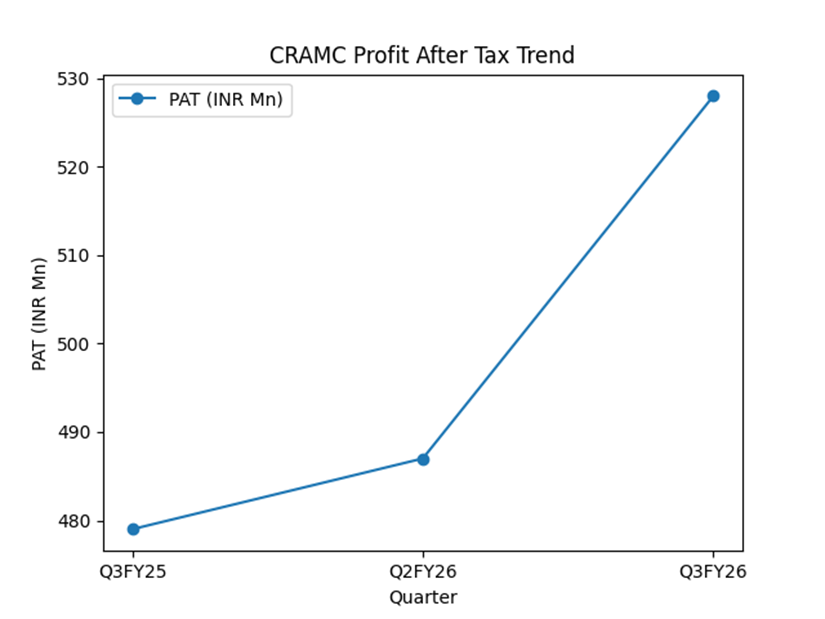

Canara Robeco Asset Management Company Ltd (BSE: 544580 / NSE: CRAMC) reported total income of ₹1,215 million and profit after tax of ₹528 million for the quarter ended December 2025, according to its Q3 FY26 investor presentation. Revenue from operations rose to ₹1,098 million from ₹960 million a year earlier, while profit after tax increased from ₹479 million in Q3 FY25. For the nine months ended December 2025, the company reported total income of ₹3,508 million and profit after tax of ₹1,624 million.

Business Overview

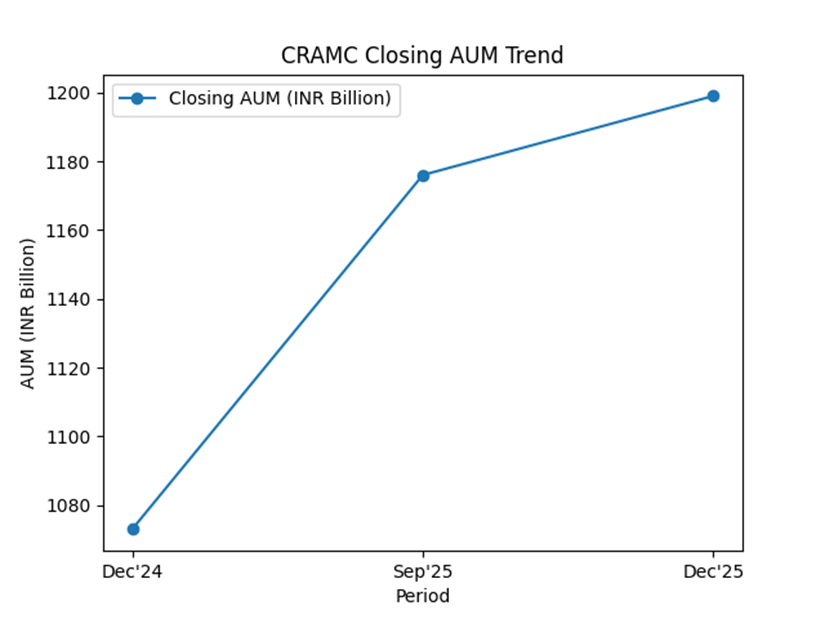

Canara Robeco Asset Management Company provides asset management services to schemes of Canara Robeco Mutual Fund and advisory services to clients. The company’s financial performance is largely driven by asset management fees and market-linked gains on investments. As of December 2025, the company reported assets under management (AUM) of ₹1,199 billion and quarterly average AUM (QAAUM) of ₹1,223 billion, with equity QAAUM of ₹1,106 billion.

Financial Performance

For Q3 FY26, total income rose 26% year-on-year to ₹1,215 million, while profit after tax increased 10% to ₹528 million. Compared with Q2 FY26, total income increased 12% and profit after tax rose 8%.

For the nine months ended December 2025, revenue from operations increased 18% year-on-year to ₹3,107 million, while total income rose 16% to ₹3,508 million. Profit after tax for the nine-month period grew 9% to ₹1,624 million.

The company reported total expenses of ₹510 million for Q3 FY26, reflecting higher employee costs and operating expenses.

Operating Metrics

Canara Robeco reported closing AUM of ₹1,199 billion and QAAUM of ₹1,223 billion as of December 2025. Equity assets accounted for ₹1,106 billion of QAAUM, while debt assets stood at ₹117 billion.

Monthly SIP contributions were ₹7.55 billion, with SIP month-end AUM of ₹404 billion. The company reported 5.07 million folios and ₹289 billion in B-30 MAAUM.

The company operated a distribution network of 29 branches and 55,191 distributors as of December 2025.

Key Developments

The company highlighted growth in digital platform usage, with user sessions increasing from 0.7 million in Q3 FY25 to 1.8 million in Q3 FY26 and engagement rates rising from 59.5% to 80.6%.

The company also reported an increase in equity-focused assets and continued expansion of its distribution footprint.

Risks and Constraints

The company noted that its financial performance is sensitive to capital market conditions, investor flows, and regulatory changes affecting the mutual fund industry.

Outlook / Guidance

Canara Robeco stated that its business remains linked to trends in equity markets, mutual fund inflows, and digital distribution adoption, without providing quantified forward guidance.