CarTrade Tech Limited (NSE: CARTRADE/BSE: 543333) announced its financial results for the third quarter ended December 31, 2025, on January 28, 2026. Information regarding current stock price, intraday percentage move, 52-week context, and specific equity analyst commentary is not available in the provided sources.

The company achieved record consolidated revenue of ₹228.37 crores and an all-time high EBITDA margin of 37% for the quarter ended December 31, 2025. These results reflect significant margin expansion and growth across its diversified digital ecosystem.

Latest Quarterly Results and Highlights

Total consolidated income reached ₹228.37 crores in Q3FY26, representing an 18% year-over-year increase from ₹192.94 crores. EBITDA for the quarter grew 56% to ₹78.25 crores, with margins reaching a record 37%. Profit before tax stood at ₹77.99 crores, a 46% increase over the previous year. Profit after tax (PAT) was reported at ₹61.52 crores, up 35% year-over-year. Excluding the impact of the New Labour Code, PAT would have been ₹68.03 crores, reflecting 49% growth.

Year-Over-Year and Full-Year Growth Context

For the nine-month period ended December 31, 2025 (9MFY26), total income grew 24% to ₹649.02 crores compared to ₹521.88 crores in 9MFY25. EBITDA for the nine-month period increased 77% to ₹185.35 crores, with a margin of 32%. Profit before tax for 9MFY26 rose 87% to ₹214.83 crores, while PAT reached ₹172.66 crores, representing a 74% increase.

Segment Updates and Business Model

CarTrade Tech operates a digital marketplace ecosystem through multiple platforms. Segment performance for Q3FY26 included:

• Consumer Group: Revenue increased 27% year-over-year with an EBITDA margin of 43%.

• Remarketing Business: Revenue grew 12% and PAT rose 68% year-over-year, maintaining an annualized run-rate of 1.9 million auction listings.

• OLX India: Revenue increased 18%, while EBITDA growth reached 70% with a 37% margin.

The company engaged approximately 85 million average monthly unique visitors in Q3FY26. Organic traffic accounted for 95% of total engagement. The physical network now exceeds 500 locations nationwide, including Shriram Automall and OLX India franchise outlets.

Regulatory Milestones and Management Commentary

The company granted 75,000 stock options to eligible employees under the ESOP 2021 (I) plan on January 28, 2026. Each option is convertible into one equity share at a 0% discount to the market price. Additionally, the Board approved a postal ballot to consider increasing the remuneration of Mrs. Aneesha Bhandary, Executive Director and CFO.

Regarding labor regulations, the implementation of the New Labour Code on November 21, 2025, resulted in an exceptional item charge of ₹650.71 lakhs. This charge relates to incremental obligations for gratuity and compensated absences due to changes in wage definitions. Management noted that the record quarter was driven by strong operating leverage and consistent performance across all business units.

Future Outlook and Broader Industry Trends

The company intends to continue investing in future technologies and platform capabilities to deepen user engagement. Broader industry trends and risks include potential downtrends in the domestic or global industry, changes in political or economic environments in India, shifts in tax laws, and technological changes. Information regarding market capitalization, specific market reactions to this report, or reasons to pass is not provided in the sources.

Where Does CarTrade Tech Limited Today?

CarTrade Tech maintains a leadership position as India’s largest digital marketplace ecosystem. It serves more than 150 million annual unique visitors through its flagship brands, including CarWale, BikeWale, and OLX India. The company facilitates the buying and selling of vehicles, electronics, furniture, and real estate for consumers and enterprises.

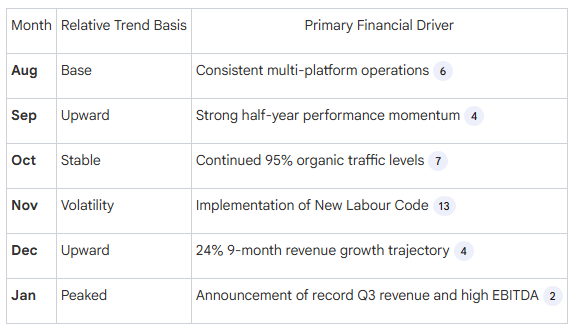

(The following is a descriptive representation of an illustrative stock chart based on the financial momentum)

Chart Description

An area chart depicting a steady upward trajectory from August 2025 to January 2026. The x-axis is labeled by month. The chart reflects the company’s growth from ₹521.88 crores in the prior nine-month period to ₹649.02 crores in the current nine-month period, culminating in a peak following the January 28 record revenue announcement.