Incorporated in 1997, Carraro India Ltd is a key manufacturer of axles and transmission systems for agricultural tractors and construction vehicles. The company plays an important role in supporting the mechanization of agriculture and infrastructure development in India and serves both domestic manufacturers and global OEMs.

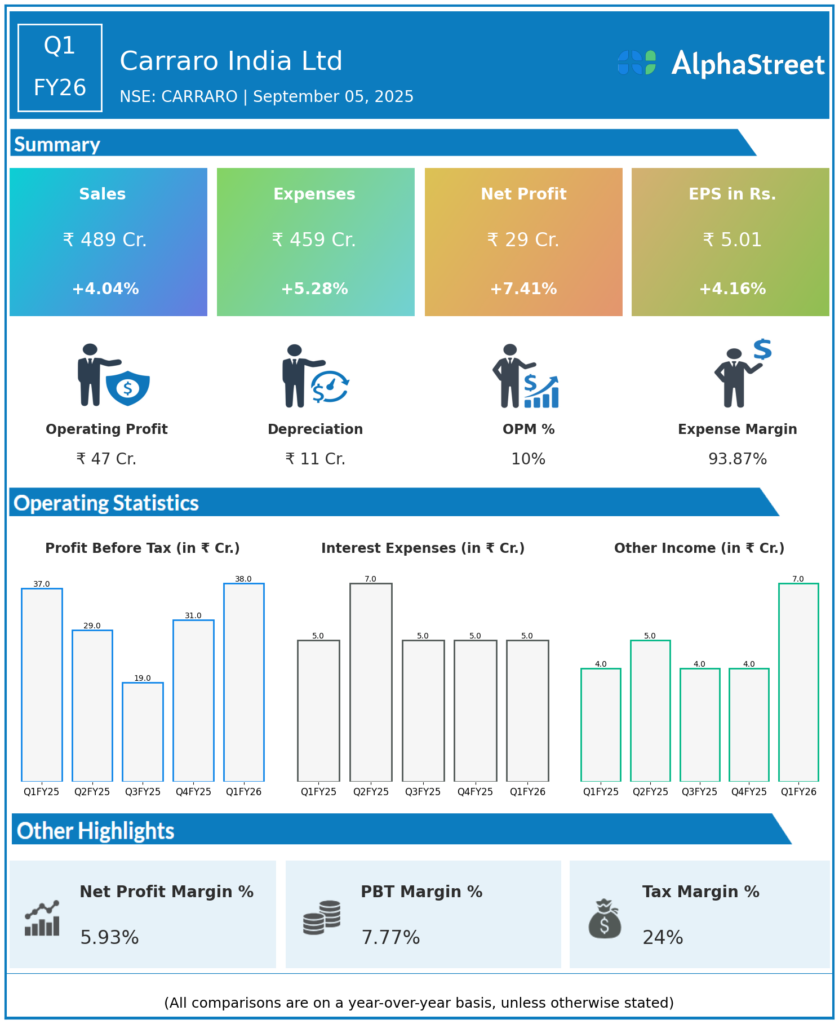

Q1 FY26 Earnings Summary

- Revenue: ₹489 crore, up 4.04% year-on-year YoY from ₹470 crore in Q1 FY25.

- Total Expenses: ₹459 crore, up 5.28% YoY from ₹436 crore.

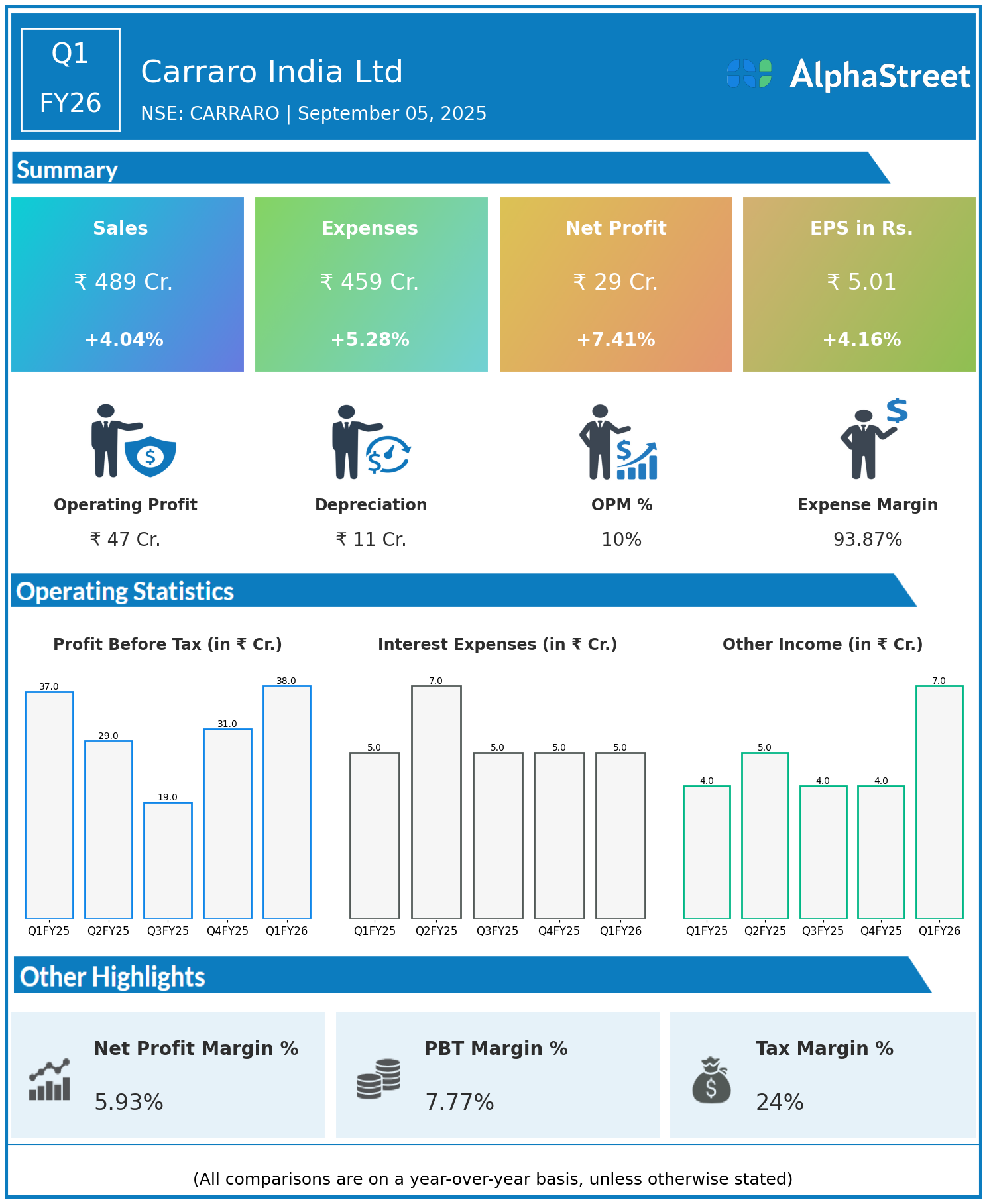

- Consolidated Net Profit PAT: ₹29 crore, up 7.41% YoY from ₹27 crore in the same quarter last year.

- Earnings Per Share EPS: ₹5.01, up 4.16% from ₹4.81 YoY.

Operational & Strategic Update

- Revenue Growth: Modest revenue growth driven by steady demand in the agriculture equipment segment and selective recovery in construction vehicle demand.

- Cost Trend: Total expenses rose faster than revenue due to higher input material costs and wage revisions, limiting margin expansion.

- Profitability: Despite cost pressures, net profit grew 7% YoY, assisted by higher sales realization and operational efficiencies.

- Segment Performance: Agricultural tractor axles and transmission systems remained the core growth driver, while construction equipment demand continued at a moderate pace.

- Strategic Focus: Ongoing efforts to expand production capabilities, strengthen partnerships with major OEMs, and enhance exports, particularly to Europe and Asia.

- Technology & Innovation: Continued investments in advanced drivetrain technologies to cater to the evolving needs of fuel-efficient and sustainable vehicles.

Corporate Developments

Carraro India’s Q1 FY26 performance reflects steady topline growth and resilience in profitability despite rising costs. Its strong presence in the agriculture equipment sector and relationships with leading OEMs are providing revenue stability across market cycles.

Looking Ahead

The company is focusing on expanding its product portfolio in transmissions for next-generation tractors and construction vehicles and scaling exports to broaden its revenue base. With agriculture mechanization and infrastructure development continuing as key themes in India, Carraro India is well-placed to capture sustainable growth in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.