CARE Ratings Limited is one of India’s leading credit rating agencies, offering a range of credit rating services that help corporates raise capital and enable investors to make informed decisions based on credit risk and risk–return expectations. Presenting below are its Q1 FY26 Earnings Results.

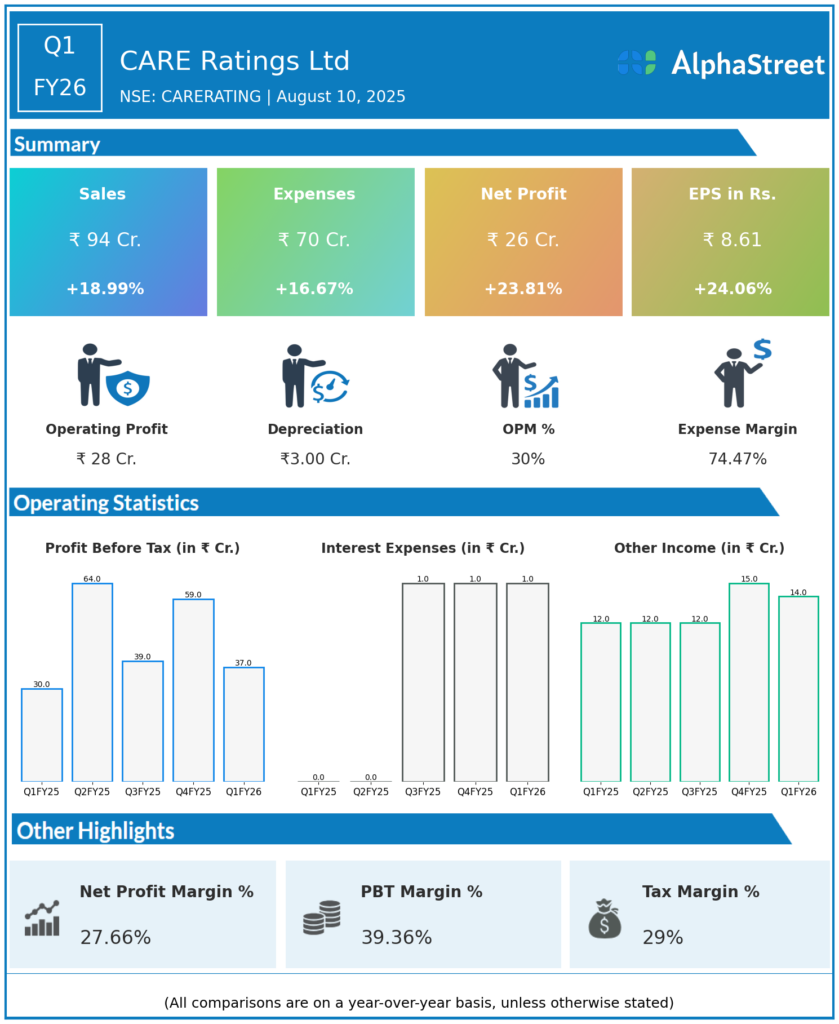

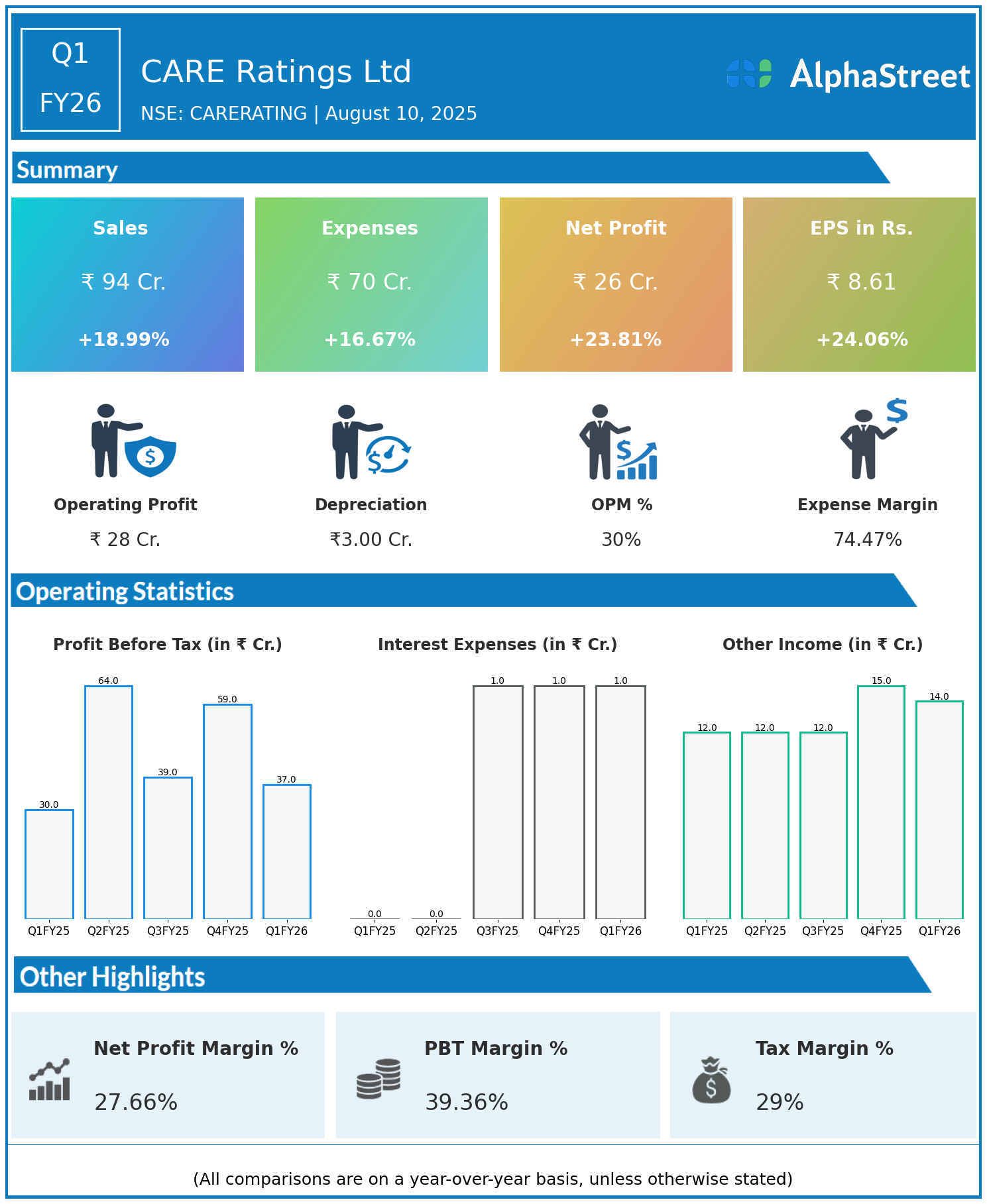

Q1 FY26 Earnings Results

- Revenue: ₹94 crore, up 18.99% year-on-year (YoY) from ₹79 crore in Q1 FY25.

- Total Expenses: ₹70 crore, up 16.67% YoY from ₹60 crore.

- Consolidated Net Profit (PAT): ₹26 crore, up 23.81% from ₹21 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹8.61, up 24.06% from ₹6.94 YoY.

Operational & Strategic Update

- Healthy Revenue Growth: The near 19% increase in revenue reflects strong demand for credit rating services, driven by higher capital market activity, increased corporate debt issuances, and demand for ratings across multiple segments.

- Controlled Cost Growth: Expenses increased at a slower pace than revenue, aided by operational efficiencies and disciplined cost management despite business expansion.

- Profitability Expansion: Net profit and EPS growth outpaced revenue growth, indicating improved margins and operating leverage as the company scaled its operations.

- Market Positioning: CARE Ratings continues to leverage its domain expertise, brand credibility, and diverse rating portfolio to maintain a strong competitive position in India’s ratings landscape.

- Strategic Focus: Emphasis remains on technology adoption for faster rating processes, expanding service offerings beyond traditional credit ratings, and strengthening relationships with corporates, banks, and financial institutions.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 reflects a robust perf 24% rise in profitability. The results underscore the company’s effective cost control, business scalability, and ability to capitalize on a positive credit market environment.

Looking Ahead

CARE Ratings is expected to benefit from continued economic growth, higher borrowing activity, and deepening capital markets in India. Expansion into new rating products, analytics-driven solutions, and strategic partnerships is likely to drive sustained growth and shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.