Going forward, the company’s margin expansions are going to be aided by the growing operational efficiencies, multiple price hikes, softening of input cost, economies of scales, increasing demand for customized products (high margin), and cost saving initiatives. The company’s EBITDA margins saw an increase from 15.5% in FY16 to 16.1% in FY22 which was primarily caused by backward integration and increasing share of value added products.

Stock Data:

| Ticker | NSE: CARBORUNIV & BSE: 513375 |

| Exchange | NSE & BSE |

| Industry | GENERAL INDUSTRIALS |

Price Performance:

| Last 5 Days | +1.62% |

| YTD | +11.69% |

| Last 12 Months | +23.25% |

Company Description:

Carborundum Universal Limited (CUMI) is a leading manufacturer and supplier of abrasives, ceramics, and electro-minerals. The company was founded in 1954 and is headquartered in Chennai, India. CUMI has a global presence and serves a diverse range of industries, including automotive, aerospace, construction, and electronics. The company’s products include grinding wheels, coated abrasives, ceramics, refractories, and electro minerals. CUMI is committed to sustainability and operates in an environmentally responsible manner.

Critical Success Factors:

- The company is optimistic about its long-term growth prospects, driven by sanguine demand for its overall business, including subsidiaries. While the farm equipment and price-sensitive sectors may face near-term headwinds, demand from the auto sector for abrasives is expected to be favourable. Additionally, the ceramics and electro-minerals segments are on a healthy growth trajectory. The recent acquisitions made by the company are expected to significantly improve sales and profitability, with the establishment of a new team, infrastructure, changes in product mix, and customer acquisition. The company expects considerable improvement in its performance from FY2024 onwards.

- The Indian abrasives industry has healthy growth prospects, with the Atma Nirbhar Bharat initiative and the government’s efforts to revive industrial activities expected to boost growth. The abrasives business serves a diverse range of industries such as steel, automobiles, auto components, and general metal fabrication, which provides momentum for growth. The key success factors for the abrasives industry in India include consistent quality, cost, value proposition, innovation, differentiation, service, and capability, which are likely to provide total grinding solutions. Additionally, with a pickup in domestic industrial activities, abrasives are expected to be early beneficiaries due to their diversified user industries.

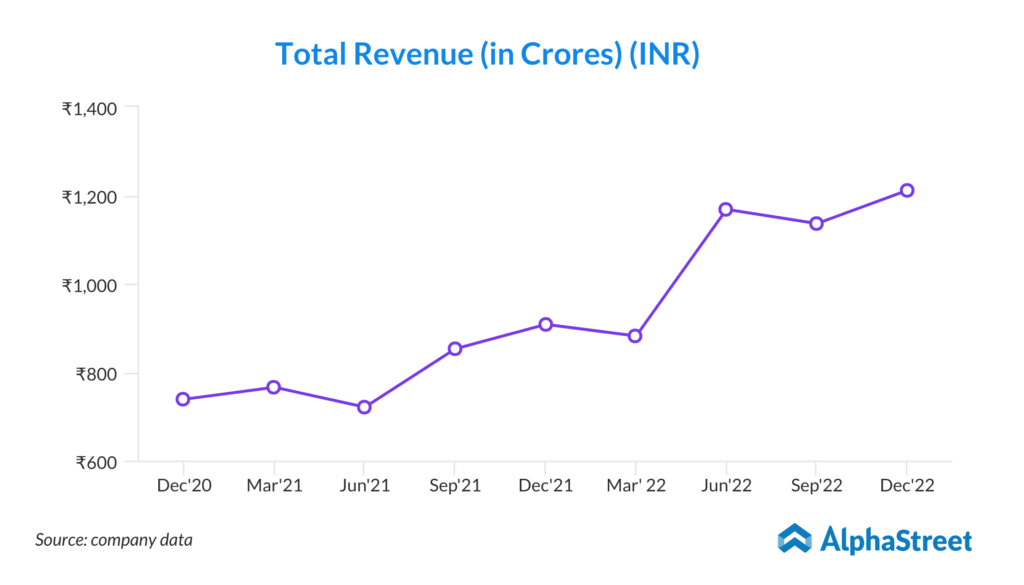

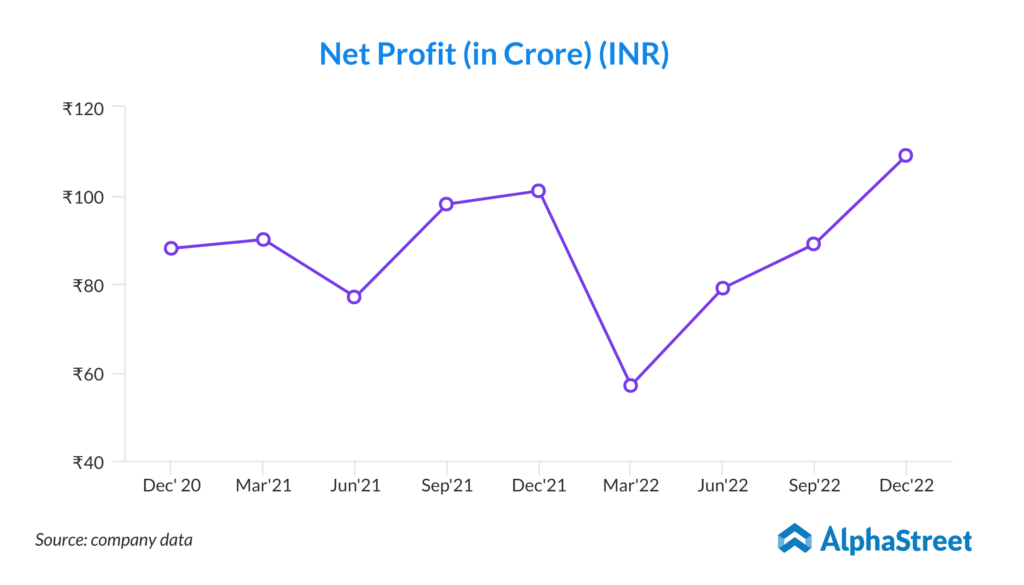

- In the abrasives segment, the revenue for the quarter increased by 50% YoY to Rs. 513 crore, mainly due to the addition of sales from newly acquired entities Rhodius and Awuko. However, standalone abrasives sales were almost flat at Rs. 282 crore. The PBIT at the consolidated level was lower by 56% YoY to Rs. 21 crore due to higher energy and input costs in Rhodius and re-establishing business in Awuko. In the electro-minerals segment, the revenue was at Rs. 412 crore, resulting in an increase of 14%, and PBIT was at Rs. 82 crore, mainly due to good performance by the Russian subsidiary. In the ceramics segment, the revenue was higher by 24% at Rs. 264 crore, and PBIT grew by 54% to Rs. 66 crore on account of growth in volume, realisation, and product mix.

- Carborundum Universal Limited (CUMI) is expected to benefit from an early economic cycle recovery in the domestic market and improvement in overseas operations. The company’s ceramics and EMD verticals are expected to maintain their high-revenue growth trajectory during FY2022-FY2024E. CUMI’s cost-competitive position in electrominerals, being the largest and lowest cost producer domestically and at a marginal difference with China, is expected to benefit the company in terms of being a domestic and overseas supplier. The company is likely to be on a high earnings growth trajectory in the long-term, with improved domestic operations and sustained healthy overseas operations, aided by recent acquisitions. However, the likely short-term impact of the Russia-Ukraine crisis, logistics, and supply-side challenges may have some short-term impact.

Key Challenges:

- CUMI reported a strong top-line performance, the operating profit growth was restricted to 8.5% y-o-y to Rs. 171 crore. This was due to higher employee costs and other expenses incurred on the integration of new acquisitions. It is worth noting that integrating new acquisitions can be a challenging process and can take time, effort, and resources, which can impact the company’s profitability in the short-term.

- The standalone abrasives sales were almost flat y-o-y at Rs. 282 crore. This indicates that the demand for the company’s abrasives products may not have grown significantly compared to the previous year, which could be a concern for the company. Despite the strong top-line performance, the abrasives segment reported a ~56% y-o-y decline in PBIT to Rs. 21 crore. This decline can be attributed to the integration cost of new acquisitions. The integration process can be complex, and costs associated with it may impact the profitability of the company in the short-term. CUMI’s long-term growth prospects seem promising, the company may face some challenges in the short-term due to the integration of new acquisitions, flat demand for abrasives products, and higher operating expenses.