX continued its strong trajectory with an 18% revenue increase and a 70% growth in EBITDA. The segment maintained a healthy 37% EBITDA margin.

Key Segment Developments

Each of the company’s business units demonstrated independent strength and scalability:

• Consumer Group (CarWale, BikeWale): This segment achieved a benchmark EBITDA margin of 43%. Revenue for the group increased by 27% Y-o-Y, supported by a massive user base across its platforms.

• OLX India (Classifieds): OLX continued its strong trajectory since acquisition, posting an 18% revenue increase and a massive 70% growth in EBITDA. It maintained a healthy 37% EBITDA margin for the quarter.

• Remarketing Business: This vertical saw 12% revenue growth and an impressive 68% surge in PAT. Its EBITDA margin improved significantly, rising from 23% in Q3 FY25 to 30% in Q3 FY26.

Core Growth Strategies

• Innovation-Led Expansion: The company explicitly identifies innovation as the primary driver for both growth and profits. This strategy has resulted in a three-year Revenue CAGR of 32% and a PAT CAGR of 83% between FY23 and FY26.

• “One Platform” Diversification: CarTrade Tech utilizes a single ecosystem to manage diversified, profitable segments including Consumer Group (CarWale, BikeWale), Remarketing (Shriram Automall), and Classifieds (OLX India). This multi-channel approach allows for structural margin expansion across the board.

• Organic Reach Advantage: A cornerstone of the company’s strategy is its massive organic customer base. Approximately 95% of its unique visitors are organic, which significantly reduces reliance on paid marketing and enhances profitability. The group currently attracts roughly 85 million monthly average unique visitors (MAU) across its platforms.

• Capital Strength and Scale: CarTrade Tech maintains a debt-free profile with massive cash reserves of approximately ₹1,145 crores. This “capital strength” provides the flexibility to pursue long-term shareholder value, evidenced by a 92% CAGR in Earnings Per Share (EPS) over the last three years.

Operational Scale and Market Leadership

CarTrade Tech solidifies its position as India’s #1 auto portal, used classified business, and vehicle auction platform. Key operational highlights include:

• Massive Reach: Approximately 85 million monthly average unique visitors (MAU) across all platforms, with 95% of visitors being organic.

• Physical Presence: The group operates through 500+ physical locations, including Automall, abSure, and OLX India outlets.

• Auction Volume: The remarketing business is on track for 1.9 million annual auction listings based on Q3 performance.

Robust Capital Strength

The company maintains an exceptionally strong balance sheet, characterized by a debt-free profile. As of December 31, 2025, CarTrade Tech holds cash reserves of approximately ₹1,145 crores. This financial stability has contributed to a 3-year growth story (FY23–FY26) featuring a Revenue CAGR of 32% and a PAT CAGR of 83%.

Founded in 2010 and listed in 2021, CarTrade Tech continues to leverage innovation to drive structural margin expansion and shareholder value, with an Earnings Per Share (EPS) CAGR of 92% over the last three years.

Outlook and Shareholder Value

CarTrade Tech’s strategy of combining technological innovation with a dominant market position has led to a 94% Share Price CAGR over the past three years. As the company continues to leverage its #1 position as India’s leading auto portal and vehicle auction platform, its focus remains on profitable, diversified growth powered by its extensive organic reach.