CARE Ratings consolidated total income decreased by 1.8% percent from INR 279.74 Crore in FY21 to INR 274.82 crore in FY22. However, total income has increased by 1.5% from last year excluding the provision reversal last year. Total expenses have increased by 9.4% during this period. Net profit decreased from INR 90.97 crore to INR 76.83 crore mainly due to provisions made on conservative basis in one of our subsidiaries for the exposure to Sri Lanka business.

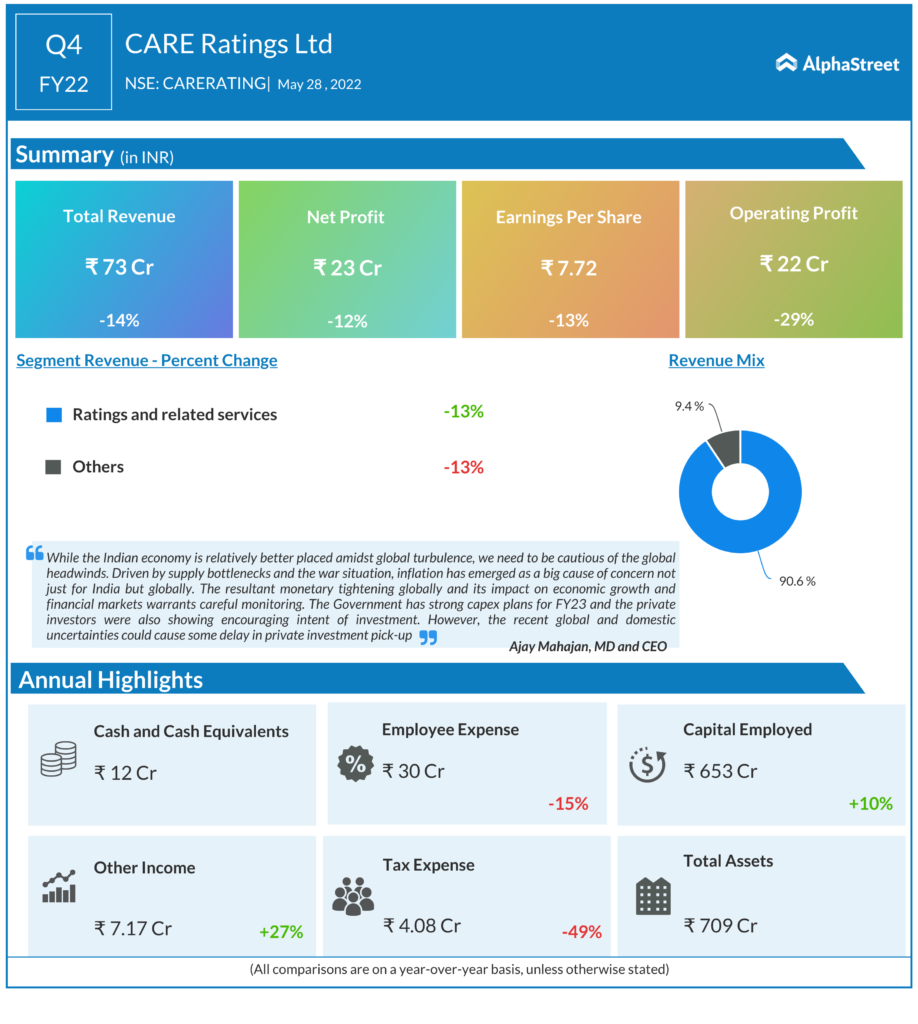

Hence, net of provisions, residual exposure to Sri Lanka stands at INR 2.36 Crore, the company is hopeful of recovery once the situation in Sri Lanka improves. For the fourth quarter total income decreased by 14.3% from INR 85.25 crore to INR 73.06 crore which is largely impacted by reversal of provision last year, which was not there in current year, while net profit decreased from INR 26.49 crore to INR 23.31 crore as majority of provisions have been taken in this quarter.