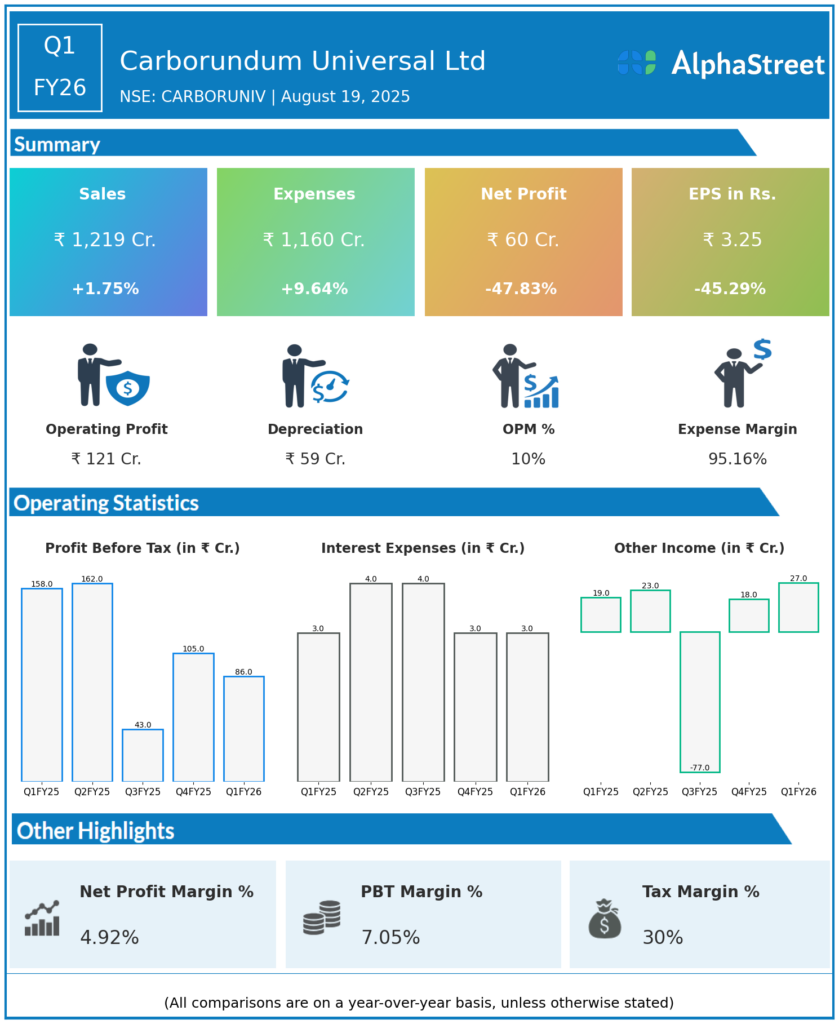

Carborundum Universal Ltd, part of the Chennai-based Murugappa group, is engaged in manufacturing abrasives, ceramics, refractories, and electro-minerals. Below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

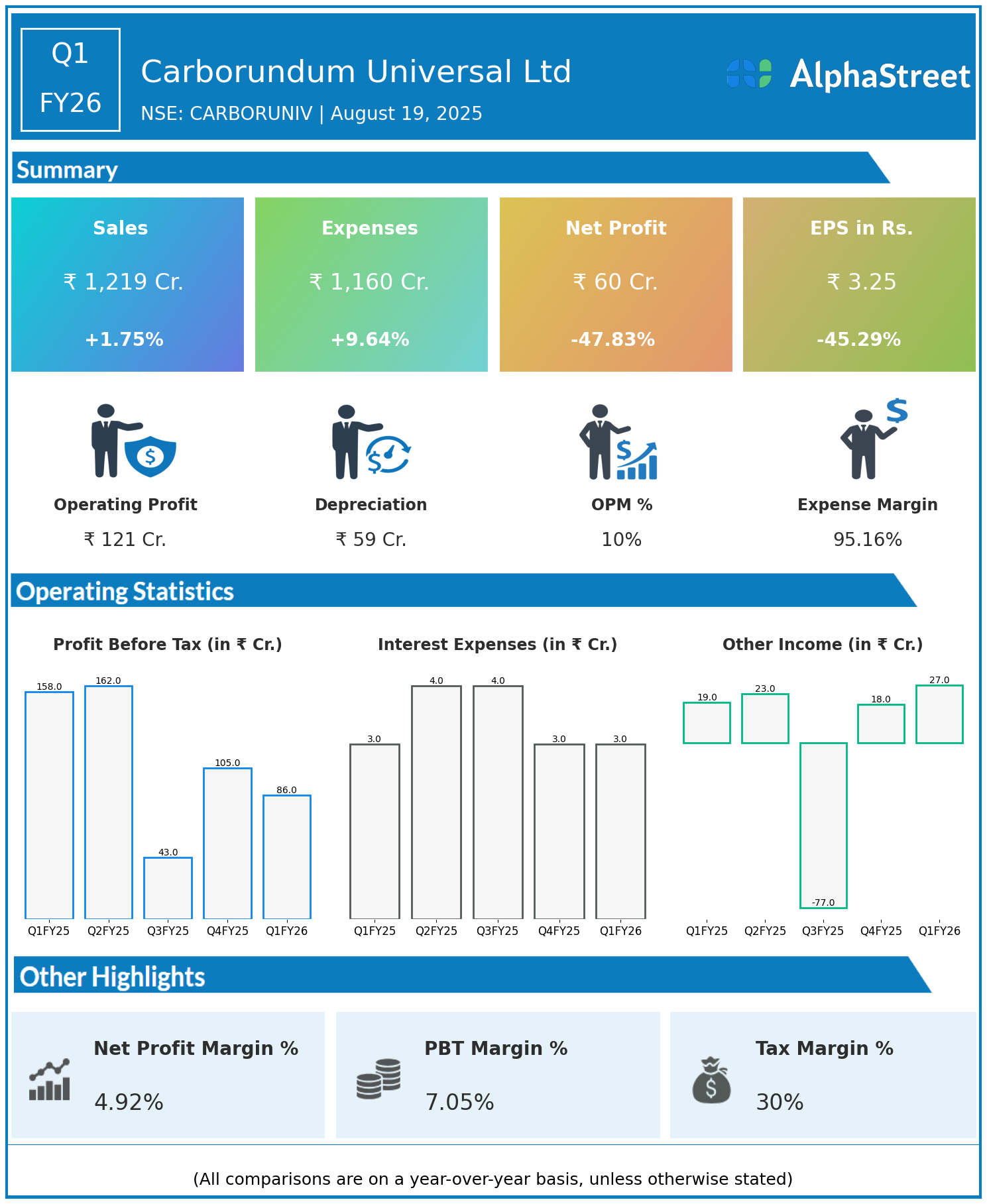

- Revenue: ₹1,219 crore, up 1.75% year-on-year (YoY) from ₹1,198 crore in Q1 FY25.

- Total Expenses: ₹1,160 crore, up 9.64% YoY from ₹1,058 crore.

- Consolidated Net Profit (PAT): ₹60 crore, down 47.83% from ₹115 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.25, down 45.29% from ₹5.94 YoY.

Operational & Strategic Update

- Revenue Growth: Revenues increased modestly by 1.75%, driven by steady demand across core product segments.

- Rising Costs: Total expenses grew significantly by 9.64%, impacted by higher raw material costs, energy prices, and operational expenses.

- Profit Decline: Net profit and EPS nearly halved due to margin compression caused by cost inflation that outpaced revenue growth.

- Market Position: Carborundum Universal maintains leadership across abrasives, ceramics, refractories, and electro-minerals through strong brand presence and diversified product portfolio.

- Strategic Focus: The company is focused on cost optimization, productivity enhancement, and product innovation to counter margin pressures and sustain long-term growth.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results reflect a challenging margin environment for Carborundum Universal Ltd, with cost escalation weighing on profitability despite stable revenues.

Looking Ahead

Carborundum Universal Ltd aims to restore margin health through operational efficiencies, supply chain optimization, and product mix improvements. The company expects gradual recovery supported by strategic initiatives and favorable demand trends over the medium term.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.