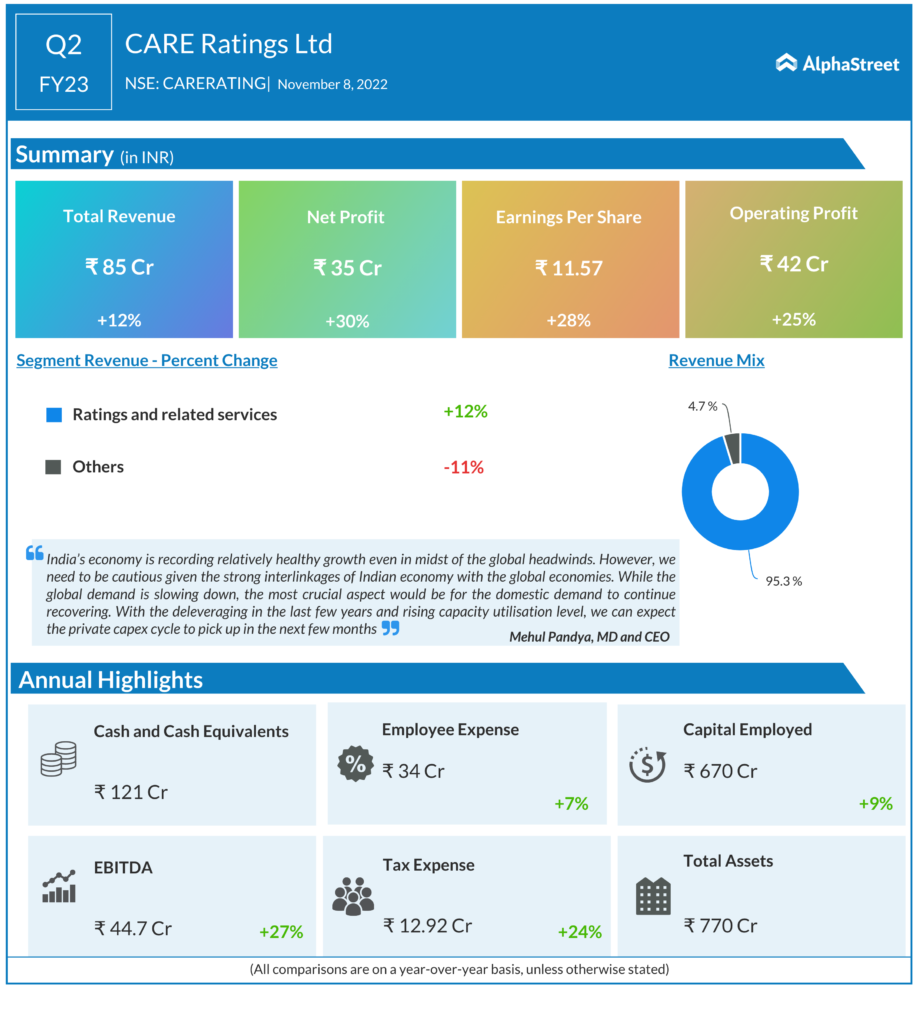

CARE Ratings reported an increased standalone net profit by 29% to INR 38.47 crore in Q2FY23 from INR 29.76 crore in Q2FY22. The ratings agency’s standalone income from operations was up by 12% to INR 77.49 crore in Q2FY23, compared with INR 69.30 crore in the corresponding quarter of the previous year.

Bank loan ratings segment led this growth, with sustained momentum in initial ratings business. Total income was up by 14% to INR 86.12 crore in Q2FY23, compared with INR 75.83 crore in Q2FY22. Total expenses have decreased by 3% during this period compared to Q2FY22. Operating profit increased by 27% to INR 44.68 crore in Q2FY23 from INR 35.19 crore in Q2FY22.

Operating profit margin and net profit margin were 58% and 45% respectively in Q2FY23, which reflected good growth compared to corresponding quarter of the previous year. Net cash generated from operating activities stood at INR 22.39 crore in the half year ended 30 September 2022, compared with INR -5.43 crore in the half year ended 30 September 2021.

The company’s consolidated total income was up by 13% to INR 93.23 crore in Q2FY23, compared with INR 82.29 crore in Q2FY22. Operating profit increased by 25% to INR 42.00 crore in Q2FY23 from INR 33.53 crore in Q2FY22. Net profit increased by 29% to INR 34.86 crore in Q2FY23 from INR 27.07 crore in Q2FY22 on absolute basis. The consolidated financials include those of CARE Ratings and its four subsidiaries.

The company said that issuances of commercial paper (CPs) and corporate bonds remained muted in Q2 FY23 compared to last year. However, there has been improvement in Corporate Bond issuances in Q2 FY23 when compared to Q1 FY23 (increase by 107% QoQ). Growth in bank credit has been driven by the services (20% growth), followed by retail segment (19.6% growth). Credit to industrial sector has grown by 12.6%. However, credit growth for large enterprises relatively lower at 7.9% (YoY), the company added.