Capri Global Capital Ltd is a diversified Non-Banking Financial Company (NBFC) with strong presence across MSME, affordable housing, construction finance, car loan distribution, and since August 2022, gold loans. The company also owns UP Warriorz, a professional women’s cricket franchise competing in the Women’s Premier League. Presenting below its Q1 FY26 Earnings Results.

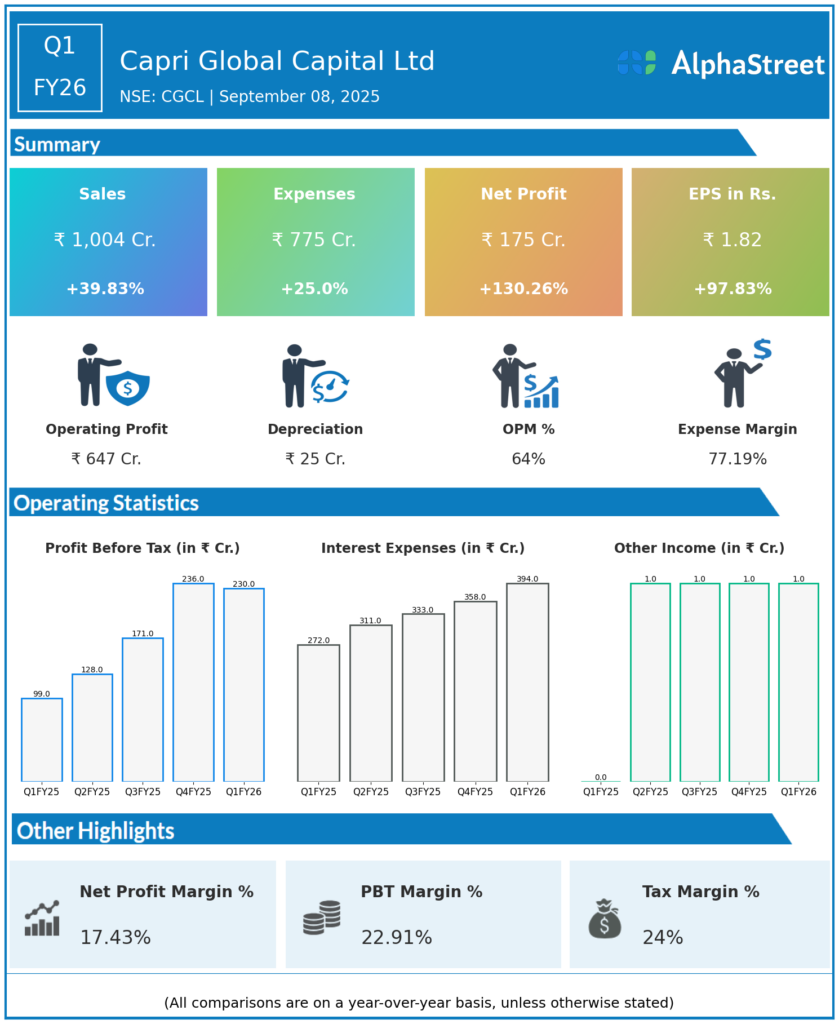

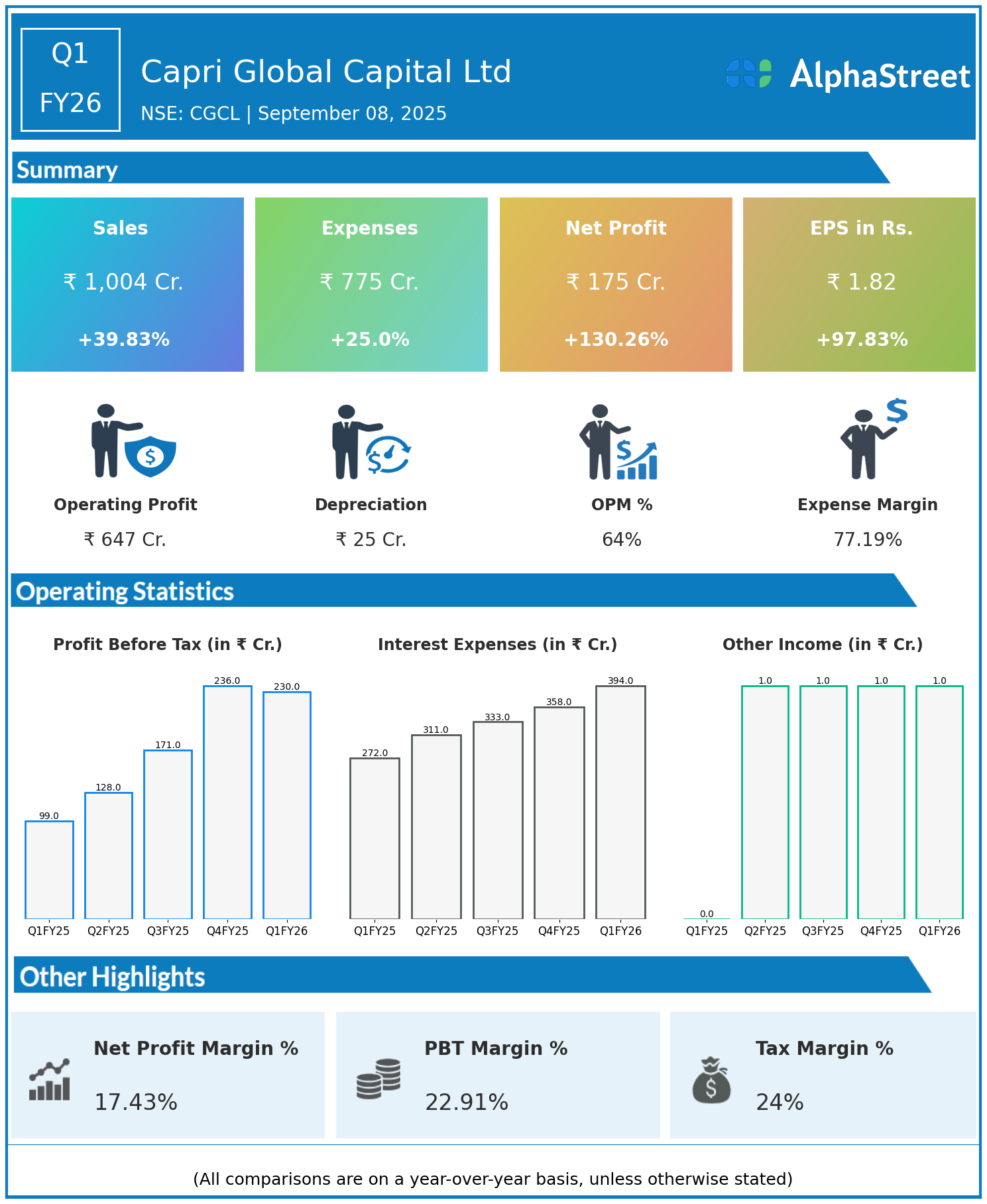

Q1 FY26 Earnings Results:

Revenue: ₹1,004 crore, up 39.83% year-on-year YoY from ₹718 crore

Total Expenses: ₹775 crore, up 25.0% YoY from ₹620 crore

Consolidated Net Profit PAT: ₹175 crore, up 130.26% YoY from ₹76 crore

Earnings Per Share EPS: ₹1.82, up 97.83% YoY from ₹0.92

Operational & Strategic Update:

Revenue Growth: Revenue posted robust double-digit growth, driven by healthy disbursements across all lending segments, especially in MSME and gold loans

Cost Management: Total expenses rose at a slower pace than revenue, highlighting effective operational control and efficiency gains

Profitability Surge: Net profit more than doubled, with significant improvement in earnings per share, underscoring the impact of operating leverage and prudent risk management

Business Diversification: Loans to MSMEs, homebuyers, and construction finance remained strong, while new business lines in gold and auto loans further diversified income streams

Strategic Expansion: The company continued to ramp up its gold loans business and leveraged the UP Warriorz brand for marketing and engagement initiatives

Corporate Developments in Q1 FY26:

Capri Global delivered record profitability for Q1 FY26, supported by a diversified lending portfolio and strategic entry into new segments. The controlled rise in expenses and innovation in product offerings have positioned the company for sustained growth.

Looking Ahead:

Capri Global aims to scale its gold and auto loan books, deepen presence in affordable housing, and continue leveraging technology for lending efficiency. The company expects momentum in financial performance to remain strong in FY26 and beyond, backed by expanding business verticals and a focus on prudent asset quality.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.