Capital Small Finance Bank Limited (NSE: CAPITALSFB) reported steady balance-sheet growth and moderate profit expansion for the quarter ended December 31, 2025, reflecting stable operating metrics and controlled asset quality.

Financial Performance

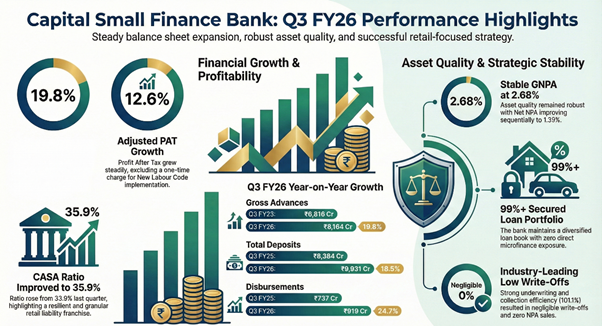

Gross advances rose 19.8% year on year to ₹8,164 crore. Deposits increased 18.5% to ₹9,931 crore. The CASA ratio improved sequentially to 35.9% from 33.9%. Quarterly disbursements grew 24.7% year on year to ₹919 crore.

Net interest income increased 11.4% year on year, supported by balance-sheet expansion. Non-interest income rose 46.1%, lifting gross revenue by 17.9% from a year earlier. Net interest margin remained stable at about 4.0%.

Pre-provision operating profit rose 20% year on year excluding a one-time charge related to labor code implementation. Including the exceptional item of ₹5.13 crore, pre-provision profit growth moderated to 9%. Profit after tax increased 12.6% year on year on an adjusted basis and about 1% after accounting for the exceptional cost. Return on assets stood at around 1.2–1.3%.

SWOT Analysis

Strengths:

– Consistent growth in advances and deposits

– Stable margins and improving CASA ratio

– Secured lending focus supporting asset quality

Weaknesses:

– Profitability sensitive to one-off cost items

– Moderate return metrics compared with larger private banks

Opportunities:

– Expansion in retail and MSME secured credit

– Deeper penetration in rural and semi-urban markets

Threats:

– Intense competition among small finance banks

– Regulatory changes affecting operating costs and capital allocation

Asset Quality & Capital

Gross non-performing assets stood at 2.68% and net NPAs at 1.35%, both improving marginally on a sequential basis. The bank maintained a secured-lending focus, primarily across MSME and loan-against-property segments.

Nine-Month Context

For the nine months ended December 2025, operating trends broadly mirrored quarterly performance, with sustained growth in advances and deposits, stable margins, and profitability affected by the one-time employee-related charge.

Market Context & Stock Performance

The results were announced amid a mixed operating environment for small finance banks, where sector-wide focus remains on deposit mobilization, margin stability, and asset quality. The bank’s shares traded in line with broader small finance bank peers around the result period, with no sharp deviation indicated following the earnings release.

Valuation Cues

Key valuation indicators include a stable net interest margin of about 4%, return on assets near 1.3%, and mid-teens growth in core earnings on an adjusted basis. Asset quality ratios remained within the range reported by listed small finance bank peers.

Broker & Analyst View

No major changes in consensus estimates or new broker actions were disclosed alongside the results, according to company filings. Market assessments continue to track balance-sheet growth, profitability trends, and asset quality stability.

What Investors Are Watching

- Trajectory of deposit growth and CASA ratio

- Sustainability of net interest margins

- Asset quality trends amid sector competition

- Normalization of costs following labor code implementation

Risks & Concerns

- Pressure on margins from rising funding costs

- Slower credit demand in core MSME segments

- Potential asset quality stress from macroeconomic volatility

- Regulatory and compliance-related cost escalation